US stocks fell the most in 2 months, sending S&P 500 1.26% lower and affirms the index’s worst start to a year since 2009. As there wasn’t any major US economic news yesterday, the spontaneous decline was triggered by mere sentiments. However it should be noted that bearish sentiments are strong, and is not without merit. Investors were already jittery to begin with as Stock prices have been rallying strongly in 2013 without any significant bearish pullback. Hence, there has always been lingering doubts about how far current bullish momentum can continue.

Corporate fundamentals are not helping the bullish cause either, with data from Thomson Reuters showing that more than 8 out of 10 S&P 500 companies’ earnings pre-announcements for current season have been lowered, not a good sign considering that P/E ratio for S&P 500 as a whole is the highest in 7 years. Therefore, it is not surprising that such a huge decline took place as that is already long overdue. What is of more interest is why prices this started yesterday, not a day before and not a day after, and happened post New York Noon at that – hours when US trading activities should have subsided.

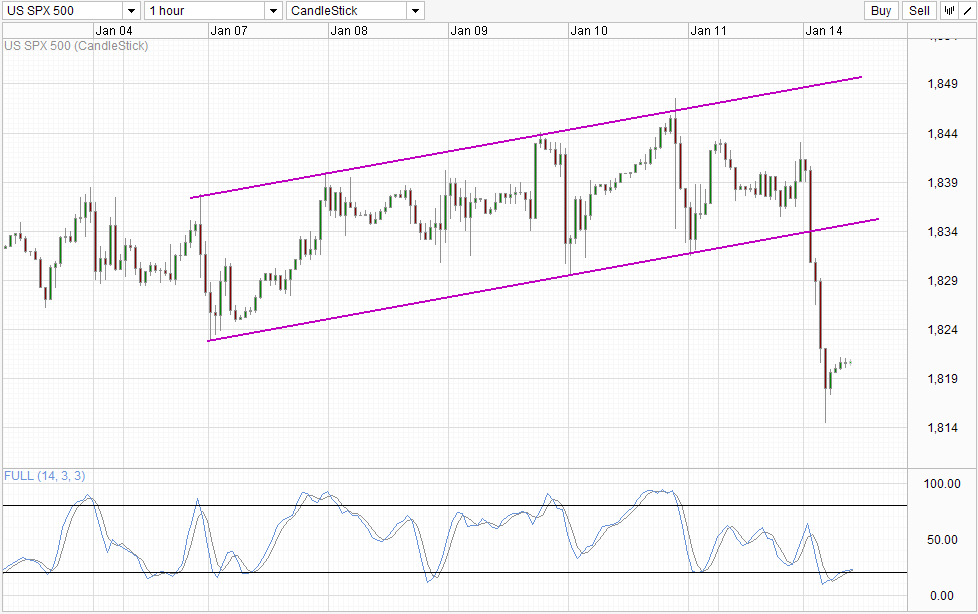

Hourly Chart

Despite not knowing the catalyst that spark the decline, there is a good likelihood that prices can further lower – trading volume yesterday was above average, with 7.1 billion shares traded, more than 10% higher than the average so far this month. The anxiety of traders is also visible via “fear index” VIX which has jumped 9.4% D/D – the largest daily percentage gain since Fed announced QE taper back in December. All these suggest that yesterday’s decline is supported by the majority of market traders, implying that most of the traders are bearish.

From a technical perspective, price is undergoing a short-term bullish correction. Overall bearish pressure will remain should price stay below the 1,823 which is the previous 2013 low formed last Monday. Stochastic readings are pointing higher above 20.0, suggesting the possibility of a bullish cycle but the convergence between Stoch/Signal lines weakens the prospect, increasing the possibility that Stoch curve may reverse around the “resistance” level around 25.0 – 30.0. If Stoch curve does reverse, the likelihood of a bearish extension increases.

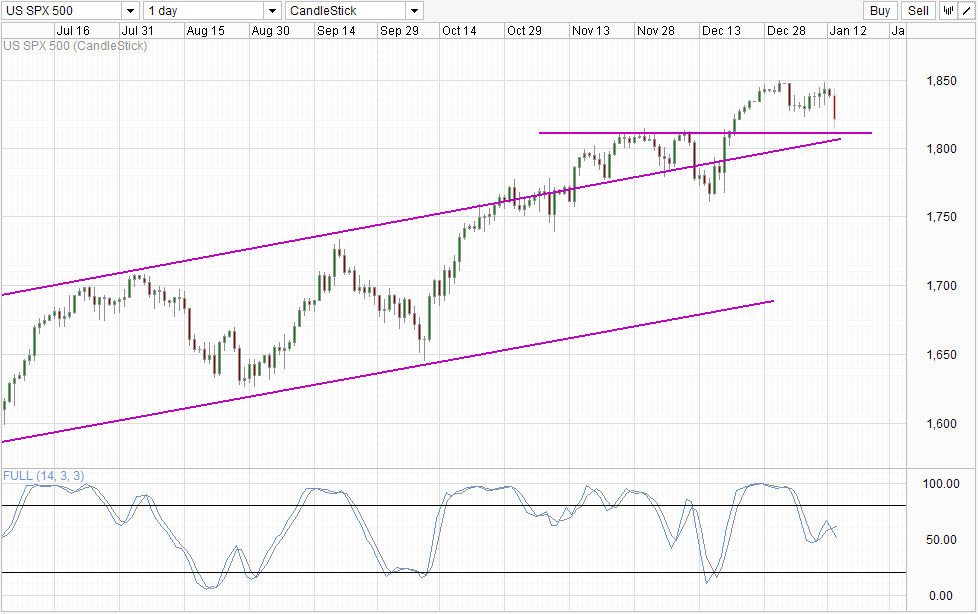

Daily Chart

Long-term chart does not fully agree with the bearish outlook though. Bullish bias remain intact, and prices will need to break the resistance turned support of around 1,810 and the confluence with Channel Top in order to dent current bullish momentum. Stochastic readings is in the midst of a bearish cycle, but it is possible that stoch curve may reverse around the 50.0 level mark where other point of inflexions have been seen previously. Hence, a strong long-term bearish push from here out requires more work, and we could only see it happening a few days later or perhaps in the week following.

This is not necessarily a bad thing though, as more information on yesterday’s decline will hopefully be made known by then, and we will have even stronger conviction on the longevity of the bearish trend that could potentially bring us all the way to Channel Bottom (around low 1,700 levels) and perhaps even beyond if this transform into the significant bearish pullback everybody’s been waiting for.

More Links:

AUD/USD – Moves to One Month High above 0.9080

EUR/USD – Resistance Level at 1.38 still Looms Large

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.