Gold has posted losses in the Wednesday session. In North American trade, spot gold is trading at $1247.86 an ounce. On the release front, ADP Nonfarm Payrolls dropped to 177 thousand, very close to the forecast of 178 thousand. The ISM Non-Manufacturing PMI improved to 57.5, beating the estimate of 56.1 points. Today’s key event is the Federal Reserve’s policy statement, with no change expected in the benchmark interest rate.

All eyes are on the Federal Reserve, which holds its monthly policy meeting later on Wednesday. A rate hike is extremely unlikely this time around, with the CME Group pricing in a hike at just 5%. This means that the markets will be focusing on the rate statement and the views of policymakers concerning economic conditions. The Fed has two key goals which have been achieved, namely full employment and an inflation rate of 2%. One area of concern which policymakers have circled is the Fed’s balance sheet, which stands at $4.5 trillion. The minutes of the March meeting stated that policymakers want to start reducing this figure before the end of 2017, so the markets will be looking for another reference to the balance sheet in the rate statement or the minutes of the meeting. The markets are fairly confident that the Fed will press the rate trigger in June, as the odds for a hike have improved to 63%. If the rate statement is more hawkish than expected, we could see these odds increase.

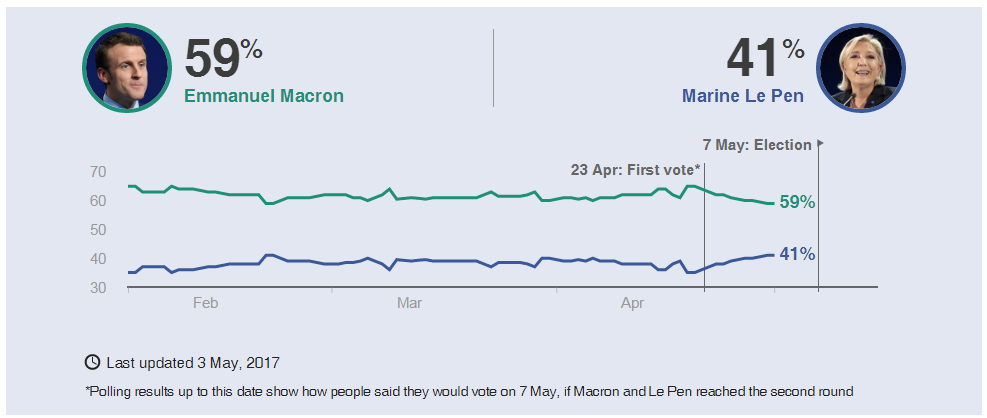

It’s Election Day (again) in France on Sunday, with Emmanuel Macron and Marine Le Pen vying for the next president of France. The euro and European stock markets have been very steady in the second round of the campaign, as opinion polls continue to show a comfortable majority for Macron:

The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

Source – BBC

French Election Timeline

May 3 – TV debate between the two remaining candidates

May 5 – [from midnight] Poll blackout

May 7 – Second round of French presidential elections. Last polls close at 19:00 BST / 14:00 EDT, with an exit poll result announced immediately.

May 11 – Official proclamation of the new President.

May 14 – [from midnight] End of Francois Hollande’s mandate

June 11 – First round of legislative elections

June 18 – Second round of legislative elections.

France Prepares for Fiery Presidential Debate

Forget the Fed, France TV Debate to Shift FX

The markets are keeping a close eye on the Federal Reserve, which holds its monthly policy meeting on Wednesday. A rate hike is extremely unlikely this time around, with the CME Group pricing in a hike at just 5%. This means that the markets will be focusing on the rate statement and the views of policymakers concerning economic conditions. The Fed has two key goals which have been achieved, namely full employment and an inflation rate of 2%. One area of concern which policymakers have circled is the Fed’s balance sheet, which stands at $4.5 trillion. The minutes of the March meeting stated that policymakers want to start reducing this figure before the end of 2017, so the markets will be looking for another reference to the balance sheet in the rate statement or the minutes of the meeting. The markets are fairly confident that the Fed will press the rate trigger in June, as the odds for a hike have improved to 63%. If the rate statement is more hawkish than expected, we could see these odds increase.

XAU/USD Fundamentals

Wednesday (May 3)

- 8:15 US ADP Nonfarm Employment Change. Estimate 178K. Actual 177K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 56.1. Actual 57.5

- 10:30 US Crude Oil Inventories. Estimate -3.3M. Actual -0.9M

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. <1.00%

Thursday (May 4)

- 8:30 US Unemployment Claims. Estimate 246K

*All release times are GMT

*Key events are in bold

XAU/USD for Wednesday, May 3, 2017

XAU/USD May 3 at 13:30 EST

Open: 1256.51 High: 1257.02 Low: 1245.08 Close: 1247.86

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1175 | 1199 | 1232 | 1260 | 1285 | 1307 |

- XAU/USD was flat in the Asian session. The pair has edged lower in the European and North American sessions

- 1232 is providing support

- 1260 is a weak resistance line

- Current range: 1232 to 1260

Further levels in both directions:

- Below: 1232 and 1199 and 1175

- Above: 1260, 1285, 1307 and 1337

OANDA’s Open Positions Ratio

XAU/USD ratio has showed little movement this week. Currently, long positions have a majority (61%). This is indicative of trader bias towards XAU/USD reversing directions and moving to higher levels.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.