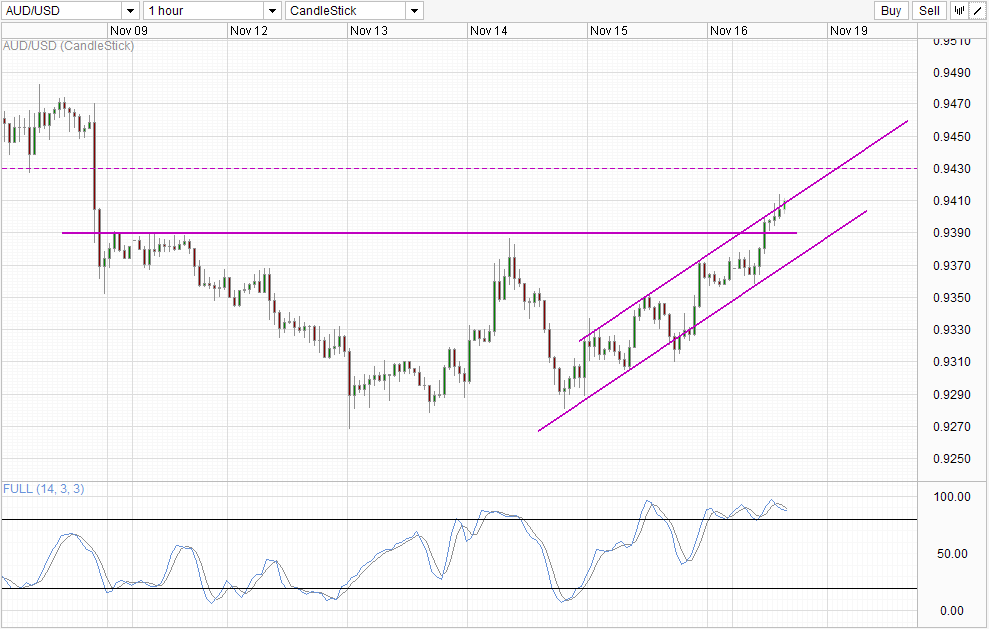

Hourly Chart

AUD/USD shrugged off the early declines to push above the 0.939 resistance, trading above 0.94 round number currently. The impetus for this surge is not obvious, as risk appetite in Asia isn’t the strongest at the moment. Hence, the only plausible reason for this soft rally would be the technical rebound off Channel Bottom around 9:00am SGT (8:00pm EST). Currently price is straddling Channel Top, seeking 0.943 resistance as bullish target. However, looking at Stochastic readings, the likelihood of price breaking 0.943 on this move alone is not high as bullish momentum is deeply Overbought with Stoch Curve pointing lower now. Nonetheless, we’ve seen Bullish momentum preventing 2 bearish cycle signals from forming back on last Friday closing time and this morning’s move. Hence it will not be surprising to see the same thing happening again.

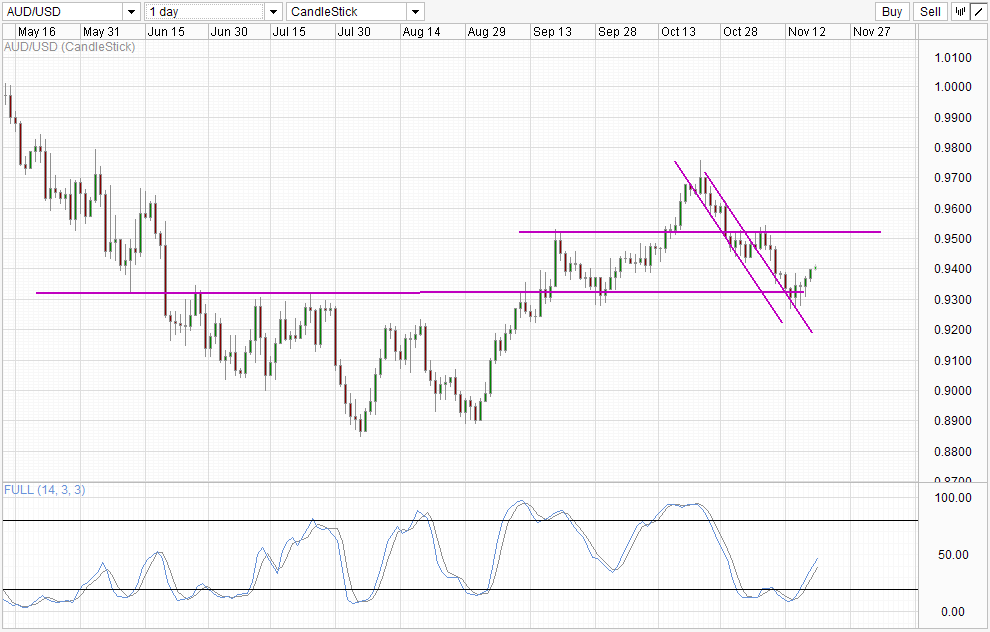

Daily Chart

The S/T bullish momentum sounds even more plausible when we look at Daily chart where bias is on the bullish side as well. Stochastic suggest that a bullish cycle is in mid flight, which opens up a possible push to 0.952. With prices breaking the 0.94 interim resistance, the likelihood for further acceleration higher increases, potentially allowing bulls to hit the resistance this week.

However, traders should note that there are 2 potential news events this week that could bring AUD/USD down. RBA minutes tomorrow may reflect strong dovish undertones which will increase rate cut speculative play, while RBA’s Glenn Steven’s speech on Thursday will most likely echo the sentiment seen from the minutes, dragging AUD/USD lower further (or higher if RBA minutes turns out to be hawkish). Not only that, with US traders being hyper-sensitive to any economic news that can increase/decrease Fed’s chances of tapering stimulus, USD is in for a bumpy ride this week – likely to impact AUD/USD in a huge way. Hence, any talk of directional play for AUD/USD this week will definitely be premature, and traders will need to endure high levels of whipsaw before we see clearer trend emerging.

More Links:

Gold Technicals – Mildly Bearish But Bulls May Lurk

EUR/USD Technicals – 1.35 Resistance Holding Strong

Week in FX Asia – Is Abenomics Working? Exports and GDP Offer Insights

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.