Yesterday’s analysis suggested that there was a slight tint of bearish bias, but concluded that the risk may not be worth it given the circumstances. In some ways we are vindicated as EUR/USD indeed rally, but even then the degree of bullishness that came forth was surprising.

As the only economic news release was US Pending Home Sales which came in much lesser than expected (0.2% vs 1.1% expected, while November numbers were revised lower from -0.6% to -1.2%), one can simply put 2 and 2 together and conclude that this weaker than expected number decrease the chances of further QE tapering in early 2014, hence diluting USD and sent EUR/USD higher. There may be some truth in this hypothesis as the decline in USD was spotted across the board with major USD pairs such as AUD/USD and GBP/USD rallying together during early US session. Furthermore, US stocks rallied as well, fitting nicely into the hypothesis which says that risk appetite has increased due to lower chances of future QE tapering.

However, this is not a valid explanation when we consider that US 10Y Treasuries yields climbed higher and tagged the 3% once again. Also, US stocks have been extremely bullish ever since the Fed taper was announced 2 weeks ago, suggesting that we are no longer under the shadow of QE influences. Hence it would be highly peculiar that suddenly speculators are playing the “will they/won’t they taper” game. The final nail in this coffin would be the fact that USD actually started strengthening during the later part of yesterday’s trading session, and the weakness seen in USD actually started during early European hours, long before Pending Home Sales numbers were released. Looking at USD/JPY, which is highly correlated to risk plays, the fact that USD/JPY has been decreasing steadily yesterday shows that it’s not QE speculation that has driven EUR/USD higher, but rather this is a mere isolated case of USD weakening.

And there are good reasons for USD to weaken too. With curtains of 2013 drawing to a close, it is no surprise that traders will be closing out their long USD positions. Then again, we could be approaching this wrong and over analysing market movement when there is none, and all these could simply be chucked into the “holiday trade” drawer.

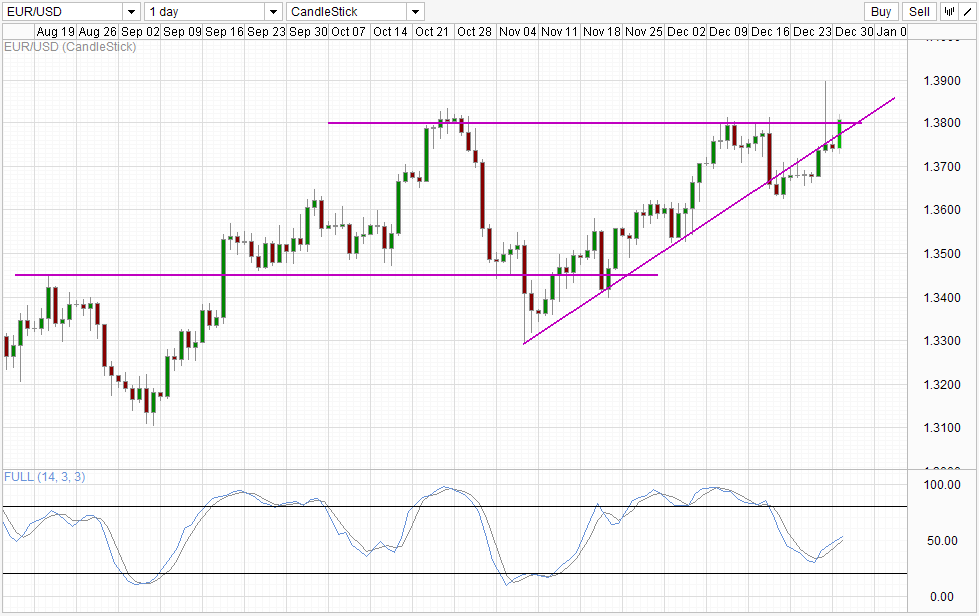

Daily Chart

In any case, it always pay to be over prepared than less. In this regard, traders can prepare themselves for a potential bullish push in early Jan should 1.38 round figure resistance is confirmed to be broken. Stochastic readings agree with Stoch curve currently pushing above the 40.0 – 50.0 “resistance band”, suggesting that current bullish cycle conviction is strong. However we would need to see a daily close above 1.3815 and preferably above the October swing high of 1.383 as price has only been recently spotted pushing much higher for no good reason before collapsing lower.

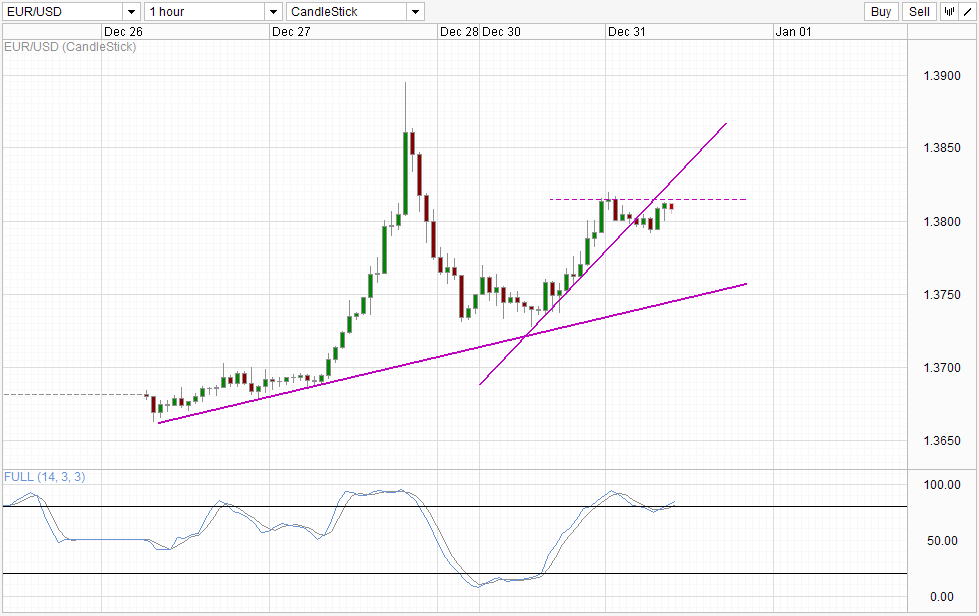

Hourly Chart

The importance of 1.3815 can also be seen on Hourly Chart. Stochastic readings are Overbought, but both Stoch and Signal lines are pointing higher, hence there is no immediate risk that a bearish reversal will be happening right now, but if price spend an extended period of time under 1.3815, the likelihood of a push back towards the lower rising trendline increases.

More Links:

GBP/USD – Pound Rally Continues As US Housing Data Disappoints

USD/CAD – Loonie Remains Under Pressure

AUD/USD – Struggling Aussie Starts Off Week Below 0.89

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.