Australian Dollar traded higher this morning, in line with most major currency pairs on continuing the bullish momentum that has started since 13th Feb. The record high of aggregate financing released by People’s Bank of China over the weekend also helped fuelled risk appetite, driving risk correlated currencies such as AUD higher, in line with broad improvement in Asian stocks. However, it should be mentioned that the rally in AUD/USD is not the strongest, with the currency pair losing out to EUR/USD and GBP/USD just via a cursory glance. This is interesting because Australia’s economy is much more dependant on China than either Euro-Zone or UK, and in the past 5 years, AUD/USD has been enjoying a higher correlation with risk appetite compared to EUR/USD and GBP/USD, Hence, from the less than spectacular rally seen we can tell that current bullish sentiment in AUD/USD is not as strong as we think.

Hourly Chart

However, this does not mean that AUD/USD will be moving lower from here, as momentum is undoubtedly up right now. In fact, there should be added respect given to Aussie bulls as prices managed to shrug off the decline after a weaker than expected employment change was announced last Thursday. This may actually explain why the rally in AUD/USD today has been less than spectacular, as traders may not be convinced that AUD/USD will be able to sustain gains in the long-run and hence more hesitant to enter.

This would imply that S/T bullish momentum may be impaired, and there is a lower likelihood of breaking the 0.907 resistance. The likelihood of a bearish pullback becomes higher as well, as prices will likely move sharply lower should risk-appetite disappear. That being said, traders wanting to short may wish to wait for further confirmation such as the break of 0.905 support and/or the rising Channel Bottom in conjunction with Stoch curve moving below 62.5 “consolidation floor”. This is important as broad sentiment remains bullish for now and that will keep AUD/USD lifted.

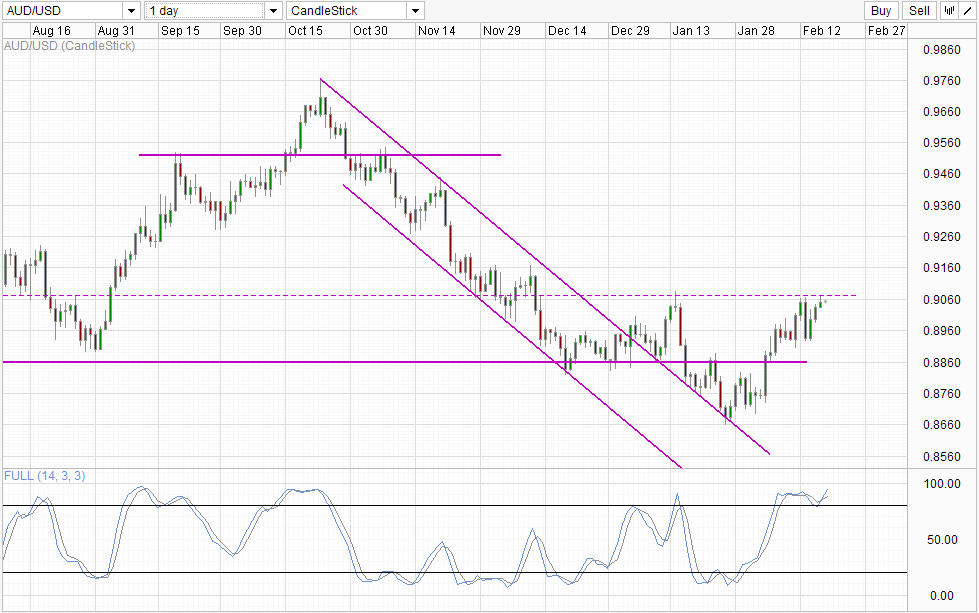

Daily Chart

Daily Chart also favors bearish sell-off as Stochastic readings are extremely Overbought, favoring a bearish reversal moving forward. However, confirmations is still needed as even Stoch curve remains bullish for now, and hence patience is definitely advised as there is still the off-chance that prices may breach 0.907 and hit 0.916 resistance before pulling back.

More Links:

EUR/USD Technicals – Trading Above 1.37 On S/T Bullish Pressure

Week In FX Asia – Chinese Fortunes Tough to Pin Down

Week In FX Americas – Look beyond the Storm Clouds

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.