Let’s call it another ‘dog day afternoon’ in Europe ahead of the North American handover. There is very little to get excited about. Investors are waiting for the meat of this week’s data release, starting with the FOMC gathering tomorrow and ending with the granddaddy of data, NFP on Friday. Until then, G10 currency vanilla option expiries are expected to keep this market somewhat occupied.

Euro equities have been helped by consumer confidence data from two of the union’s stalwarts. Europe’s largest economy, Germany saw its confidence edge higher in February from the previous month, beating most expectations (5.8 vs. 5.7). In France, the scenario was stable, month-over-month, with fewer households anticipating a rise in unemployment.

It seems that the German print has taken some comfort from the current calm in the Eurozone markets, and boosting consumer moral. This mornings GfK survey is just another in a plethora of upbeat sentiment surveys showing the improving good mood amongst the German populous and their businesses. Not knocking this good news, however, German output accounts for approximately ‘only’ +30% of the EU, leaving +70% unaccounted. Despite the country’s prospects looking rosier, in the peripherals, such as Spain, their economy continues to struggle.

Data this morning from Spain’s National Statistics Institute, saw calendar adjusted retail sales for the month of December aggressively fall again (-10.7%, y/y). This additional evidence just proves that the Spanish economy’s woes only deepened in the final months of last year.

The negative Spanish trend remains a bearish investors friend. November retail sales fell -7.8%, October -9.7% and September -11%. This is to be expected when a country has a +26% unemployment rate. Also helping to depress sales numbers was Prime Ministers Rajoy increasing the VAT last September. Introducing a tax hike is one way to try and close one of Europe’s largest budget gaps, however, there is a sweet spot and an average -10% drop in sales may not be it!

Spain’s official GDP is released next Wednesday. The estimate so far is a fall of -0.6% in Q4, this after the -0.3% print in Q3. Already, EU economic commissioner Olli Rehn has suggested that Spain ‘could be given more leeway to meet strict budget targets if the economy there continues to contract. So far, periphery investor nervousness has not followed through in other asset classes. This market seems to want to wait for the outcome of the two-day US FOMC meeting. Helicopter Ben gets to deliver policy makers monetary decisions tomorrow.

In Asia, the spotlight was on the Reserve Bank of India. They managed to deliver a -25bp cut in the repo rate (+7.75%) as widely expected by market, but supplemented the outright cut with a -25bp cut in the cash reserve ratio. It looks like the Indian monetary authority’s have “thrown down the gauntlet to the government.” Cutting the cash reserve helps to pump liquidity back into the financial system.

The Indian government has it work cut out to win further cuts as it needs to show progress in bringing its ballooning fiscal deficit under control. Their issues are not unique; all major economy’s are walking the same tightrope! The market still expects another -100bps repo cuts from BoI by year-end. Capital inflows into the equity class should provide support for the INR?

Rating agencies again have hit the newswires, obviously trying to up their public profile before they are forgotten! They must have felt neglected. A going away present for Governor Carney at the Bank of Canada came from Moody’s. It decided to cut long term senior debt of six Canadian banks by one level, citing recent bank data as the instigator.

Not to be outshone, Fitch has scaled back the chances of it stripping the US of its AAA status, saying “the recent agreement on the temporary suspension of the country’s debt limit removed the near-term risk of a cut.” There is no-way that we can forget these rating agencies, do they not consistently produce confident and stellar work?

Speaking of confidence, analysts are looking for a small pullback from the US confidence board consumer confidence index this morning (63.5 from 65.1). If so, this print will be encroaches on a six-month low. Partial blame may be attributed to the impact of the payroll tax increase evident in the preliminary Michigan sentiment reading. If the print is produced, watch for the equity market to lean left, again hurting neighborly growth-sensitive currencies (CAD, MXN).

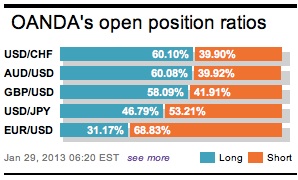

The ‘single unit’ is currently been strangled by large vanilla options that expire mid-morning NY time. The downside seems to only have the one at 1.34, while the top is littered, starting at 1.3450, 70 and ending at the psychological 1.35 print.

The technical charts are trying to maintain a bull EUR bias, however, overbought levels continue to weigh. Currently, the market feels like there are better levels to want to own the EUR outright. The bulls seem to be relying on these shallow pullbacks for their own conviction. Expect many to stick to the buy-on-dips until a clearer picture is painted.

Other Links:

What Excuse Is The EUR To Use Now?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.