No surprises for AUD/USD in this new year as bears continue to remain firmly in charge. Prices fell to a low of 0.8886 on open, led by the disappointing Chinese PMI Manufacturing number that was released on New Year’s Day. The weaker than expected growth rate seen in China’s manufacturing sector pile on further woes on Australia which is already suffering from a plateauing mining sector which has contributed to the decline in Australia’s slower GDP growth, adding bearish pressure to AUD.

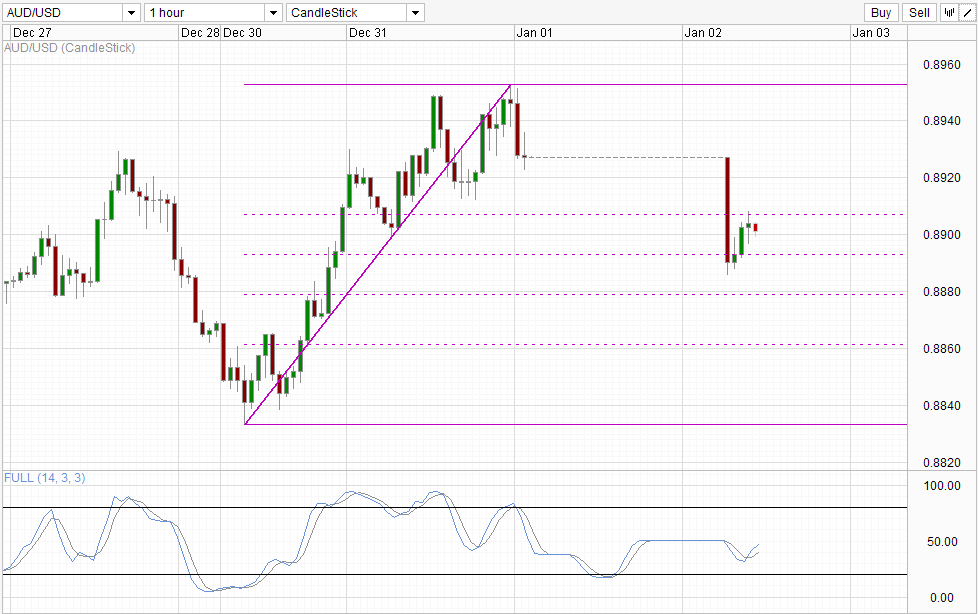

Hourly Chart

But it seems that bulls are not taking this without a fight, which makes sense considering that price has been on the uptrend since the start of this week. Today’s decline found support around the 50% Fib retracement level, with current price testing the 38.2% Fib and confluence with support support seen on 27th Dec and the swing low of New Year’s Eve. Should price manage to break the aforementioned level, we could see bullish acceleration towards the recent swing high and the potential for bullish extension beyond that remains. Stochastic indicator agrees with Stoch curve currently staying around the 50.0 “resistance” level. If price head higher from here stoch curve will break the aforementioned “resistance” and suggest that bullish

From a fundamental perspective, there is a chance that AUD traders have overreacted to the Chinese PMI numbers. Case in point, Australia’s stock index opened bullishly today, with none other than mining companies stocks leading the bullish charge. This suggest that China’s recent PMI numbers isn’t that bad after all. In retrospect, a 51.0 print is still respectable even though it is lower than the 51.3 expected and 51.4 previous. Market has been sprouting doom and gloom prophesies about China, but incredibly the Asian giant remains robust despite all the financial reforms and the recent credit/liquidity scare. Hence, it may not be surprising that market is actually bullish that China has defied the odds and manage to grow mildly.

This is in no way saying that AUD/USD should be pushing higher in the long run, but rather bears may have overextend themselves amidst a short-term bullish uptrend, and we could be seeing strong bullish correction in the short-term coming up.

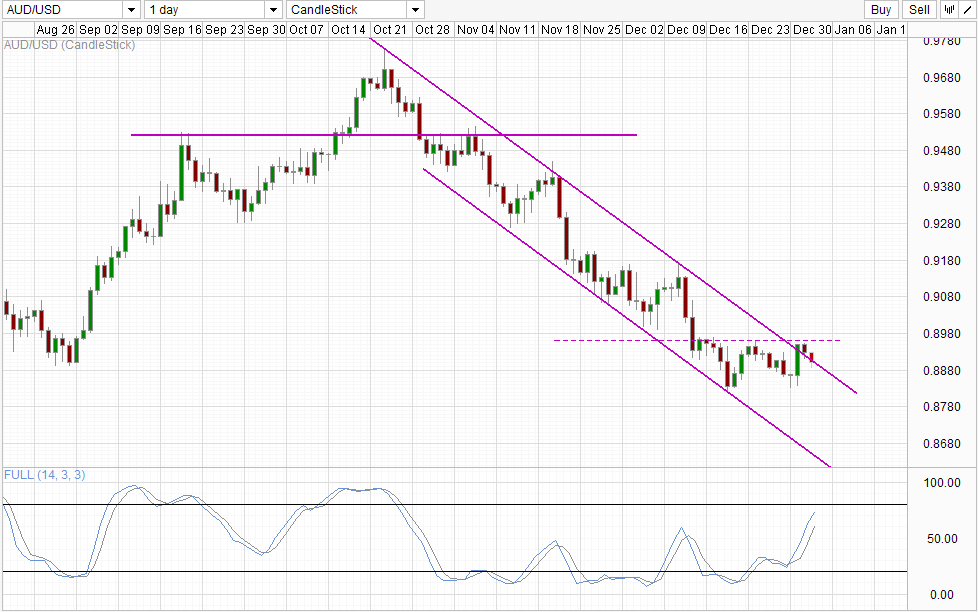

Daily Chart

Long-term trend for AUD/USD remains lower, with the bearish channel remains in play despite prices breaking out of Channel Top 2 days ago. 0.896 continues to act as a formidable ceiling, sending price lower back towards Channel Top currently. Nonetheless, looking at Stochastic curve which is pointing higher, a rebound off Channel Top towards 0.896 once again cannot be ruled out, echoing the bullish potential in the short-term. However, divergence between Stoch peaks and price peaks suggest that we could be seeing a strong long-term bearish push coming up, which will likely break the 0.882 – 0.896 consolidation that has been in play in the past 2 weeks.

The only long-term bullish potential for AUD/USD would be a surprise weakening of USD which may come in Feb – Mar when the US debt ceiling issue comes back into focus. However, even that could turn out to be bears’ fortune should Congress manage to negotiate a deal without much fuss.

More Links:

EUR/USD Technicals – Bears Claiming First Blood In 2014

USD/CAD – 2013 In Review

AUD/USD – 2013 In Review

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.