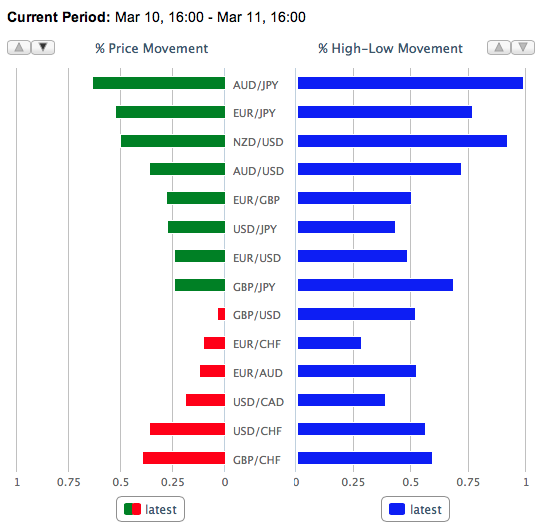

As mentioned previously in the blog the first Monday after the Non-farm payrolls report on the first friday of every month (except when the Friday falls on the 1st of the month) is the least volatile trading day. True to from here is the graphical representation of major currency price changes:

To view more instruments you can visit the OANDA Currency Volatility Tool

EUR/USD

The EUR recovered slightly after the losses of last week. Positive employment in the United States (+236K) and a lower rate (7.7%) along the strong stock market gains closed the week at a negative for the EUR. The start of the week brought recovery although more likely for the dollar being over bought, as German and French economic indicators continued to be soft.

USD/JPY

Bank of Japan nominee Kuroda had a confirmation hearing in the Japanese Upper House. There are few who oppose his nomination and his speech was watched closely as it was expected to give hints about his tenure at the head of the BoJ.

Mingze Wu reported earlier:

Content of the speech is rather predictable, though Kuroda gave us a peek on some of the actual actions he may embark on:

– Purchasing of long-term bonds to lower yields

– Additional easing measures in 2013 as current easing program not enough to hit 2% target

– CPI as measurement of inflation, not internal BOJ’s metrics

– Communication between market and BOJ to improve

– Cut in excess reserve rate possible, but need further discussion

– Employment figure NOT target of BOJ, unlike the FED

– BOJ will NOT finance government

– Monetary policy goal NOT aimed to boost asset prices

The JPY continues to drop and is soon to hit levels not since since April 2009.

GBP/USD

No major events for the Pound on Monday, but the British Manufacturing Production numbers will be followed closely tomorrow. The GBP has been under pressure and was hit by the positive US economic indicators. On the other hand indicators in the UK keep falling and there is a lack of leadership as the Bank of England Governor is set to depart before the end of summer.

AUD/USD

The AUD recovered as it started the week on a down trend after the negative economic releases from China. Yen weakness and attractive technical levels boosted the appeal of Aussie and Kiwi dollars even as China inflation continues to rise and industrial production increased 9.9% but its lower than the previous year.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.