Crude oil suffered an aggressive fall yesterday, and if we include the decline that was seen in the post NY noon trading session, the slide in prices from peak to trough within the 24 hour period would be greater than US$2 per barrel – a significant decline by any measure. This drop matches well with the bearish risk trend that was seen during early Asian session which was carried into European and American trading session which saw stocks falling (albeit not significantly) yesterday, suggesting that the decline may be inspired by the loss in market confidence.

However, this assertion does not seem to be correct as WTI continue to dip lower during early European session despite S&P 500 futures pushing above 1,850 during the same period. Similar rallies could be seen in AUD/USD and other traditional risk correlated assets, suggesting that WTI is actually moving against broad risk trend today. Confirmation for this assertion can also be seen from the small rally right now towards 102.5 despite risk appetite appearing to have come off slightly.

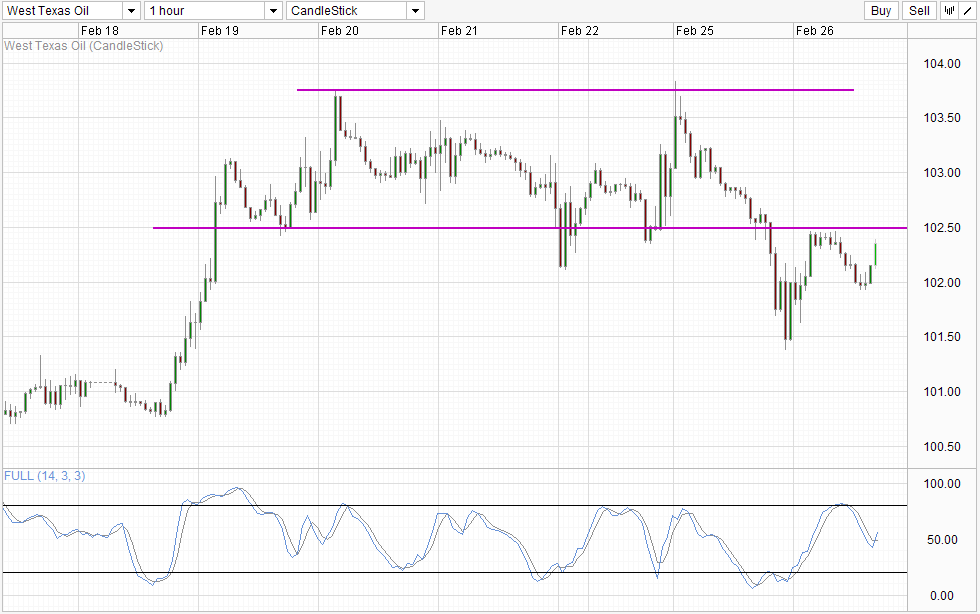

Hourly Chart

Hence, the reason why WTI pushed lower may be due to bearish sentiment, with traders/speculators sending prices lower expecting a larger than previously estimated build up in inventories that will be reported later by the US Department of Energy. If this is indeed true, then it is likely that price may not drive further lower too much if DOE numbers does come in at around +1.3 million barrels, and upside risks become higher should the number matches the previous estimate or come in even lower than expected. Furthermore, given that S&P 500 Futures remained steady above 1,850 key resistance, the likelihood of risk appetite during US session later staying bullish is high. Even though WTI prices have been mostly ignoring risk trends since this morning, a bullish risk trend definitely will not help the bearish cause and will be neutral at best and may even pull WTI higher.

From a pure technical perspective, bias is still firmly on the bearish court as long as prices stay below 102.5. Stochastic readings are pointing higher for now but looking at how Stoch curve behaved in the past week, there hasn’t been a case where a rebound around 50.0 level resulted in a bullish trend reversal. The strongest bullish reaction that followed such a stoch rebound was seen on 20th Feb where prices eventually traded lower once again after pushing higher. Hence, even if the same thing happen right now 102.5 resistance will break but it is likely that 103.0 will hold, and bearish pressure will still remain though it may be weaker than before.

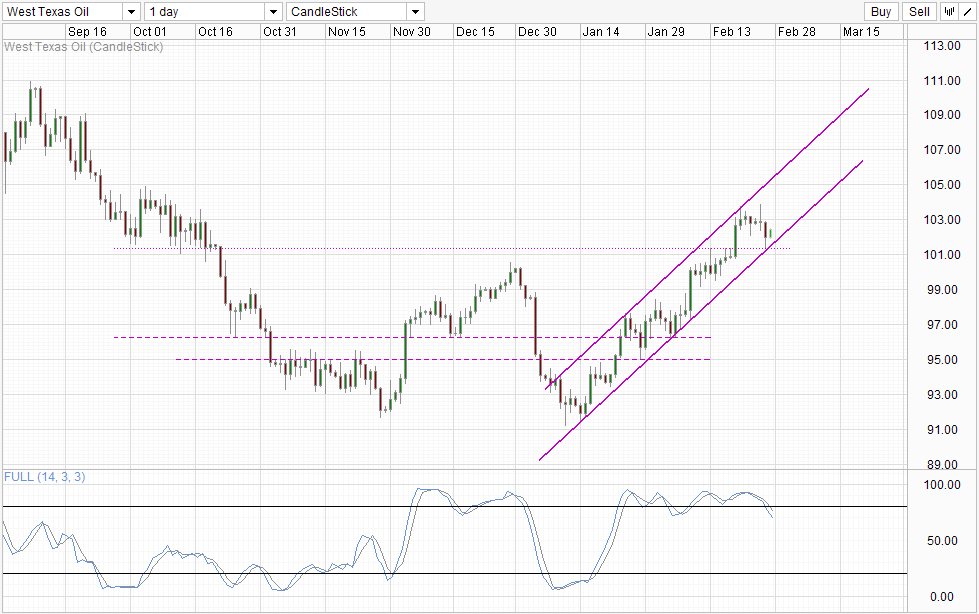

Daily Chart

Daily Chart is more bullish though, as there is a case to be made for price to rebound from Channel Bottom and head towards Channel Top. However, Stochastic readings do not agree and is signalling the beginning of the bearish cycle. That being said, ideally Stoch curve should push below the 70.0 mark coinciding with price breaking below Channel Bottom and perhaps even below 101.0 to confirm a strong bearish breakout. Without which, the possibility of Stoch curve rebounding off 70.0 mark and pushing higher cannot be ignored and we could still see prices moving up in the short/mid term.

More Links:

GBP/USD – Pound Moves Higher As UK Retail Sales Sparkles

AUD/USD Technicals – S/T Bearish Pressure Remain Despite Failed Breakout Earlier

S&P 500 – Testing 1,850 Again After Tumultuous Day

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.