Japanese stocks traded sharply lower today after a series of bad news over the weekend and this morning. First off we have weaker than expected Chinese Exports which shrunk at a tremendous pace of 18.1% which market did not see coming. Analysts consensus estimates expected Exports to grow at a decent pace of 7.5%, which is already lower compared to Jan’s 10.6%. Such a huge drop in export is a major concern for the health of the global economy as it seems that there are lesser people buying products, and this will likely impact Japanese firms who are mostly exporters. On the other hand, imports into China has grew 10.1% – higher than expected but that brings little comfort to Japan as Chinese tend to not buy Japanese goods due to price and nationalistic reasons.

Along came Sunday and a weaker than expected Chinese inflation metric was released, adding more fears that global economy is indeed slowing down, but the damage from this news release is not as great compared to what happened this morning – disappointment from Japan’s own backyard. Q4 GDP final figures is came in at 0.7% vs initial estimates of 0.9%. Certainly Japanese economy is growing at a decent pace, but given that Abenomics have had a year to run, expectations are certainly higher. What is perhaps more worrying is two-fold, firstly the GDP growth is actually slower than inflation growth, once again showing that the quest for higher inflation in the that the economy will jump start is actually detrimental to the economy as real growth is actually negative. The second problem is more of a sentiment issue – the initial overestimation reflects over optimism by officials and market may start to have stronger doubts moving forward when rosier pictures/bullish rhetoric are mentioned by Japanese leadership.

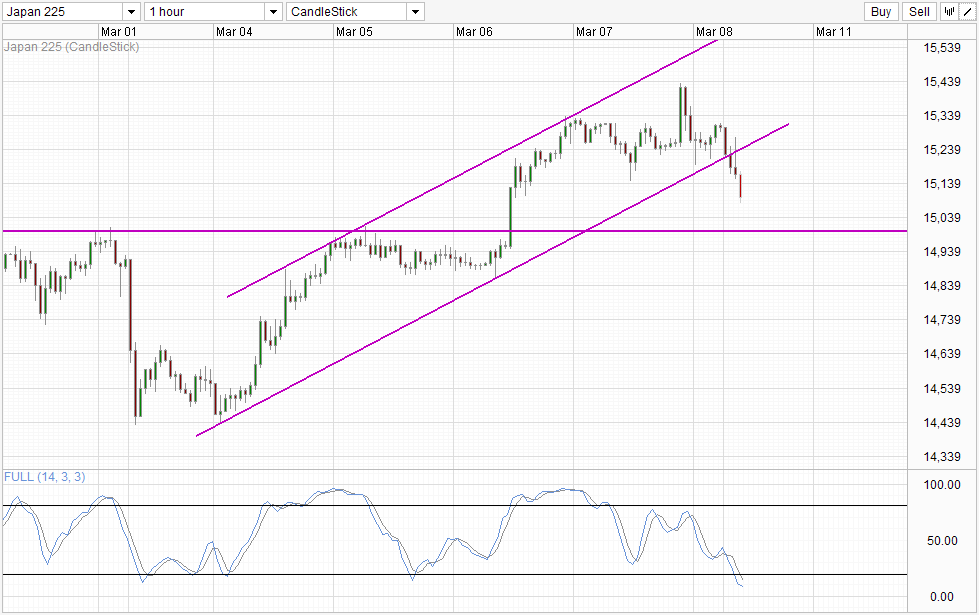

Hourly Chart

All the above mentioned bearish factors sent Nikkei 225 towards rising Channel Bottom when market opened, with bears making short-work of the support level, breaking even the soft support of 15,150 beneath it. However, it should be noted that bearish momentum has gone a great distance and the risk of a temporary pullback is higher now. This is evident via Stochastic indicator where Stoch curve is deeply Oversold and is tapering flat now. Also, from a price action perspective, a retest of 15,150 or even Channel Bottom will not necessary invalidate current bearish momentum. Hence, it is likely that bears will not provide any strong resistance against short-term pullbacks. In fact, should bulls fail to break 15,150 or Channel Bottom, we could see stronger bearish momentum building up from there that can lead us towards 15,000 key round figure.

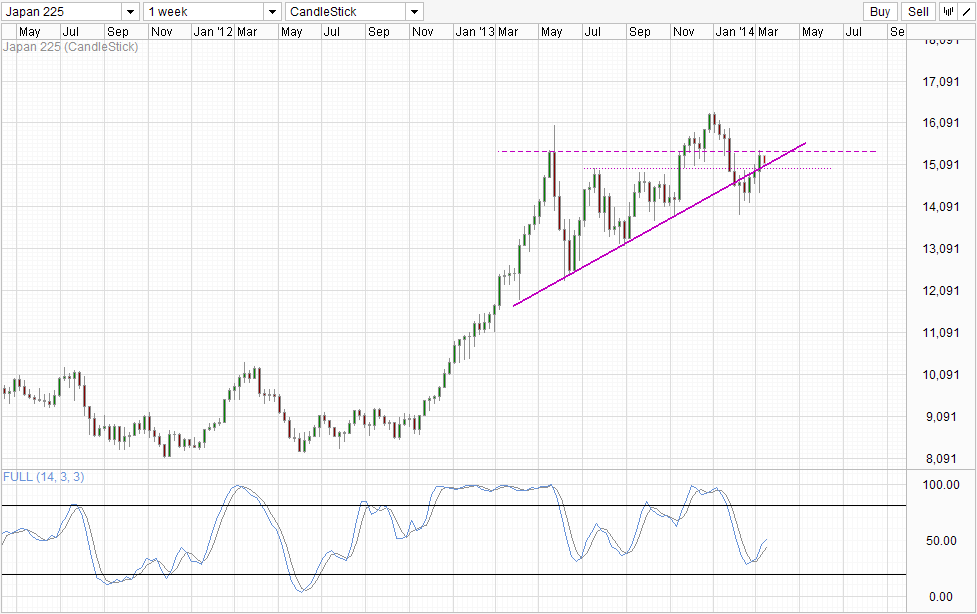

Weekly Chart

Looking at weekly chart, the case for a rebound becomes even stronger as price is heading directly into the rising trendline that has kept bullish momentum going since Q2 2013. Should the trendline hold, the likelihood of prices pushing higher and move back towards 16,000+ region becomes higher as the bullish momentum will be affirmed. On the other hand, should price trades below the trendline once again, the bearish break seen during Feb 2014 will be confirmed and we could see bearish momentum building up quickly.

More Links:

AUD/USD – Eases Away from Resistance Level at 0.91

EUR/USD – Surges to Two Year High above 1.39

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.