We’ve seen a decent rally in the yen today on the back of reports that the Japanese fiscal spending package will be much smaller than previously thought – ¥6 trillion rather than ¥20 trillion – calling into question both the effectiveness of any monetary stimulus that could come and how large it will be.

The rally in the yen has sent the euro back to 114.45 against the Japanese currency, where it has run into a confluence of support levels, including a prior area of resistance from when the pair came off its lows in June before making a higher low. It also falls around 50% retracement of the move from 6 July lows to 20 July highs.

Yen Rise Supported By Guesstimates

Finally, the pair could also be finding support from bottom of the Ichimoku cloud on the 4-hour chart, after breaking above it two weeks ago. Should this hold, it could be seen as confirmation of that initial break and signal a bullish continuation in the pair following a brief correction.

From here, we could see a move back towards this month’s highs, or higher, with initial resistance potentially being found around 115.50, while 116-116.50 has also recently been a key level of support and resistance.

A break through here on the other hand would obviously suggest otherwise and while the pair could find further support around 113.75, we could see further declines in the coming days and weeks. Confirmation of this would come from a break of the lagging line through the bottom of the cloud.

OANDA MP – Yen Rises on Stimulus Doubts (Video)

At this point, we could see a move back towards the lows of June and July, with the pair having previously found support and resistance between 113 and 113.30.

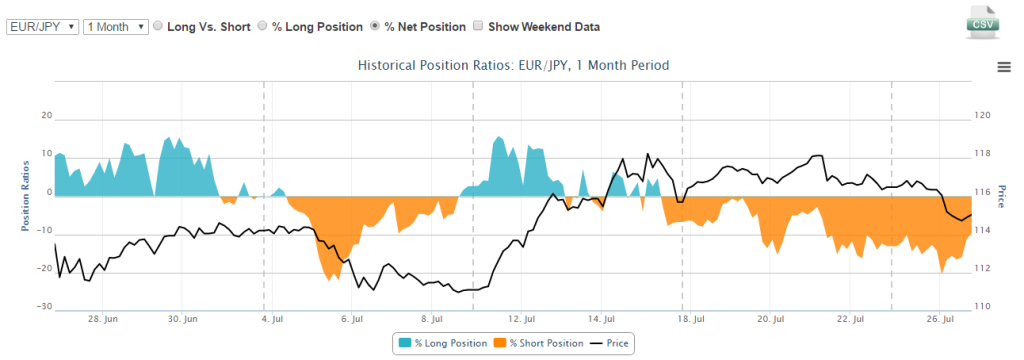

The OANDA Historical Positions tool shows that the net client position in this pair has followed price quite well throughout July and now we’re seeing the net short position being reduced at this key support level. This could be seen as a bullish signal although of course, the position still remains net short and there’s no guarantee that it will continue to track price so well.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.