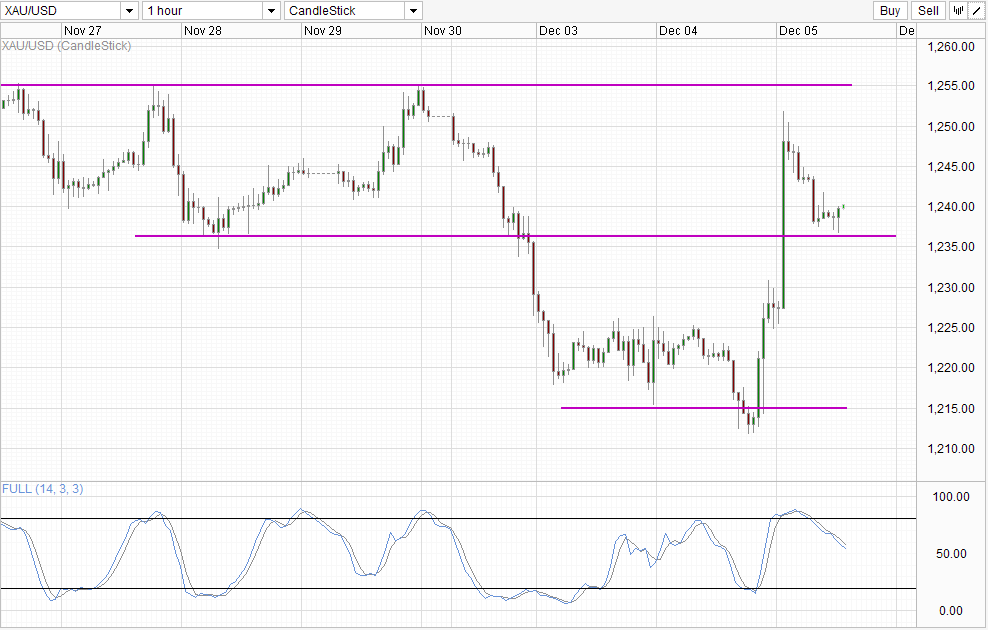

Hourly Chart

Despite talks of further QE Tapering fears (which has been picked apart in the S&P 500 analysis), Gold prices sky rocketed yesterday, pushing from a low of 1,212 just before US open to a high of 1,252 during midday New York. This gain cannot be explained via fundamentals as there aren’t any news that could have triggered market to seek Gold on a flight to safety. In fact, we had a strong New Home Sales print yesterday which should have encouraged risk appetite (which triggered much of the “more QE taper fears” talk) and drove Gold prices lower.

It seems that the only reason why gold prices pushed so much higher yesterday can only be accounted by sudden demand that basically came out of nowhere. Right now there hasn’t been any reports or rumors about any major institution buying Gold, but it is hard to imagine that yesterday’s rally was a concerted broad market movement. The strong bearish sell-off that followed certainly lend credence to this assertion, as a broad market move should not have suffered significant pullbacks so quickly.

If this hypothesis is indeed true, then we should not expect any more large bullish movement to come forth in the near term, as it is unlikely that other large institutions will join in the buying frenzy without good reasons. Hence a move towards 1,255 ceiling once more may be difficult, but prices may still remain nicely supported above 1,237 soft support as bears may be scared to commit given so many unknowns right now.

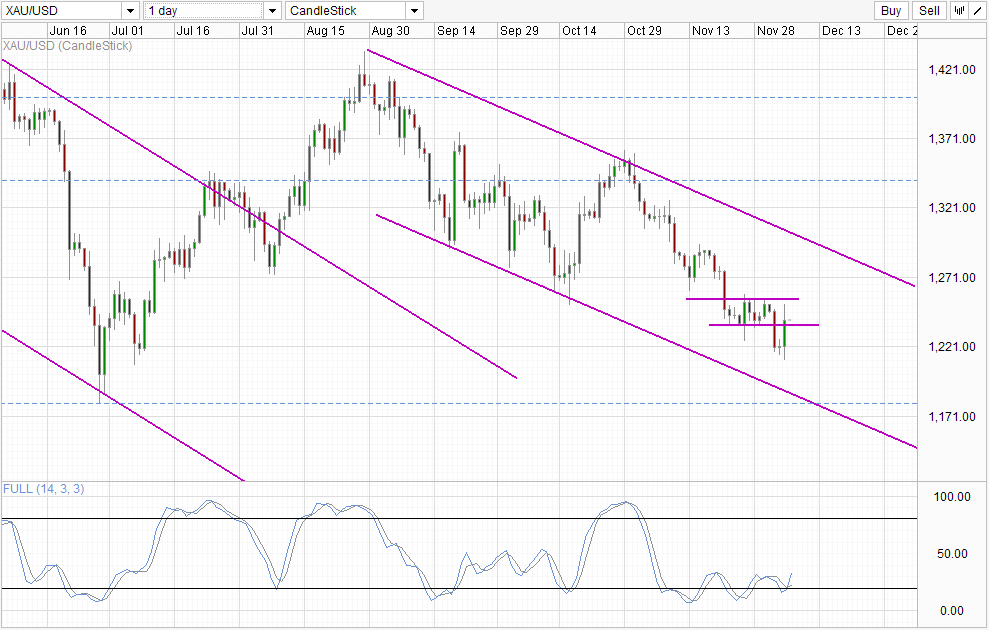

Daily Chart

Daily Chart remain bearish though, and a move towards Channel Bottom is still in the works. Stochastic readings is giving us a bullish cycle signal, but Stoch curve will need to clear its “resistance” level of 33.0 and preferably above 53.0 in order to demonstrate stronger bullish conviction that will bring us all the way up towards Channel Top. But even then overall bearishness will not be invalidated, and long-term direction for Gold will still remain bearish.

More Links:

GBP/USD – Maintains above Key Level of 1.6350

AUD/USD – Reaches Three Month Low below 0.90

EUR/USD – Settles below Key Level at 1.36

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.