Euro policy makers have never made it easy for the 17-member single currency. From inception, the EUR has been trading against many odds. Socially and culturally the currency was supposedly destined to fail. However, a bakers-dozen years later, despite blundering the Cypriot bailout while myopically focusing on the country’s Russian deposit accounts, the EUR continues to fight while the Euro-zone once again demonstrates its ineptitude in a crisis.

Last night the Cypriot Parliament firmly rejected the +EUR 10b controversial bank bailout deal, leaving markets this morning to contemplate the next move. Firmly touted as a unique situation, many believe that the small island of Cyprus is unlikely to derail the gradual economic recovery underway. However, human nature and not knowing has investors collectively thinking about the risk of contagion to other vulnerable peripheral European countries. Even with the ECB willing to provide support to Cypriot banks has global risk appetite under pressure, allowing recent trends in the forex market to stall. Investors slowly continue to shift into the relative safety of the USD. This should remain the dominant theme until the market gets further clarity on the situation in Europe.

If you take Cyprus out of the equation then the highlight of the week is today’s FOMC rate announcement and press conference. Lets assume the Cypriot fiasco does not exist, and then one should assume that Ben and his cohorts are well pleased with market and economic developments since QE3 commenced six-months ago. In the macro sense, stocks have rallied, NFP job reports have strengthened, and household confidence is building. The market does not expect any change to the +$85b monthly asset purchase pace for now. The committee is likely to reaffirm the policy thresholds it introduced in December. An update to the exit strategy is also possible. Now if you include Cyprus then this week’s market shock should have Bernanke giving us his reassuring “dovish” speech.

The “mighty” dollar prefers higher rates, however, any ongoing accommodation from Helicopter Ben and the possibility of affirmation of current policy from the FOMC makes achieving higher yields a tad more difficult to maintain, especially in this Cyprus risk-off environment. Higher yields will certainly support the dollar against the Yen and Sterling. This should keep Japanese PM Abe and Chancellor Osborne somewhat happier in the short term.

Sterling is the worst performing major currency after the yen this year, coming under relentless selling pressure. This morning whiplash trading range is not surprising. To date, the currency has lost -7% against the dollar and -5.5% versus the euro on risks of a triple-dip recession in Britain and prospects of further monetary easing.

Today’s UK Budget should be considered significant. The market does not expect any noteworthy fiscal expansion in the Budget, but there may be measures with regard to the FLS or banking sector. Any surprise fiscal innovative moves could increase the risk of “ratings” action. When combined with the risk of an increase in Asset Purchases and the Bank’s tolerance towards “high-inflation,” are factors that should undermine the sterling’s medium term value.

The MPC minutes this morning revealed again that outgoing Governor King and two other officials were defeated in their push for more stimuli for the second month in a row (6-3). They had argued for another +GBP25b of AP, believing that extra stimulus would support demand without setting off inflation. The majority indicated that more stimuli would drive up expectations for future inflation, pressuring wages and prices and potentially causing an “unwarranted depreciation of sterling if it was interpreted as a lack of commitment to maintaining low inflation in the medium term.”

The end result continues to show a persistent divide amongst MPC members on how to respond to lack of growth and inflation. The Chancellor of the Exchequer Osborne probably needs to tweak the BoE mandate in a bid to encourage faster growth – will we get to see this later this morning?

The sterling bears did not get the QE vote they wanted, allowing for a sharp GBP rebound this morning (1.5040 to 1.5145 in one move). It’s a classic market squeeze where a plethora of sterling sellers managed to get themselves short ahead of the BoE minutes. Disappointed with the vote outcome, they exited or have been trying. Sterling’s move has nothing to do with the interest rate outlook itself. Overall, investors will not be dissuaded by today’s outcome thus far. The market still expects more QE, not sure when, but it should cap GBP rallies.

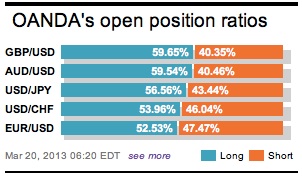

The ‘single’ currency trader is also concerned about a possible short squeeze. The best hedge against Euro uncertainty is probably being ‘short’ of the currency. However, CFTC data and option vols (currently 50% lower than at the height of the crisis last year) indicate that the market is not positioned for an intense EUR sell-off just yet. The mighty dollar is supported by risk aversion and economic recovery, while the EUR remains vulnerable to Euro-zone contraction and rate differentials favoring US Treasury’s. These are enough reasons for investors to want to sell the EUR on rallies for now.

Other Links:

Too many Cuts, Not Enough Band Aids For The EURO

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.