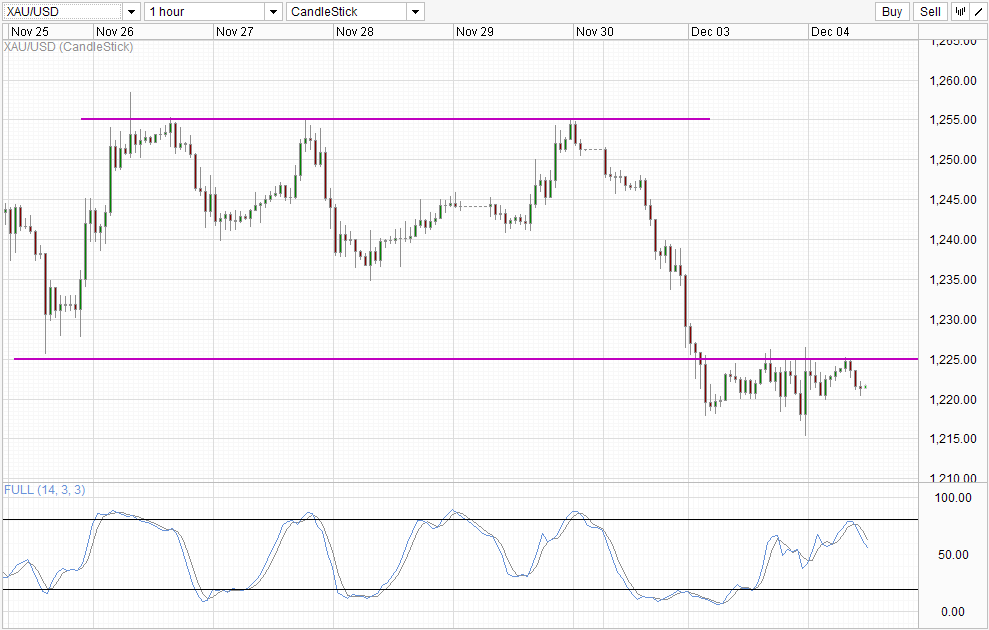

Hourly Chart

Not much movement on the gold front, even though US Stocks were trading lower on supposed taper fears. This is not entirely unexpected, as Gold appeared to have overreacted on Monday. However, bears continue to reign with 1,225 resistance holding strongly. Currently Stochastic readings have peaked and is pointing lower, breaking the soft “support” of 65.0. This increases the likelihood of prices pushing towards 1,215 but the likelihood of further bearish extension remains unclear.

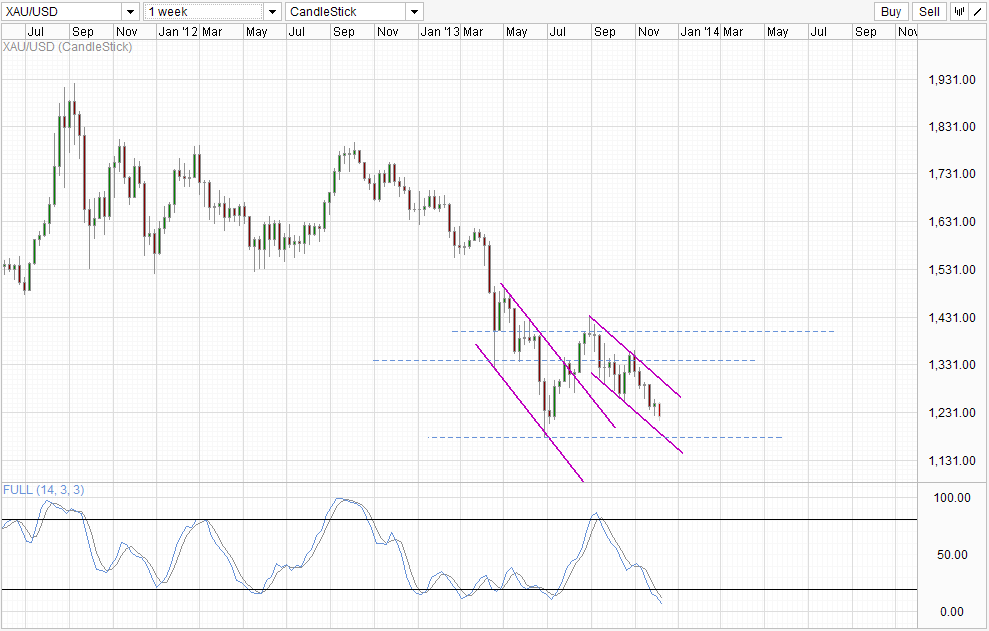

Weekly Chart

Weekly Chart is almost identical to the one shown yesterday, with prices firmly bearish but bullish rebound expected around 1,180 which is the confluence of Channel Bottom and current 2013 Low forged back in June. In this regard, the likelihood of price eventually breaking 1,215 is high (as the ultimate bearish target is 1,180 within the next few weeks), however this tells us very little about in the immediate short-run, and prices could still stay within the tighter 1,220 – 1,225 range in the next 1-2 days.

This Friday’s US NFP may provide yet more bearish drive should numbers come in much better than expected once again, increasing QE Taper fears. However, it should be noted that the supposed QE Taper fears did not manage to drive Gold much lower yesterday, hence bearish follow-through on Friday post strong NFP print is also doubtful, especially with 1,200 and 1,180 significant support lying just below current price levels.

More Links:

GBP/USD – Bounces off Support at 1.6350

AUD/USD – Continues Drive Towards 0.90 with Three Month Low

EUR/USD – Finds Support at Key Level at 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.