Crude makes a comeback but there is no such luck for gold as U.S. yields and the big dollar march higher.

After a choppy session on Friday where oil spent most of it on the back foot, as the washout of stale long positioning continued in earnest, both Brent and WTI shock of their standing eight counts to rally aggressively and finish the day over one percent higher from their opens. The impressive comeback was sparked by Saudi Arabia compliance comments and the Baker Hughes Rig Count which showed another fall in U.S rig numbers to 736. The decline continues a multi-month trend of falling rig numbers with talk of “peak shale” gathering pace. Prematurely in our opinion.

This morning in Asia Brent and WTI has managed a slightly positive start, trading at 57.95 and 51.80 respectively, a small rise from Friday’s bright close. Geopolitical tensions in the Middle East will continue to support both contracts through the Asian session following Friday’s comeback.

Brent spot will face initial resistance each side of 58.50 ahead of the more formidable 59.10 level. To make serious progress past those lofty heights will likely require fresh news to drive momentum. Support lies distantly at 57.25 and 56.60 demonstrating just how powerful its relief rally was on Friday.

WTI spot faces resistance at 52.00 and then 52.50 ahead of its long-term resistance region between 53.50 and 54.50. Like Brent, support is distant at 51.10 which is followed by 50.50.

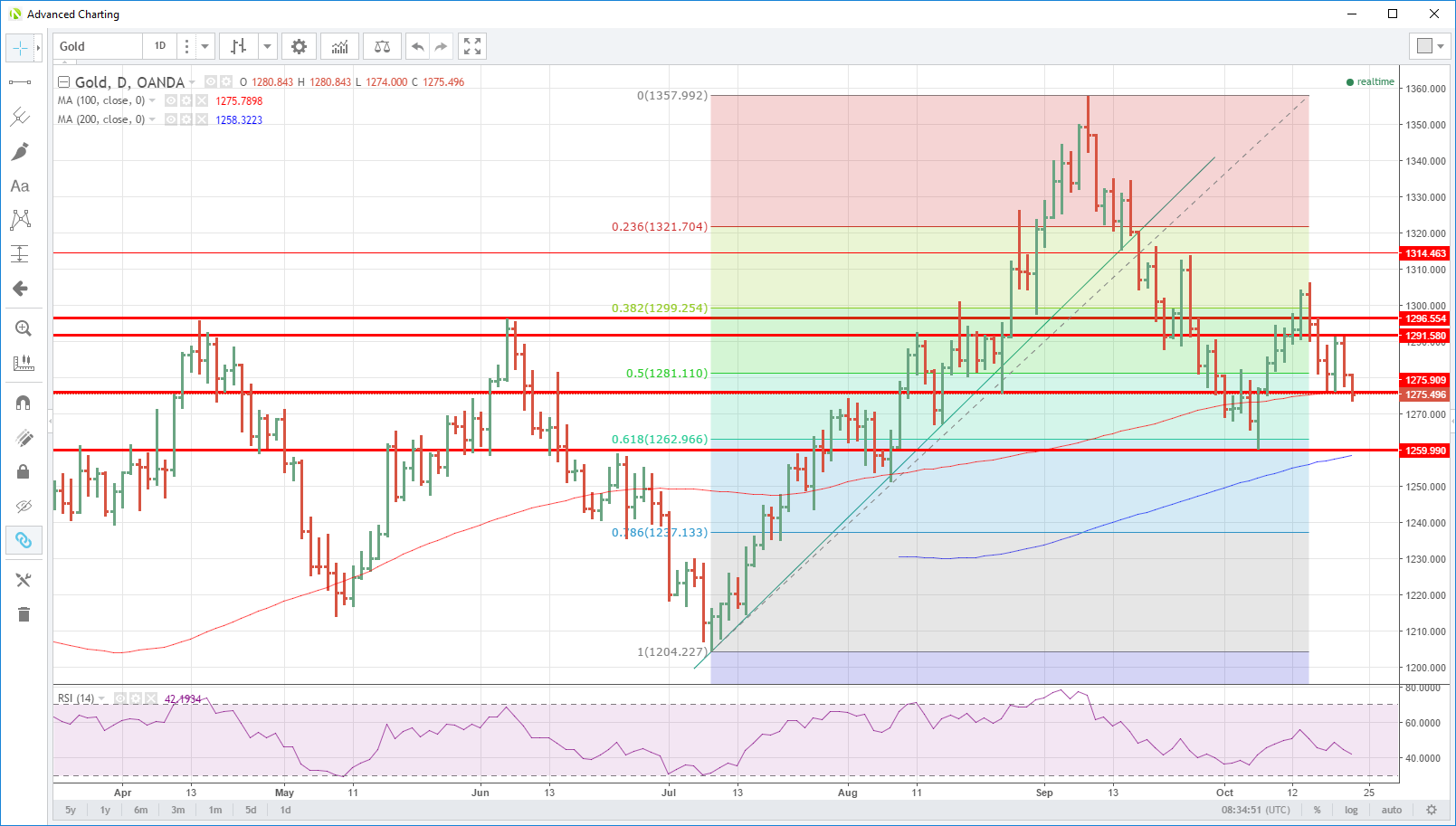

Gold

Gold closed ominously on Friday at 1280.25, giving up all its previous day’s gains as a stronger U.S. dollar and rising U.S. bond yields continue to haunt it. The news wasn’t much better in early Asia this morning with gold falling another five dollars to 1276.25 as the dollar gained more strength again after Shino Abe’s resounding election victory in Japan over the weekend.

With the U.S. 10 year marching towards 2.40%, we can expect golds appeal as an investment asset to continue to dimish in the short term implying more downside pain is possible for the yellow metal.

Gold has now formed a double top at 1291.50 which will be a difficult level to recapture in the short-term. Gold is trading at 1277.40 and support is now just below at 1275.80, the 100-day moving average and also a double bottom. A daily close below here implies a move towards the 1260.00 October low and also the 200-day moving average. A break of this level could see more stop-loss action and some structural shifts to short positioning.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.