Early Monday trade continued the bullish uptrend that has been in play since 13th Feb, as prices pushed from Friday’s close of 1.36922 to above 1.37 almost immediately after market opened. This strong sign of bullishness is also contributed by broad “risk on” sentiment during Asian hours due to a record aggregate financing figure released by People’s Bank of China which amounted to 2.58 Trillion Yuan ($425 Billion) – suggesting that Chinese Banks are continuing to be risk taking and the threat of a liquidity crisis in China becomes a little bit lower.

Hourly Chart

Certainly EUR/USD wasn’t the most bullish of them all (GBP/USD earned the title), but this pair remains one of the bigger gainers this morning, underlining the strong bullish sentiment surrounding the currency pair right now. This put bulls in a good position to retest the 1.3715 soft resistance that had kept Friday’s gains. With additional support likely to come from the ascending trendline, the likelihood of a 1.3715 retest and possible break becomes higher. Gradient on Stochastic curve may have lowered but readings continue to point higher. With some space left before hitting Overbought, we should be able to see further bullish gains before a S/T bearish pullback occurs.

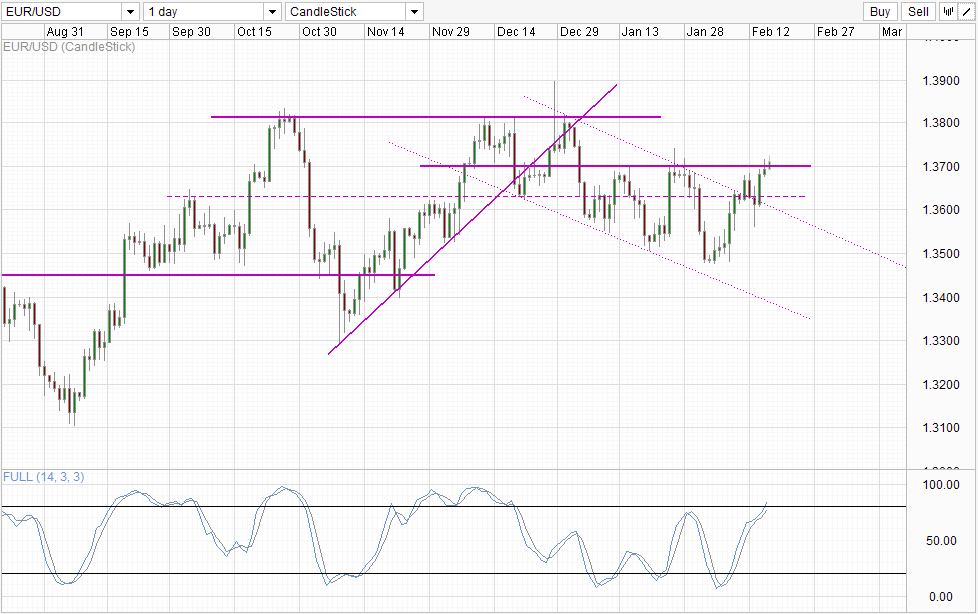

Daily Chart

Daily Chart is less optimistic. Even though prices have cleared the 1.37 round figure, we are still trading below the previous swing high of 1.374. Furthermore, Stochastic readings are already within the Overbought region, suggesting that current bullish momentum may start to wane. As such, the potential of a “fakeout” above 1.37 cannot be ignored, and traders will need further confirmation before a push towards 1.3815 is seen as likely.

Nonetheless, there are good bullish support. Current rally from 13th Feb (12th Feb US session) occurred following the break of 1.3625 – 1.363 resistance. This break also coincide with a rebound of descending Channel Top, confirming the break of the Channel seen on 11th Feb. As such, we are already riding on a breakout bullish wave and hence it should not take too much effort to break 1.37 given that overall market is on the bullish front right now.

Fundamentals are mixed though. Market sentiment is definitely bullish but one wonders how long this would last. Even though China banks are continuing to lend more money, the risk of bad debts rising remains. As it is right now, bad debt ratios in China has already reached a 3 year high, and pumping in more money into the system trying to save all these struggling firms may result in throwing more good money after bad, especially if Chinese economy doesn’t pick up. Hence, it is apt to say that immediate downside risk from China is lower for now, but long-term risks have just increased.

On the Europe front, things are looking great for the Euro-Zone. The Italian Government managed to auction 3-Year debt at record lows last Friday despite all the political turmoil, suggesting that investors are starting to gain trust and confidence in the EUR currency once again after a 5 year crisis. The same trend is also seen in Spanish and Portuguese sovereign debt, showing that this confidence is not isolated in Italy alone but also in other Europe peripherals. This may help to buffer any losses should risk appetite suddenly plunge due to China’s credit crunch, but only time will tell if this reason alone will be able to go against long-term risk-off trends should it happens.

More Links:

Week In FX Asia – Chinese Fortunes Tough to Pin Down

Week In FX Americas – Look beyond the Storm Clouds

Week In FX Europe – European Recovery Remains In Progress

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.