Yesterday in our analysis we’ve mentioned how the inventory number from Department of Energy weekly report would need to exceed 2.63 million barrels (API inventory numbers) in order to fuel further sell-off. This is because market has already priced in such a scenario, and upside risk was higher as traders would be disappointed should numbers hit below expectations or be muted at best when numbers come in as expected.

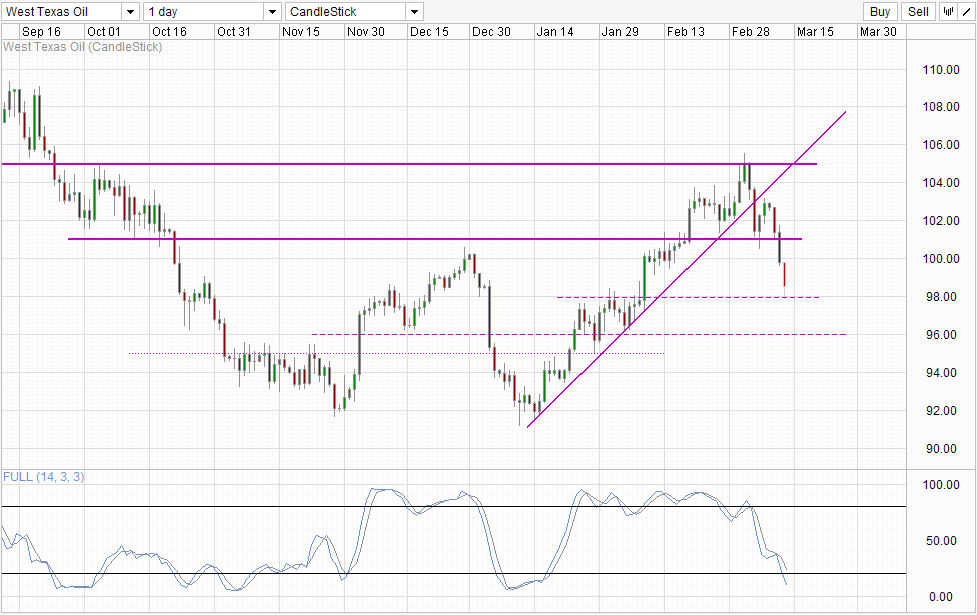

What we did not see coming, was the huge jump in inventories level – DOE report for the week of 7th March grew by 6.18 million barrels, more than twice reported by API and more than 3 times that of analysts initial estimates. This suggest that demand for crude oil is way below expectation, pushing WTI prices all the way to 98.0 when the report was released.

Fundamentally, with the cold weather clearing up, it is unlikely that demand for energy for heating purpose will go up. Global demand for manufacturing needs is also expected to fall as activity in China appears to be steadily dropping, while the other developed nations have yet to see significant growth to make up for it. The only saving grace for WTI now would be the Russia/Ukraine crisis that is keeping precious metals and energy commodities afloat. That being said, comparing Brent Crude that has been relatively stable in recent weeks despite falling global manufacturing activities, WTI is clearly bearish and the supposed support from the political/military crisis appears to be doing very little to counteract the inherent supply/demand issue of WTI.

Nonetheless, there are signs of temporary reprieve. Stochastic readings suggest that bearish momentum is heavily oversold, while prices have also rebounded from the 98.0 support and claw back more than 50% of the losses attributable to the DOE numbers (fell from 99.0 – 98.0, current price is around 98.6). Should price clear the 99.0 mark, we could see immediate bearish pressure dissipating, and the risk of further sell-off becomes lower. However, failure to do so may result in a swift retest of 98.0 and possibly breaking the support level and opening 96.0 as the next bearish target.

More Links:

GBP/USD – Little Movement Ahead of US Key Releases

USD/CAD – US Dollar in Holding Pattern As Markets Await Key Numbers

USD/JPY – Steady in Cautious Trading

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.