Latest Employment Data from Australia showed number of employed growing by 1.1K in the month of October versus an expected 10.0K. This itself would be a bearish enough reason to send AUD/USD scurrying lower, but the data beneath the headline figure is even more bearish. Full Time employment numbers have fallen by 27.9K, one of the largest monthly drop we have seen in the past 5 years. The only reason why headline figure still appears positive was due to Part Time Employment numbers which grew 28.9K. One saving grace was the Participation Rate which maintained at 64.8%, suggesting that the unemployed are still looking for jobs. But considering that the expectations were for participation rate to increase to 64.9%, and that previous month’s 64.8% was a result of a revision lower, this month’s number is still considered mildly bearish.

Hourly Chart

Hence it is not surprising to see AUD/USD falling close to 50 pips following the announcement. It is likely that there was additional bearish pressure from technical traders following the break of 0.952 support and rising Channel Bottom. However, right now from a technical perspective, the possibility of a bullish pullback is high with prices unable to match the lows of 5th November, with Stochastic readings suggesting that the bearish momentum may be over for now as readings are pointing higher within the Oversold region.

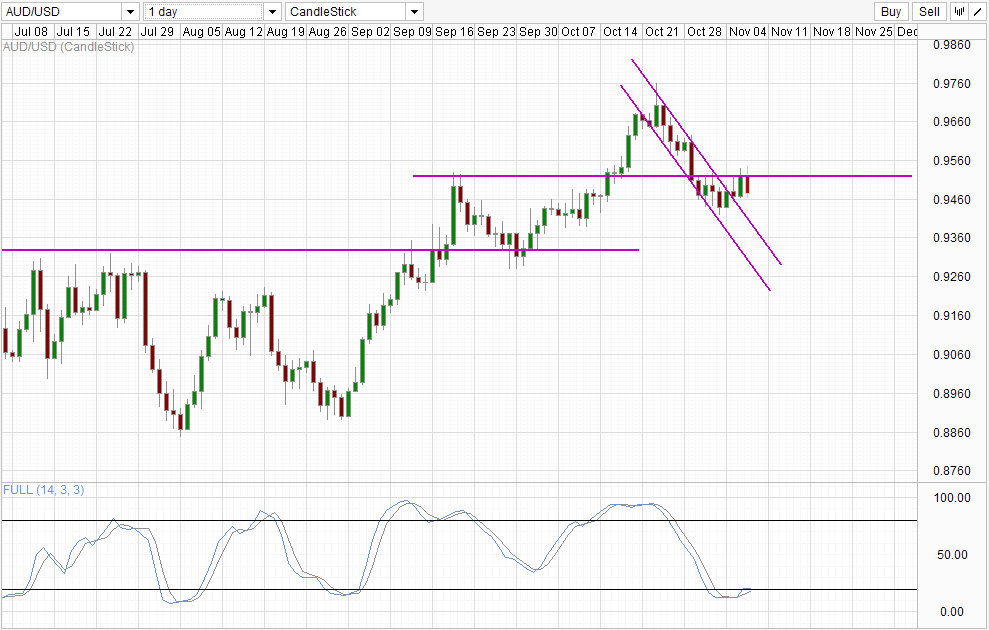

Daily Chart

Daily Chart is less bullish though, with prices heading towards Channel Top following the rebound off 0.952. Stochastic readings are Oversold, but it seems that we have averted a bullish cycle signal, underlining the strong bearish bias that price is under currently.

Putting Short-term and Long-term chart together, the most bearish scenario would be price breaking the 0.942 which will trigger additional short-term bearish acceleration. On the daily chart the push will result in a Tweezers Top bearish reversal pattern, while Stochastic readings will be able to move below 20.0 more resolutely, hence increasing bearish conviction in both S/T and L/T timeframe.

More Links:

GBP/USD – Consolidates around 1.61

EUR/USD – Recovers to Above Key 1.35 Level

Dow 30 – New Record Close But Bearish Risk Remains

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.