Despite some of the asset classes heading into the lower volume ‘dog-day’s of summer,’ there is a plethora of economic data points soon to be revealed to keep even the most bored of investors busy. Whether it’s interesting and volatile enough for the remaining few trading is another matter. Have faith; it will not be too long before investors again will be jousting with the full force of a German and Aussie election and the FOMC tapering talk next month. This week will bring with it readings on retailing, factory activity, housing and inflation to name but a few and that is only stateside data.

It seems that Euro equities have taken Asia’s lead, and are tracking higher first thing. During the overnight session a weaker yen had been supporting Asian stocks, while hopes of Chinese stability boosted other regional bourses. The Nikkei has rallied +2.6% overnight, as the yen quietly reversed some of its past five-day’s strength. A variety of factors continue to make the yen softer. Japan’s currency has been pressurized by reports that Prime Minister Abe has called for a study on lowering effective corporate tax rates. Not helping any was yesterday’s weaker than forecasted Q2 growth data – slower growth could require further government stimulus, which would obviously weigh on the yen yet again.

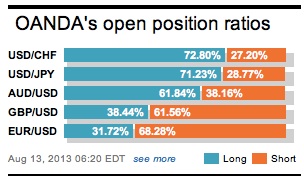

As noted yesterday, failure of USD/JPY ahead of ¥95.59 Fibo improves the short-term outlook. Asia continues to see significant Japanese importer demand for USD/JPY, and outright stop-losses are beginning to gather north of ¥98.10. There continues to be some talk that US names are looking for some more EUR/JPY with light EUR stops clustered around 131.20. US retail sales, industrial production and housing starts combined this morning could have the dollar trading well through ¥98.

The annual rate of inflation in the UK fell last month. July’s CPI arrived exactly inline with market expectation at +2.8%. However, it continues to outpace UK’s wage growth, which will only squeeze further consumers spending power. The new BoE governor Carney gets to avoid having to write a letter to the UK Chancellor for the second-month in a row to explain the higher inflation concerns. To date, the UK economy appears to be experiencing a fledgling recovery after multi- years of stagnation. With household incomes remaining subdued the prospects of economic revival soon is only further away. The BoE expects annual inflation to slow to their +2% threshold by 2015. Any cooling of inflation will be reason enough for Governor Carney to keep interest rates at record low until the unemployment rate eases to that +7% psychological watermark. Tomorrow’s UK job report is expected to show unemployment at +7.8%. With a new threshold indicator investors should expect heightened monthly volatility around the employment release.

Cable so far has run into some resistance ahead of offers at 1.5500, cooling inflation signs will do that. There is more offers reported topside north of 1.5525-35. In the mid-morning NY cut-off, there are 1.5450 and 1.55 options supposedly coming off. Support is now reported clustering in and around 1.5430 and 1.5400. Sterling’s direction should be highly influenced by various cross action – EUR/GBP.

The EUR has found its sea legs just before heading Stateside after investors welcomed a stronger reading on German business sentiment. The EUR has again spiked and is now trading through €1.33 after the German ZEW economic expectation index for this month came in at 42.0 vs. 36.3 last month. The market was looking for a 40.0 print. Just as important was the current condition index printing 18.3 compared with last months 10.6. Perhaps ECB’s Draghi and company will claim a victory. Their dovish tone and commitment to maintain a very accommodative monetary stance is certainly supporting economic sentiment. The Euro-zone’s industrial production figures were also in focus. They happened to rise at its fastest pace in two and a half-years to +0.7% from -0.2%, m/m. Despite being a tad weaker than expected, it certainly goes a long way supporting the theory that the Euro-zone recession may have ended.

Optimism is helping the 17-member single currency, but not enough to push the currency out of its range. Signs of recession ending in important Euro countries has the USD and Yen on the back foot ahead of retail sales and inventory numbers out of the US this morning. The EUR’s initial squeeze from 1.3280 has run into more market offers at 1.3315-25. Investors still favor the EUR to test 1.3335-50 before trading lower again as larger sovereign offers could put a top in. Despite the German data beating market expectations it only matched the rumors.

Other Links:

EURO Apathy Could Pressure The ‘Single’ Currency Further

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.