The Australian dollar had an active day in all major trading sessions. It seemed to run out of steam at the end of the Asian session, just to be picked up by the European and American sessions. Disappointing data did not make a dent in the rise of the Aussie. The RBA made the decision earlier this month not to reduce the 3.00% benchmark rate, but left itself some room to cut if the economy needed it. Some indicators hint at that cut not happening this year, and some analyst are starting to price in a Q4 rate increase which could drive the AUD higher.

Japan had a bigger impact in the market, where strong statements by the Deputy governors continue. Rumours of an unscheduled easing measure right after Kuroda take office took the Yen in the direction Japanese PM Abe has pointed all along.

The Pound continues to struggle as more economic releases came under expectations. House Price balance and Industrial production both fell in February versus January. European credit downgrades continue to haunt the UK by association. The currency recovered slightly near the end of the American session, but is just barely hanging above the 1.49 level.

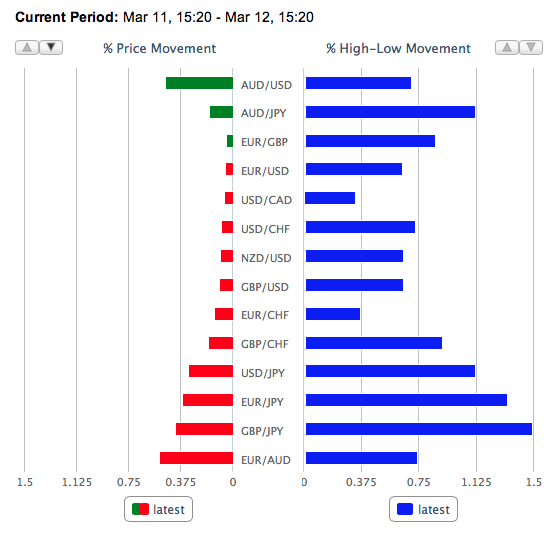

Here is a snapshot of the major forex market pair price changes for March 12, 2013:

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.