Australian Dollar strengthened significantly after the latest employment data were released this morning. Unemployment rate stayed flat at 6.0%, but Employment Change was extremely encouraging, coming in +47.3K M/M versus an expected 15.0K. The figure is even more impressive when we look behind the headline number, which is broken down into Full Time which gained 80.5K. Part time jobs have shrunk by 33.3K but that is not really a huge issue as it is clear that from the stable unemployment rate that this decline is due to part-timers being upgraded to full time positions. No matter which way you want to cut it, it is clear that the numbers are extremely positive and a good sign for Australia’s economic revival.

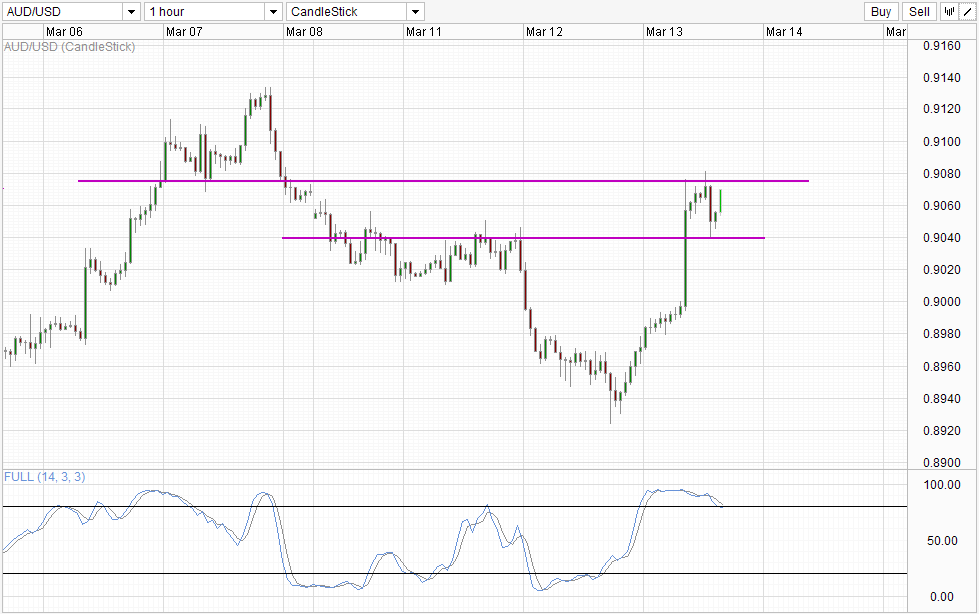

Hourly Chart

The timing of the employment data was also immaculate. Earlier on we had RBNZ rate decision in which the NZ Central Bank hiked policy rate by 25 basis points. As such, market was already leaning towards the hawkish camp, and the strong employment numbers certainly fuelled belief that RBA will refrain from any rate cut in the near future, facilitating the strong bullish reaction that clawed back all the losses this week and put AUD/USD in the black.

There was a bearish pullback during late Asian afternoon but prices stayed above 0.904 resistance turned support, with prices currently pushing back up towards 0.907 resistance once again. Considering that prices actually climbed continuously in the couple of hours following the employment announcement, it is clear that this bullish momentum is not a flash in the pan. As such, we should be able to expect prices to stay elevated in the interim and perhaps even break 0.907 to seek greater heights if broad risk appetite turn bullish again.

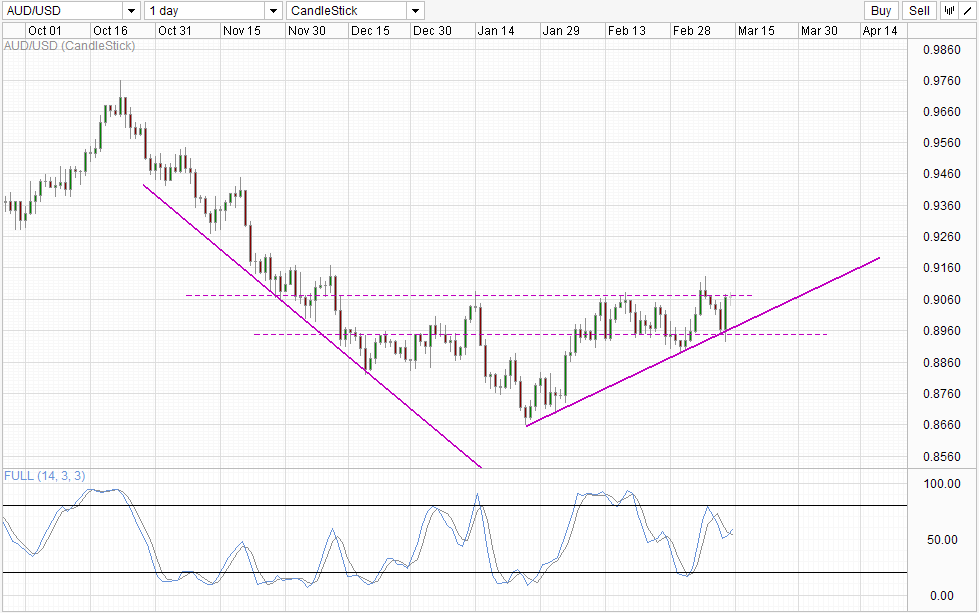

Daily Chart

Daily Chart is less optimistic though. Today’s rally is still within the consolidation zone seen in Feb, and long-term trend is still firmly bearish. Without breaking 0.907 and preferably above 0.915, it is difficult to see current rally as anything but corrective. Similarly, even though Stochastic curve is currently pointing higher and has crossed the signal line, the threat of bearish cycle remains. Couple this with weak fundamentals of Australia’s economy and decreasing manufacturing activities seen in China, the outlook for AUD/USD remains weak and bulls will still need to do more in order to prove themselves that a strong sustainable bull trend is in play.

More Links:

Gold Technicals – No Stopping Bulls As 6 Month High Reached

WTI Crude – Huge Inventory Jump Reignites Oversupply Fears

NZD/USD – Bullish Breakout Above 0.8525 Post RBNZ Rate Hike Seen

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.