Carney on the Defensive, Tax Reform and Fed Chair Announcement to Come

Post Rate Hike Thoughts

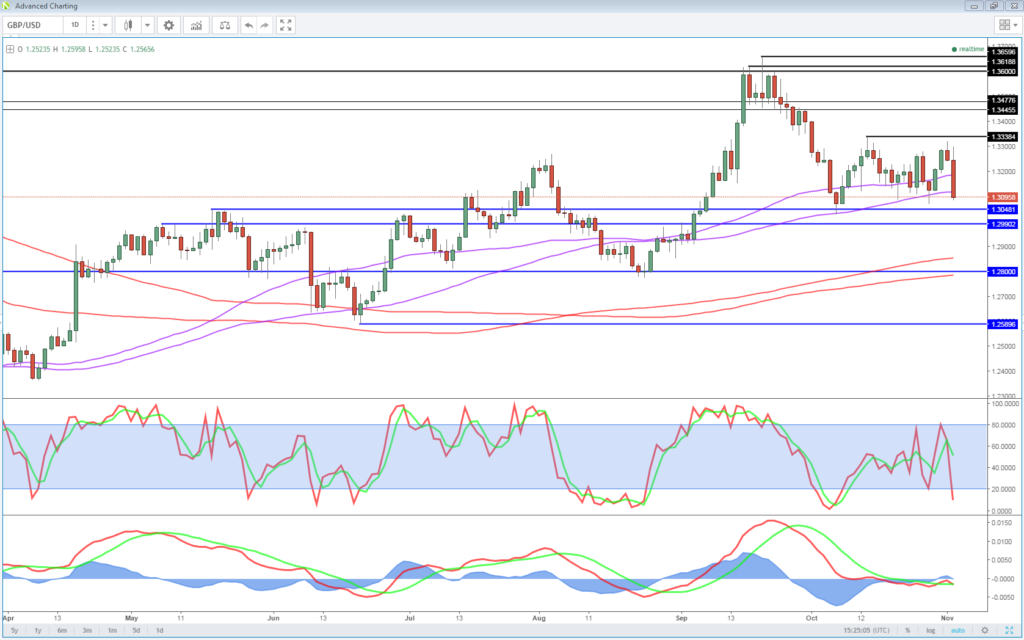

A dovish rate hike from the Bank of England on Thursday has triggered a sell-off in the pound while yields on UK debt have also fallen.

We may be jumping to the wrong conclusions prior to the press conference with Mark Carney but the impression that the MPC has given is this is a “one and done” rate hike. Dropping the reference to the market under-pricing future tightening while at the same time referencing the market pricing in two rate hikes over the next three years doesn’t suggest another rate hike is planned any time soon.

With inflation expected to return closer to target over the next 12 months, the chance to raise rates may not exist for long and policy makers were clearly keen to seize the opportunity while it still could.

OANDA fxTrade Advanced Charting Platform

Pound Plummets 1% on BoE Decision

Post Press Conference Reaction

The controversial decision to raise interest rates at a time of significant economic uncertainty unsurprisingly left Mark Carney on the defensive throughout his press conference on Thursday, as reporters repeatedly questioned why the central bank decided it was the appropriate time for the first rate hike in a decade.

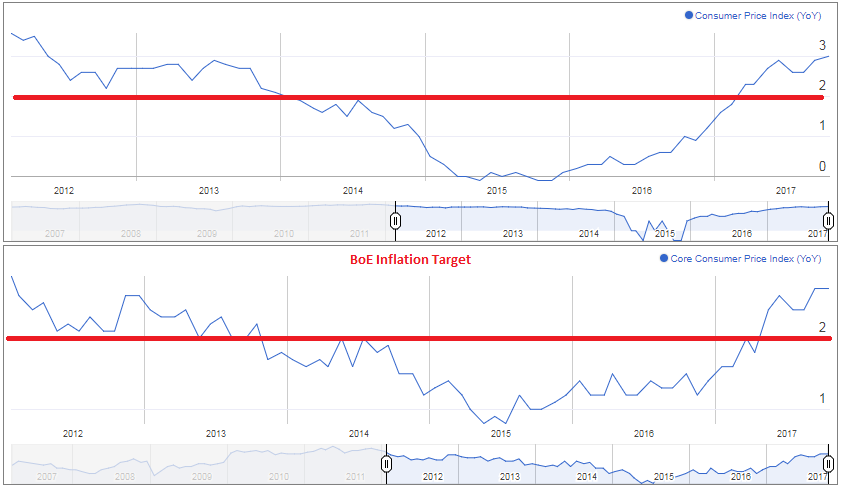

Naturally the decision on whether the raise interest rates is far from straightforward with inflation significantly overshooting the central bank’s 2% target and the labour market in good shape, while at the same time the economic outlook is uncertain at best and real incomes are already being squeezed. While the MPC has been divided on the correct course of action in recent months, the pendulum eventually swung in favour of the hawks with some policy makers clearly of the belief that they had reached the limitations of how much inflation they could stomach.

UK Inflation

As can be interpreted from the market reaction though, the rate hike came with quite a dovish twist. Policy makers refrained from including language in the statement that suggest markets were behind the curve on rate hikes which would indicate that two over the next three years is expected, which would represent an extremely gradual tightening process. Given the assumptions that the central bank has on labour market slack and the relationship with wages and inflation, it’s possible that even two hikes may be a little punchy. The experience of the Fed would certainly support this view.

All things considered, the view appears to be that the BoE has taken a risky and unnecessarily step in raising interest rates today, one they may regret and be forced to reverse over the next year or so. Even if this is avoided, with the rate now back at the level the central bank deemed the lower bound for seven years prior to the Brexit referendum, we may be waiting some time for interest rates to rise again.

USD/JPY – Yen Gains Ground Ahead of Fed Chair Nomination

The BoE’s job may be done for the day but the fun may be just beginning for markets, with details of Trump’s tax reforms and the new Fed Chair announcement still to come. Jerome Powell is expected to be announced as Janet Yellen’s successor late on in the session which will leave another seat available on the Board of Governors for Trump to fill. Certain candidates may have missed out on the position of Chair but with other important roles to be filled, there’s potential for them to join Powell at the top.

Tax reform and the future leadership of the Fed have both been very important factors in the dollar revival over the last couple of months so it will be interesting to see how the greenback responds to both of these events today.

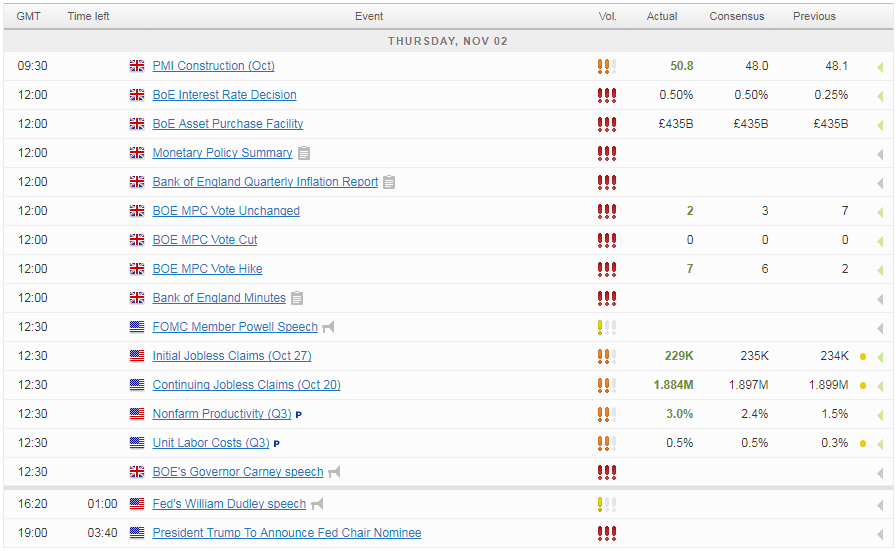

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.