Interesting times for Gold. There was no conceivable reason why Gold should be trading higher – Fed’s Yellen’s testimony to House showed that QE tapering will still go ahead as the new Chairman pledged to “continue Bernanke’s work”. This should have decreased demand for Gold as risk of high inflation is expected to go even lower. The only other bullish driver for Gold – risk aversion, seems to be nowhere in sight either as Stocks climbed higher yesterday as well. As such, it is difficult to fathom why Gold actually traded higher on a D/D basis.

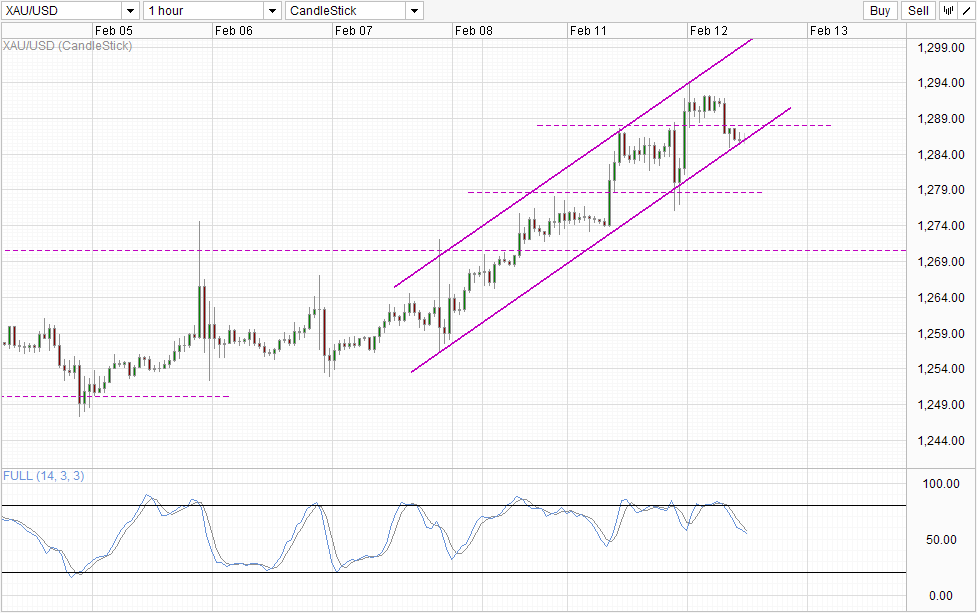

Hourly Chart

Hence, it’s not really surprising to see prices falling back lower during Asian session a few hours ago, as the fundamental reasons for the rally is weak. Certainly some may point to the fact that US stocks should have no business trading higher as well as the fundamental drivers are not exactly stellar right now. But even on a comparative basis, we can see that US stock futures are remaining lifted but the same cannot be said of Gold. As such, it is reasonable to conclude that Gold is indeed under slightly heavier bearish pressure.

From a technical perspective, prices is being supported by the rising Channel Bottom, and even though Stochastic readings are pointing lower, a rebound scenario cannot be ruled out as a recent Stoch trough was formed around the 60.0 level. As such, Stoch curve will need to push lower in order to signal stronger bearish conviction but ultimately prices should break below Channel Bottom conclusively to open a move towards 1,278 support.

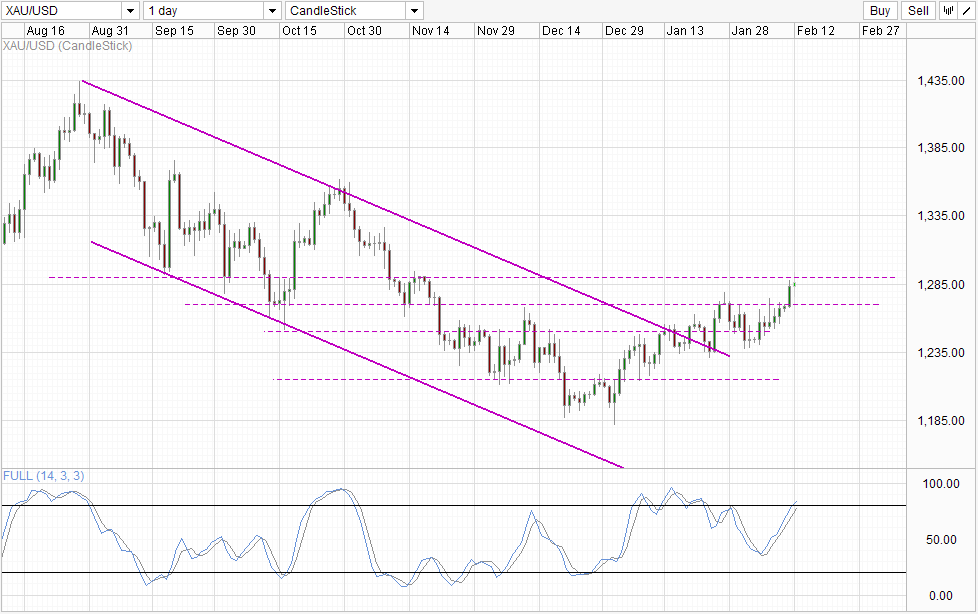

Daily Chart

Daily Chart remains bullish though as the recovery from 2014 remains intact. However, broad direction is still bearish, and hence more weight should be given to Stochastic indicator that is showing Overbought momentum. This does not mean that prices will reverse lower immediately, but the likelihood should never be dismissed even though Stochastic signals tend to be unreliable when a strong trend is emerging. This is especially true when the market is clearly rallying higher not on fundamentals but based on sentiments alone.

More Links:

GBP/USD – Runs in to Trouble at 1.6450 Resistance Level

AUD/USD – Doing Well to Stay Above Key 0.90 Level

EUR/USD – Eases Away from Resistance at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.