Gold Bears simply just can’t get a good break. Despite trading sharply lower 2 weeks ago, last week was less than productive with regards to bearish headway.

Things started out promisingly on Monday though, with prices falling quickly to a low of 1,225 as bears went for the jugular early seeking blood. However, the resilience of bulls is impressive, with prices moving back up to a high of 1,258 – and more importantly above the prior Friday’s close of 1,243. This show of strength by bulls can be explained by the fact that speculators are still playing the QE Taper/No Taper guessing game, coupled with institutions continuing to buy/hold more gold for long-term investment purposes.

Prices didn’t do much since, trading sideways with 4 additional swings (around 10+ USD each) during the week , closing around 1,251 by the end of Friday. This shows that both bulls and bears may not be fully convicted in their respective stands, suggesting that we could still see yet more sideways movement this week.

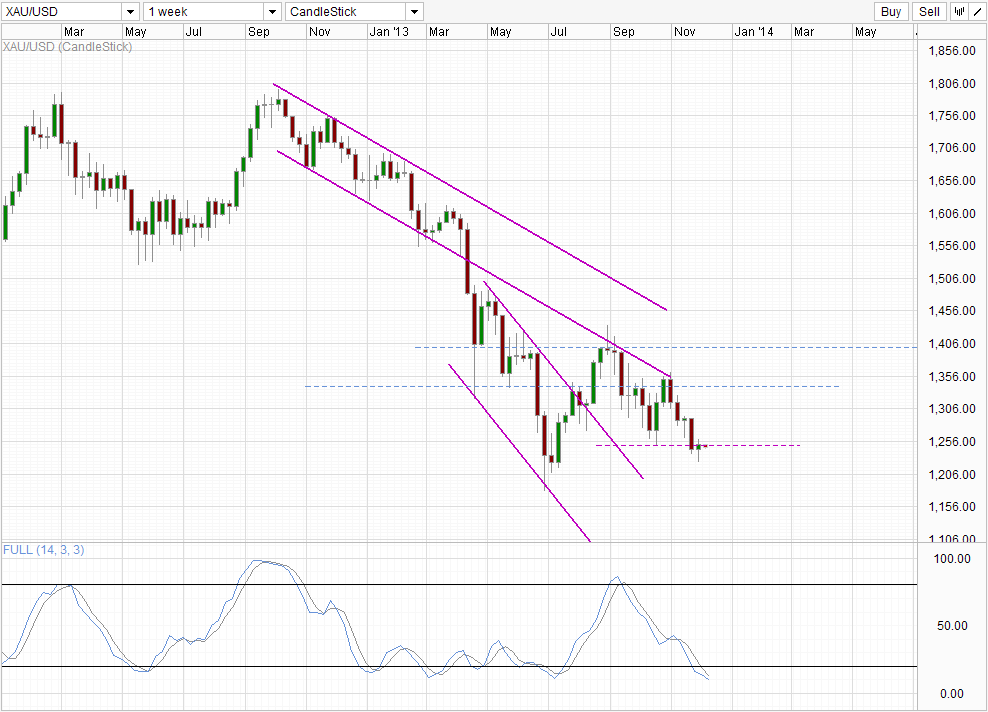

Weekly Chart

From a technical perspective, it is interesting to see Gold prices pushing lower the moment market opened. Prices should have been mildly bullish after closing above the key 1,250, but early bearish movement this week suggest that bears is still firmly in control despite the sideways outlook. Hence, even though prices remain flat for now, the likelihood of future bearish breakout is higher than any bullish venture.

That being said, it should be noted that bearish breakout may not be so forthcoming, especially with Stochastic readings being oversold currently and favoring a longer “resting period” for bears if not a full on bullish pullback. Hence, it is important that bears do not get ahead of themselves and start selling now as previous week has showed us that huge swings up and down can be reasonably expected.

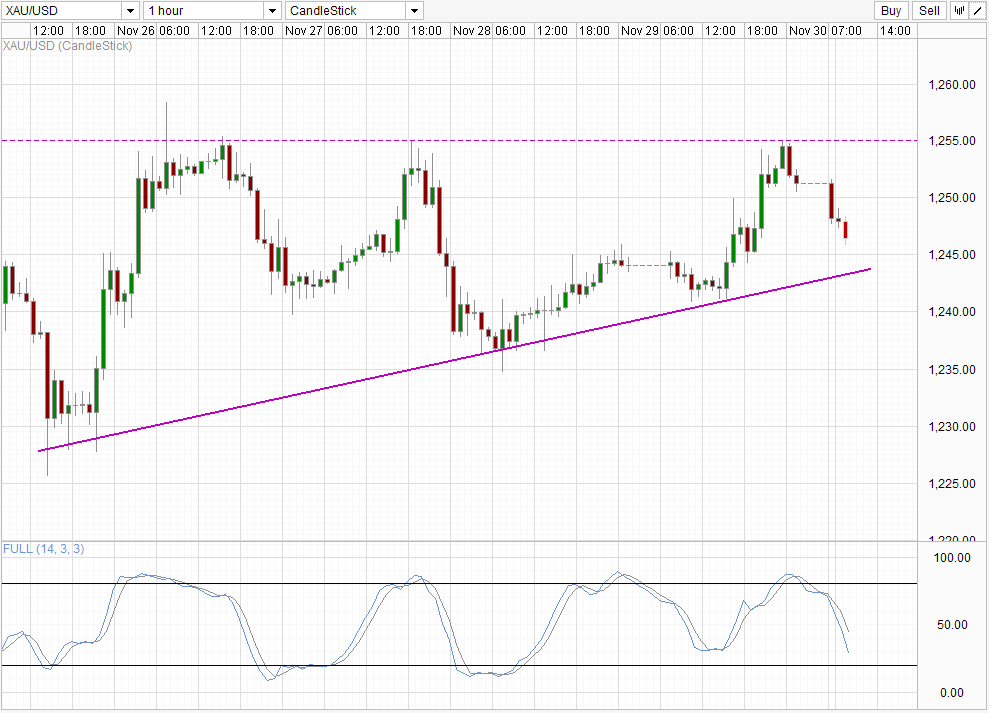

Hourly Chart

Hourly Chart shows that price is bearish below 1,255, with a rising trendline that will likely put a stop to current bearish venture, potentially opening up a move back up towards 1,255 once more. Stochastic agrees with readings close to the Oversold region and will likely be deep within Oversold should prices tag the rising trendline. Should prices does push up higher with 1,255 resistance holding, it is possible that we could see bearish acceleration back towards 1,240+ during the later part of the week should prices break the rising trendline eventually (which may happen even if prices stay around 1,255 as the trendline continue to rise).

Fundamentally, with various Central Banks making rate decision announcements and Q3 GDP figures being released this week, not to mention the highly explosive US NFP numbers, Gold will be in for a bumpy ride as speculative play on QE Taper/No QE Taper will increase tremendously. Hence traders will need to distinguish between huge swings and genuine directional moves and only commit should strong directional trends emerge with confirmation (and ideally lined up with fundamental direction)

More Links:

AUD/USD – Finds Solid Support at 0.91

EUR/USD – Settles around 1.36

Week in FX Asia – China’s Gold Appetite Gets Bigger

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.