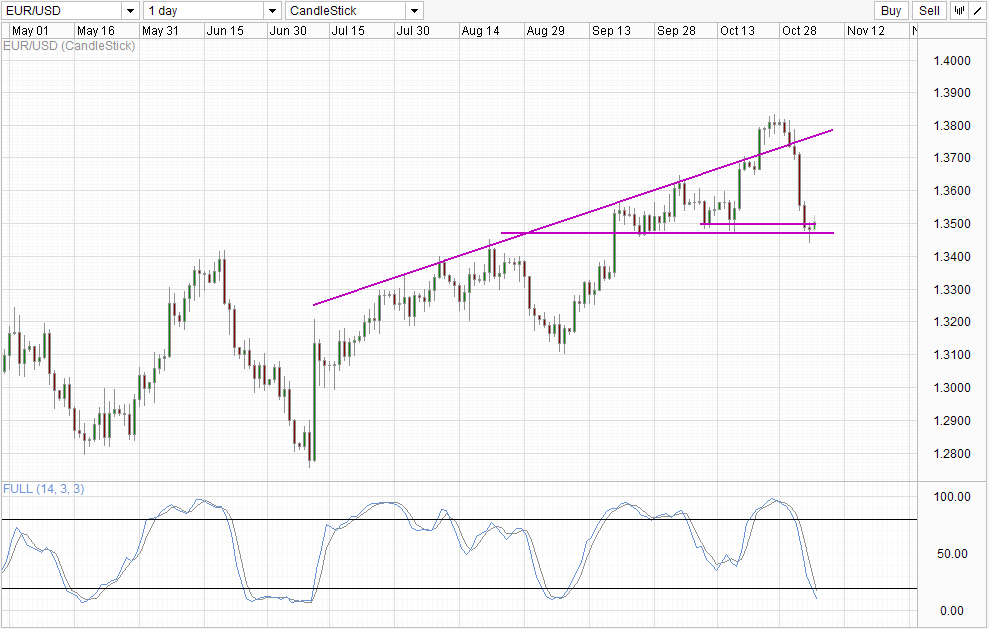

Daily Chart

EUR/USD recovered significantly from the dip below 1.35 yesterday, with prices trading higher following stronger than expected print from German Manufacturing PMI. Euro-Zone Sentix Investor confidence also came in much higher than expected, hitting 9.3 vs an expected 6.2 and 6.1 previous.

However, prices were always looking slightly bullish, as prices were already recovering before the aforementioned bullish news. This is not entirely surprising as the move towards 1.35 appeared to be an strong knee-jerk overreaction following hawkish statements made by Fed’s Fisher, which is prone to bullish pullbacks especially when the reaction in EUR/USD was the largest amongst all major USD pairs. The bullish news only helped to quicken the move back above 1.35, but prices were already looking nicely supported with yesterday’s daily candle closing within the support band and forming a bullish hammer pattern.

Currently price is forming a bullish candlestick, but it does not make the strongest Morning Star pattern as the body is much shorter compared to last Friday’s candle. Hence, a stronger bullish candle may be needed for additional confirmation. This is echoed by Stochastic indicator which suggest that bearish momentum is Oversold, but a proper bullish cycle signal is not yet in play. It is likely that an additional bullish candle will help to turn around the Stoch curve and potentially give us the bullish signal, adding conviction that a move towards 1.36 and rising trendline is possible.

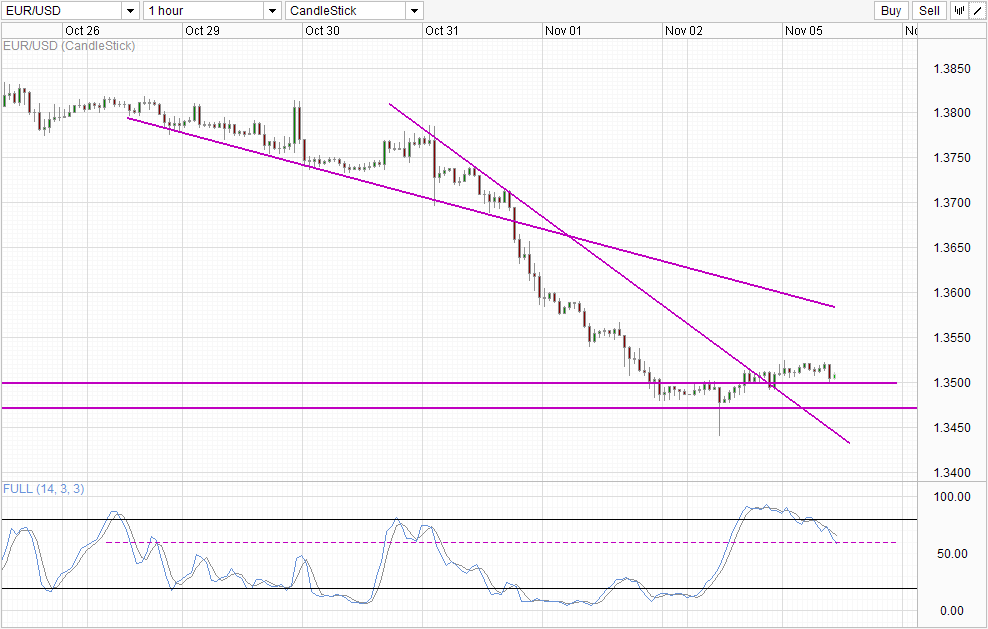

Hourly Chart

Short-term hourly chart tells us that 1.35 is being retested again. Currently the 1.35 level appears to be holding firm, but stochastic readings has just given a fresh bearish cycle signal, and a move towards the lower end of the support zone around 1.347 may be possible. However, it is also plausible that 1.35 will hold as Stochastic readings may still yet rebound from current 60.0 levels where points of inflexion were seen previously.

However, Bulls have more problems stacked against them later this week. ECB Rate decision on Thursday and NFP Friday may provide yet more volatility which may send prices below 1.347, which may tilt initiative back in bears favor especially since short-term direction since late October has been bearish. Therefore, if bulls are not able to push significantly higher from 1.35 (e.g. above 1.355), the possibility for a bearish continuation increases greatly.

Fundamentally, there isn’t any big stumbling block for EUR right now. ECB’s Nowotny recently state that the Central Bank will not be easing anytime soon, and may have to live with a strong EUR for now even though it is not desirable. Latest economic numbers are not the most healthy, but certainly the direction is bullish if not stable. Hence there are good reasons to believe that EUR will continue to remain elevated for now. However, that does not necessarily mean that EUR/USD will trade higher, as USD strength is likely to pull this currency pair in the opposite direction. Hence traders who want to participate in a EUR recovery narrative may be better off pairing with another rather than the Greenback right now.

More Links:

AUD/USD Technicals – S/T Bearishness Seen Pre RBA

USD/JPY – Rangebound As Japanese Markets on Holiday

USD/CAD – Canadian Dollar Continues Pressure on Greenback

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.