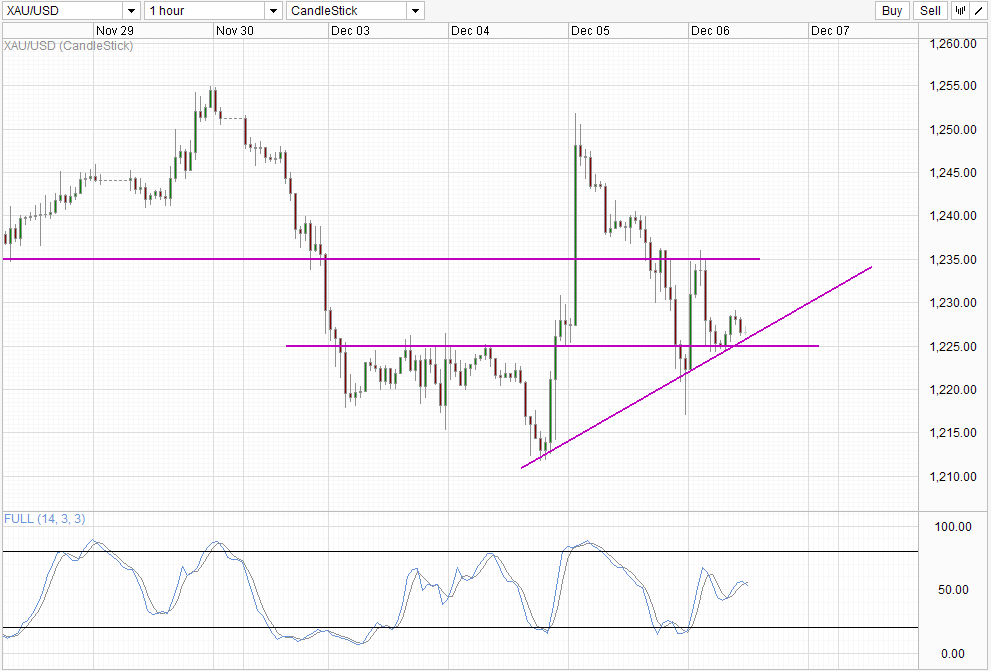

Hourly Chart

Gold prices tanked yesterday as expected , hitting a low of 1,217 during early hours of US session. Prices were already inherently bearish with bearish momentum seen during early Asian session yesterday, with QE Taper fears which arose from stronger than expected GDP and Jobless Claims numbers contributing in the bearish acceleration. However, price was still unable to breach the consolidation zone between 1,220 – 1,225 (stretches to 1,215 if you are generous), and instead bounced back towards 1,235 resistance quickly.

Similar to yesterday, the rally is once again inexplicable. Overall sentiment in Gold should be bearish, and there wasn’t any news announcement or speeches by key figures that could have inspired such a rally. Technicals may explain in part, but the relative swiftness of the rally and the quick pullback that occurred subsequently once again suggest that this recovery rally may yet be another large order from one or a few large institutions (no names as of now) that have bought aggressively for whatever reasons unknown to us right now.

What this implies is that even though prices are trading above this newly formed rising trendline, the overall short-term bearish sentiment of Gold isn’t over, and prices may still break the rising trendline and confluence with 1,225 resistance turned support today, resulting in quick acceleration towards 1,215 thereabouts.

Today’s Non-Farm Payroll release will definitely create volatility which may be the catalyst needed for the bearish breakout scenario. However, it should be noted that the likelihood of prices rebounding off the trendline is high as well, as market may have already price in a better than expected NFP number following strong ADP employment and Jobless Claims earlier this week.

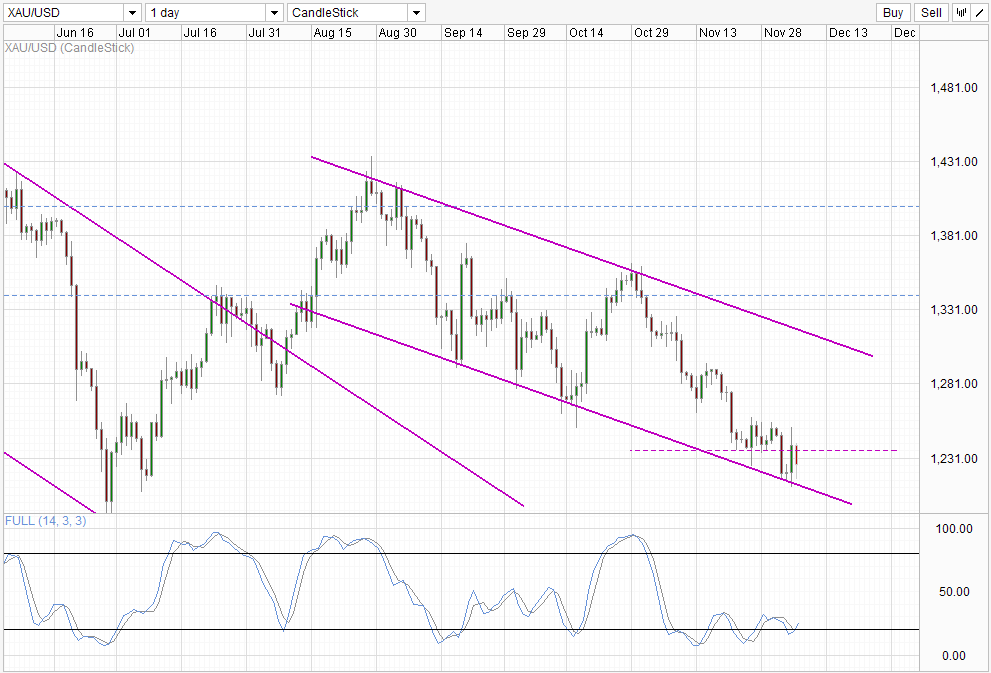

Daily Chart

On the daily chart, Price will remain bearish as long as we are below 1,250 – 1,255 resistance. Even though we have tagged Channel Bottom with Stochastic curve pointing higher, Stochastic curve will need to clear the 33.0 level before strong bullish conviction can be affirmed (which will likely line up with a 1,250 -1,255 break).

Even though US economic numbers have been tremendously strong in this week, it is unlikely that the Fed will suddenly change their expected stance of not tapering QE in December. Hence, there is a real possibility of price returning back up towards Channel Top in the month of December. However, long-term bullish prospect for Gold is going to be limited as overall sentiment for Gold is still bearish, which increase the likelihood of prices rebounding off Channel Top and heading lower (if we even reach there to begin with) in the long run. Therefore, Bulls betting on a short-term Gold rally may want to weigh their risk/reward ratio before entering, as Gold prices may continue to push lower for 1 full week before the 17-18th FOMC meeting.

More Links:

GBP/USD – Pound Drops Sharply As US Numbers Sparkle

USD/CAD – US Dollar Edges Higher as Unemployment Claims Drop

AUD/USD – Aussie Tests 90 Line as US Data Sparkles

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.