The IMF has come up with a sustainable debt and repayment timeline for Greece. The IMF proposal is to get the debt to GDP rate down to 120 percent, from current 190 levels and give Greece until 2022. European members will have to agree on the debt reduction and extended deadline in order for Greece to be able to move forward.

One of the biggest detractors for the IMF proposal is Germany. Chancellor Angela Merkel and Finance Minister Wolfgang Schäuble have stood their ground and are confusing former allies. The reason? Next year is an election year in Germany. If current German leadership agrees to reduce Greek debt, it would in fact be out of German taxpayers.

Schäuble and Merkel have both expressed their optimism that a deal will be reached. Yet so far they have become its biggest roadblock.

Japan is getting ready for a general election on December 16th. The opposition leader and former Prime Minister Shinzo Abe has heavily hinted at the changes he will try to enforce on the Bank of Japan if he takes office. BoJ Governor Masaaki Shirakawa defended the monetary policy of the central bank and compared it to that of Europe and the United States.

The Japanese stock market was closed on Friday for a national holiday and came roaring back on Monday. Toward the end of the session the index retreated slightly off intraday highs as investors entered into a profit taking stance. The Yen’s weakness and the perceived strong performance by Wall Street on Black Friday pushed the index to finish at 9,388.94, its highest close since May 1st of this year.

The new Bank of England governor was announced today. The shock appointment was Mark Carney, the current Bank of Canada governor. Sir Mervyn King’s term will end in seven months on June 30th. Carney’s term with the BoC was due to end in 2015 and as the result of the BoE appointment will end in June 2013.

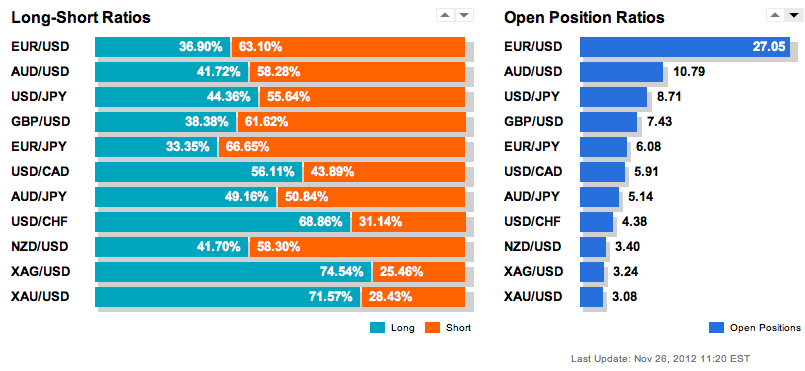

Euro shorts continue to carve territory versus long on the Open Positions ratio. EUR/USD longs are moving towards a 63.10% versus 36.90% of EUR/USD shorts. Metal position longs continue to dominate shorts. The USD in general continues to gain positions in all major pairs, with obvious exceptions of metal pairs.

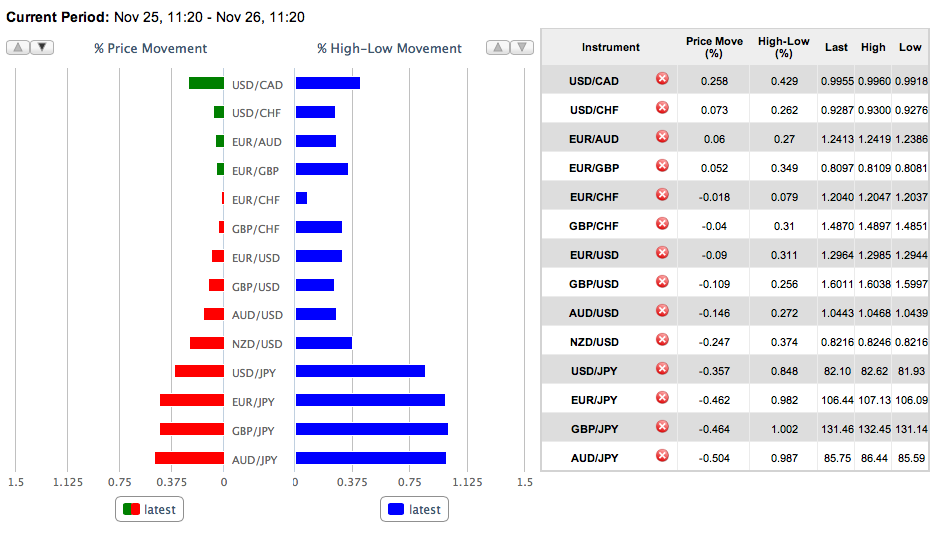

Last week was filled with holidays so it was expected traders will return and change the picture that was drawn last week. Yen pairs recovered after some investors decided to take their profits and all eyes will be on the Eurogroup meeting on Brussels to discuss the Greek debt agreement.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.