To be or not to be, that is the question.

President Obama faces a strong dilemma – approve the Keystone XL Pipeline and he would angers his supporters who voted for him because of his promise of keeping environmental degradation in check. Refuse to approve, and Republicans will use this as a stick to beat Obama for failure to create jobs and keep oil prices low even though there is no evidence that construction of the XL pipeline will have such a huge impact on either outcome.

The latest State Department report on potential environmental impact didn’t help matters either. Hard liners remain unconvinced despite the report asserting no major climate impact, while pro-Keystone supporters will use this latest information to pressure Obama further. Either way, President Obama has to make a decision eventually, and this decision will shape WTI Crude prices for 2014.

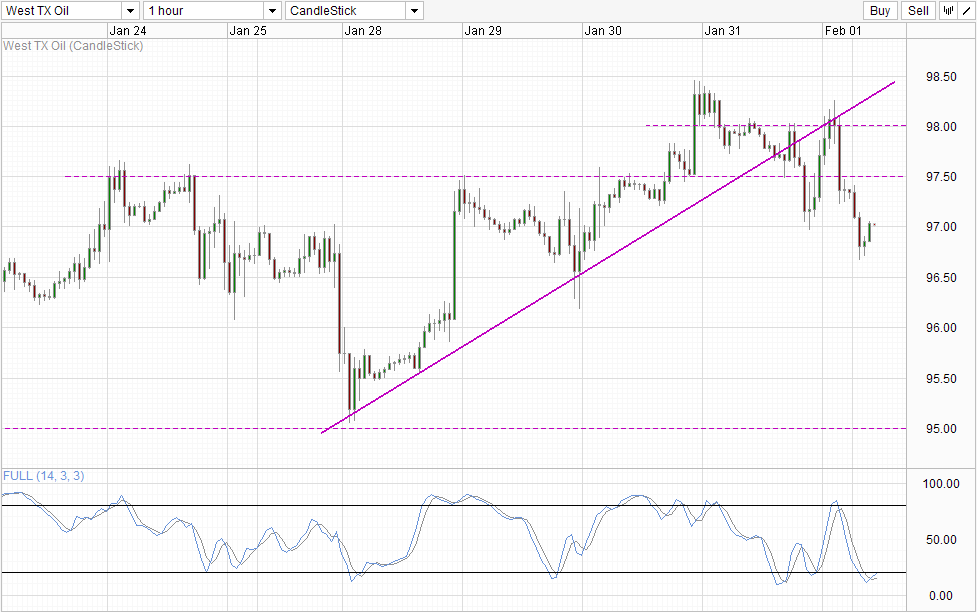

Hourly Chart

As it is, WTI prices are already highly volatile due to news surrounding Keystone pipelines. Rightly or wrongly, investors and speculators alike are viewing the pipeline development as the lifeline to resolve current supply/demand imbalance – a problem that has been brought about by political influence to produce more (via tax rebates, grants) and the difficulty of exporting Oil barrels stamped with “Made In USA” – all done in the bid to achieve energy independence. Hence, it is not surprising to see WTI prices pushing higher when the report was released on Friday, as market participants interpreted this as being one step closer to the materialization of the Pipeline.

The rally didn’t last long though, as the report stopped short of providing a recommendation. Furthermore, there wasn’t any acknowledgement from the White House, suggesting that Obama is no where closer to making a decision. With the situation being mostly the same, coupled with risk off sentiment during the period, it is no surprise that the rally sputtered and gave up most of the gains towards the final few hours of Friday’s trade.

This descend continued this morning, with prices hitting a low of 96.68 following weak manufacturing data from China over the weekend – suggesting that global demand for oil will fall further. Even though Stochastic readings suggest that prices are Oversold and a pull-back is likely moving forward, the continued risk off sentiment in Asian market right now may still yet drag prices down to 96.5 before a significant bullish pullback can be seen.

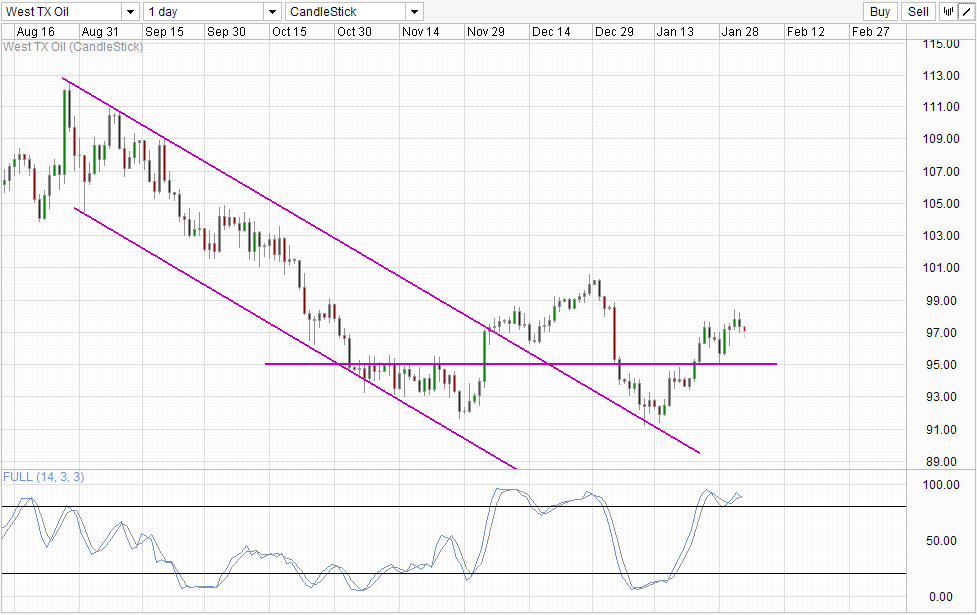

Daily Chart

Long-term trend on the daily chart is bearish, with lower highs and lower lows. However, current bullish momentum from the recovery since mid Jan cannot be invalidated, and further confirmation will be required (e.g. break of 96.25 and preferably below 95.0) in order to ascertain that the broad bearish play is back. Stochastic readings is certainly Overbought, but a proper bearish cycle signal is still missing. Looking at the previous rebound of 95.0 which coincide with an avoidance of a bearish cycle signal, the need for confirmation becomes even greater.

More Links:

Gold Technicals – Staying Supported By Risk Aversion Flows

GBP/USD – Eases Below Support Level at 1.6450

EUR/USD – Drops Sharply to Two Month Low Below 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.