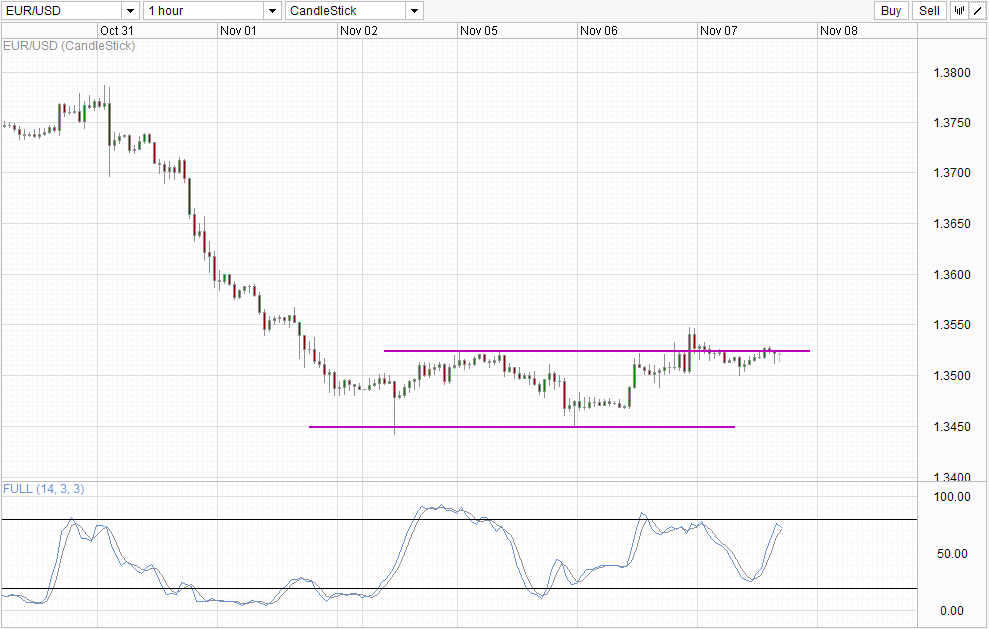

Hourly Chart

EUR/USD is trading just under the 1.3525 resistance a few hours before the ECB Rate Decision (07:45 am EST). Current bias is bearish due to the strong bearish bias that has been in play since last week’s decline. Stochastic readings agree with a Stoch top forming around Stoch “resistance” band between 65.0 – 80.0. This opens up a potential move towards 1st bearish target of 1.3480, and perhaps even the lower end of current consolidation range around 1.3450.

However, ECB event is highly expected to be bullish for EUR, as the Central Bank is expected to keep rates on hold (Index swaps are pricing in a 4% chance that ECB will cut rates today). Hence, the likelihood of prices breaking 1.352 and pushing beyond 1.3550 in the short-term is high if ECB expectations are met. Nonetheless, should prices rally in the immediate aftermath but revert lower below 1.352 and preferably below 1.35, the likelihood of a move towards 1.345 increases and we could even see prices breaking the support level for a new bearish extension.

Conversely, should ECB cut rates/ introduces easing measures unexpectedly yet prices stay above 1.345, forward bias will turn towards bullish, and traders should look out for strong acceleration should 1.352 and 1.355 resistances are broken subsequent.

More Links:

AUD/USD – Bearish Floodgates Waiting To Open After Dismal Job Numbers

GBP/USD – Consolidates around 1.61

WTI Crude – Slightly Higher But S/T Bearish Pressure Remains For Now

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.