The euro has inched lower on Friday, after gaining close to 1 percent in the Thursday session. Currently, EUR/USD is trading at 1.0970. On the release front, there was just one event out of the eurozone. Retail PMI improved to 52.7, its highest level since July 2015. In the US, the focus is on employment numbers, with the release of three key indicators – nonfarm payrolls, wage growth and the unemployment rate. Nonfarm payrolls dropped to just 98 thousand in March, but is expected to rebound to 194 thousand in the April report. The markets will be looking for some clues about monetary policy, as Fed Chair Yellen and FOMC members Fischer and Yellen will deliver speeches during the day.

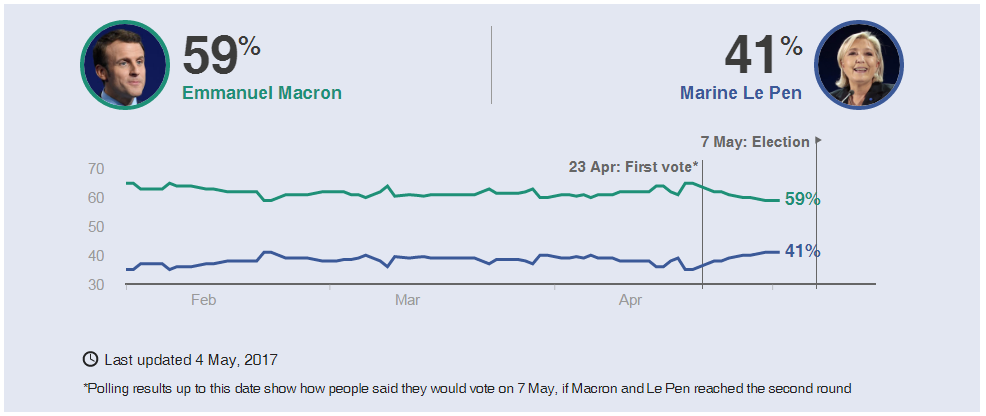

With just two days remaining before the French presidential election, opinion polls continue to point to a decisive victory for centrist Emmanuel Macron over far-right candidate Marine Le Pen. The two squared off in a testy television debate on Wednesday, with Macron widely considered to have won the debate. Throughout the week, polls have shown Macron holding comfortable lead of 20 points over Le Pen, and the euro climbed to 6-month highs on Thursday, as the markets are clearly confident that the polls are on track and that Macron will win. Still, many voters don’t like either candidate and remain undecided, which means that the polls may not be as accurate as they were in the first round. If Le Pen loses but does much better than predicted, we could see the euro lose ground.

The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

Source – BBC

French Election Timeline

May 3 – TV debate between the two remaining candidates

May 5 – [from midnight] Poll blackout

May 7 – Second round of French presidential elections. Last polls close at 19:00 BST / 14:00 EDT, with an exit poll result announced immediately.

May 11 – Official proclamation of the new President.

May 14 – [from midnight] End of Francois Hollande’s mandate

June 11 – First round of legislative elections

June 18 – Second round of legislative elections.

President Donald Trump won a crucial victory on Thursday, as the House of Representatives narrowly passed a bill to repeal and replace the Affordable Health Care Act, known as Obamacare. Earlier this year, the House failed to even vote on a new bill, which was seen as a blow to Trump. However, Trump’s declaration of victory may be premature, as the bill will face a tough battle in the Senate, which is likely to make significant changes to the legislation. What is significant is that Trump finally won a major legislative win, which could give him some much-needed momentum as he tackles other major issues such as fiscal spending and tax reform.

Republican Healthcare Bill Passes the House Headed for Senate

As expected, the Federal Reserve stayed on the sidelines on Wednesday, holding the benchmark rate at 0.75 percent. The Fed rate statement was hawkish, as policymakers emphasized the positives and downplayed a soft first quarter. The statement noted that consumer spending remains strong and that inflation was “running close” to the Fed’s 2 percent target. The Fed’s message is clearly one of optimism, as the central bank remains on track to raise interest rates twice more in 2017. The Fed’s bullish statement immediately raised the likelihood of a rate hike at June meeting, which jumped to 74 percent after the statement, up from 63% before meeting. The Fed has two key goals which have been achieved, namely full employment and an inflation rate of 2%. One area of concern is the balance sheet, which stands at $4.5 trillion. The minutes of the March meeting stated that policymakers want to start reducing this figure before the end of 2017, and we could see another reference to the balance sheet in the April minutes.

EUR/USD Fundamentals

Friday (May 5)

- 4:10 Eurozone Retail PMI. Actual 52.7

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 194K

- 8:30 US Unemployment Rate. Estimate 4.6%

- 11:30 US FOMC Member Stanley Fischer Speaks

- 13:30 US Federal Reserve Chair Janet Yellen Speaks

- 13:30 US FOMC Member Charles Evans Speaks

- 15:00 US Consumer Credit. Estimate 15.0B

*All release times are EDT

*Key events are in bold

EUR/USD for Friday, May 5, 2017

EUR/USD Friday, May 5 at 4:30 EDT

Open: 1.0984 High: 1.0990 Low: 1.0969 Close: 1.0971

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0616 | 1.0708 | 1.0873 | 1.0985 | 1.1122 | 1.1242 |

EUR/USD was flat in the Asian session and has inched lower in European trade

- 1.0873 is providing support

- 1.0985 was tested earlier in resistance and is a weak line. It could break in the Friday session

Further levels in both directions:

- Below: 1.0873, 1.0708, 1.0616 and 1.0506

- Above: 1.0985, 1.1122 and 1.1242

- Current range: 1.0873 to 1.0985

OANDA’s Open Positions Ratio

EUR/USD ratio is showing slight gains in short positions. Currently, short positions have a majority (65%), indicative of EUR/USD continuing to move to lower ground.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.