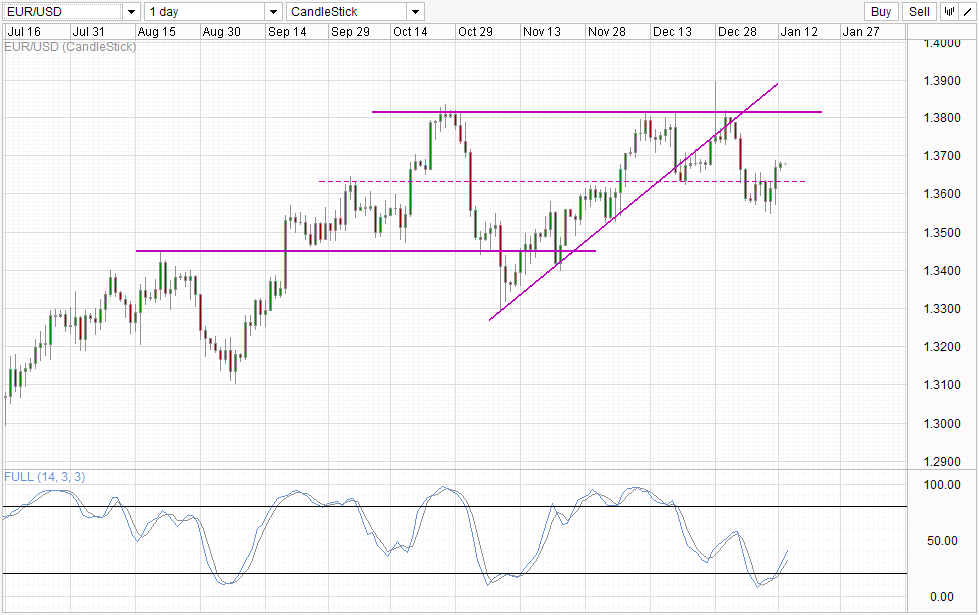

EUR/USD rallied higher post NFP, in line with other major USD pairs as USD took a beating on the weaker than expected NFP print. This rally has successfully invalidated or at least temporarily negated the Triple Top pattern after trading above the key 1.363 level. With this push, price is back within the 1.363 – 1.3815 range with 1.37 as interim resistance. Stochastic indicator agrees with a fresh Bullish Cycle signal formed, favoring a move towards 1.3815.

However, as Stoch curve will most likely be within Overbought region should price hit 1.3815, a rebound off the ceiling is more likely. Considering that fundamentals still favor a stronger USD and weaker EUR moving forward, a rebound scenario fits better into the bearish fundamental narrative compared to a bullish breakout scenario.

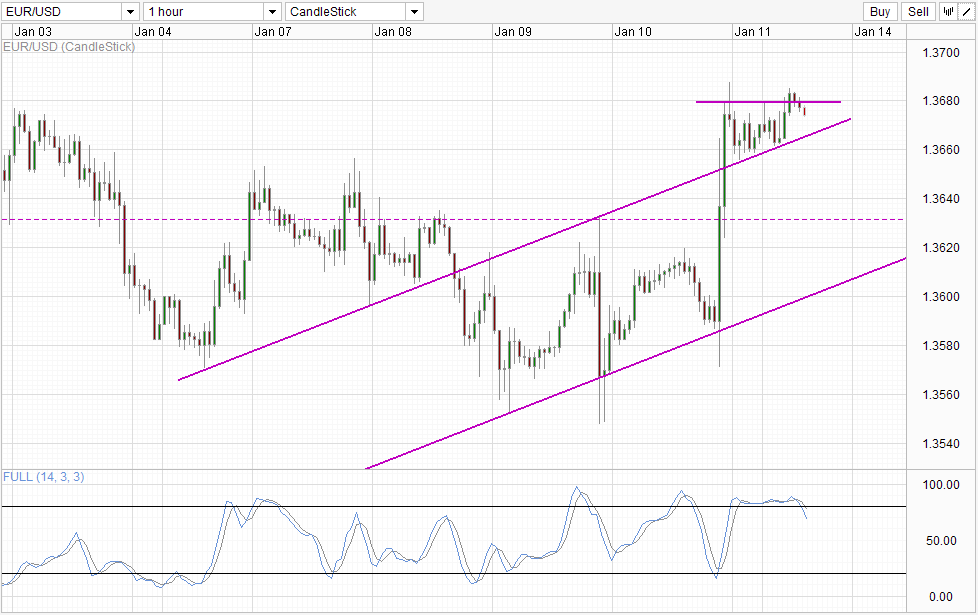

Hourly Chart

This bearish outlook is not only visible on the Long-Term chart, but also on the Short-Term as well. First off, prices seem to be unable to overcome the post NFP highs on Friday, unlike AUD/USD or NZD/USD. Fellow European counterpart GBP/USD similarly didn’t overcome post NFP highs, but current price is clearly head and shoulders above 3rd Jan levels, with a visible uptrend that is in play. Hence, it is no exaggeration to say that EUR/USD is the most bearish amongst all major risk currencies.

Stochastic readings agree with the bearish outlook, with a fresh bearish cycle signal currently in play. However, price would need to clear the rising Channel Top and preferably trade below 1.3660 to confirm this bearish reversal. A move towards Channel Bottom is possible should the bearish break is seen, with 1.363 providing interim support. However, prices may still be able to stay above 1.36 and more importantly within the sideways consolidation zone between 1.355 – 1.363 as long-term bears may still need a longer period for recuperation before the next leg of bearish push happens. Nonetheless, should last Friday’s high of 1.3687 is broken, the objective of 1.3815 mentioned earlier becomes possible and given that 1.37 round figure resistance is so just a mere 13 pips away, it is likely that Short-Term bullish momentum resulting from the 1.3687 break will be able to break 1.37, in line with the daily chart technical analysis.

With very little notable US nor European economic news this week (CPI numbers seldom impact EUR/USD), price action in the next few days will be a good indication of what the market is thinking without any unwanted noise arising from over/under expectations of news. But this would also mean that likelihood of prices staying within the above mentioned consolidation zone will be higher should be break into it once more as there will be very impetus to drive EUR/USD in the short-run.

More Links:

AUD/USD Technicals – Post NFP Rally Giving Bears Run For Their Money

Gold Technicals – Remaining Bullish After NFP Dust Has Settled

Week in FX Europe – BoE And ECB Hold Rates As NFP Disappoints

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.