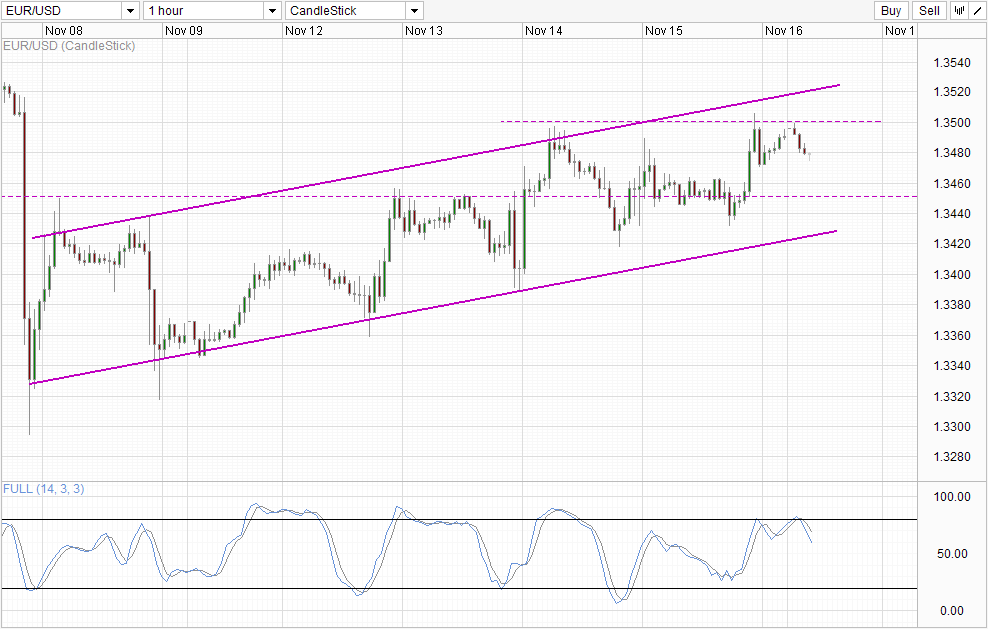

Hourly Chart

The weakening of EUR/USD underlying bullish sentiment failed to establish anything significant last Friday. EUR/USD did dip below the 1.345 support briefly, but prices recovered strongly during early US session, pushing above 1.35 before settling around 1.349 before closing. As there were no major news release from Europe then (Euro-Zone CPI is not a major market mover, and in any case the numbers came in as expected), the move was all on USD weakness. This assertion can be supported by the US economic news released when the rally was at its strongest.

First off the bat we have Empire Manufacturing Index which fell to -2.21 versus an expected +5.00. Industrial Production has also shrank by 0.1% when a mild growth of 0.2% was expected. This slight disappointment might have been overlooked in the past, but market was hyper-sensitive last week due to Janet Yellen’s dovish speech. As such, it is no surprise that market reacted bullishly (bearishly for USD) on the weaker than expected economic numbers, as the chance of Fed holding off QE Taper just got slightly higher.

However, it should be noted that EUR/USD is indeed not as bullish as before. Even though ECB’s Coene suggested that the Central Bank does not feel it is “necessary to do more” (referring to further rate cuts) in an interview on Saturday, Monday did not start off bullishly for EUR/USD, with prices heading lower once again almost immediately after market opened. Technical influences shouldn’t be ignored as well, as prices did have a short push towards 1.35 which failed, opening up 1.345 as the immediate bearish target – a notion agreed by Stochastic indicator which is showing a fresh bearish cycle signal currently.

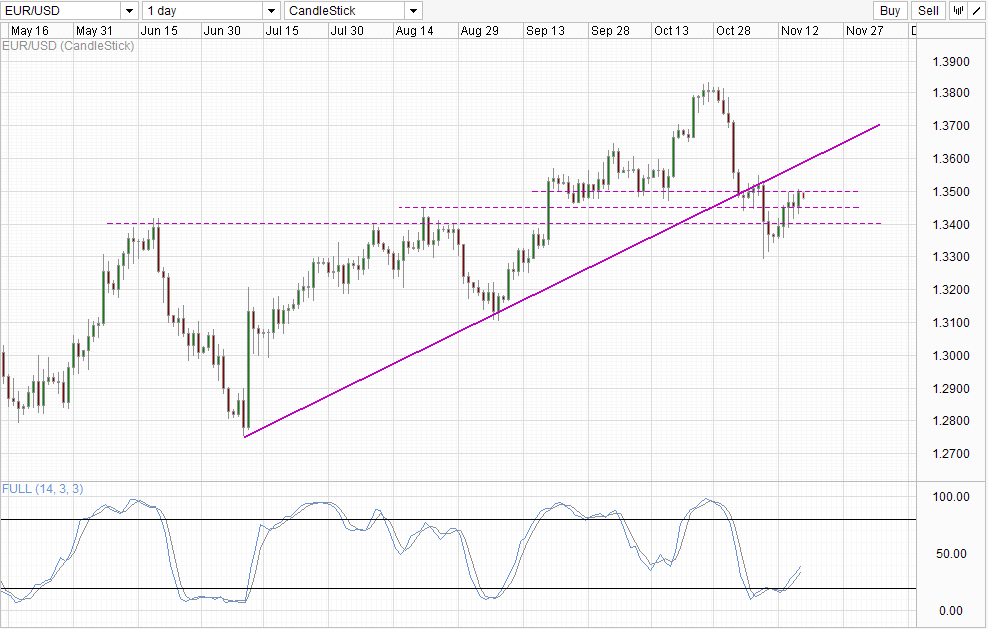

Daily Chart

Long-term chart for EUR/USD continues to be bullish though. Stochastic curve continues to point higher with no sign of abating even though the 1.35 level stays strong. However, stoch curve has its own “resistance” around 40.0 to content with, and hence it should not be surprising if Stoch curve move lower from here just as 1.35 holds. But should price push above the 1.35 resistance, it is likely that Stoch curve will push above 40.0 – making Stoch indicator here a good confirmation for both upswing and downswing scenarios. Underside of the rising trendline will be the immediate Bullish Target (close to 1.36) should 1.35 breaks early this week, while 1.34 will be the bearish target with 1.345 providing interim support (as seen from short-term chart) should 1.35 holds.

Once again there isn’t any major economic news coming out from Euro-Zone this week. We do have some flash Purchasing Manufacturing Index and German ZEW Economic Sentiment but these numbers tended not to move EUR/USD unless they are way off expectations. Hence all eyes will be on USD related news once more. Should market remain high-strung with regards to QE Taper possibilities, then we may see wild swings in EUR/USD, which may actually result in the break of all the above mentioned support/resistance levels due to volatility. If this happens, traders can look at the post announcement reactions (e.g. after US Retail Sales announcement or Existing Home Sales) and gauge market sentiment from there once more. It bears mentioning that even though S/T underlying sentiment seems to favor bears now, but considering that market is feeling jittery now, everything can change in a heartbeat.

More Links:

Week in FX Americas – Market Unfazed By Yellen Comments

Week in FX Europe – BoE Shifting The Goal Posts?

Week in FX Asia – Is Abenomics Working? Exports and GDP Offer Insights

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.