AUD/USD had an eventful day yesterday. Prices rallied and broke 0.90 round figure following a stupendous Employment Change aided by bullish pressure spillover from RBNZ rate hike. However, a large portion of the gains were given up by the end of US session as prices pushed lower in line with other risk correlated assets following the decline in US stocks.

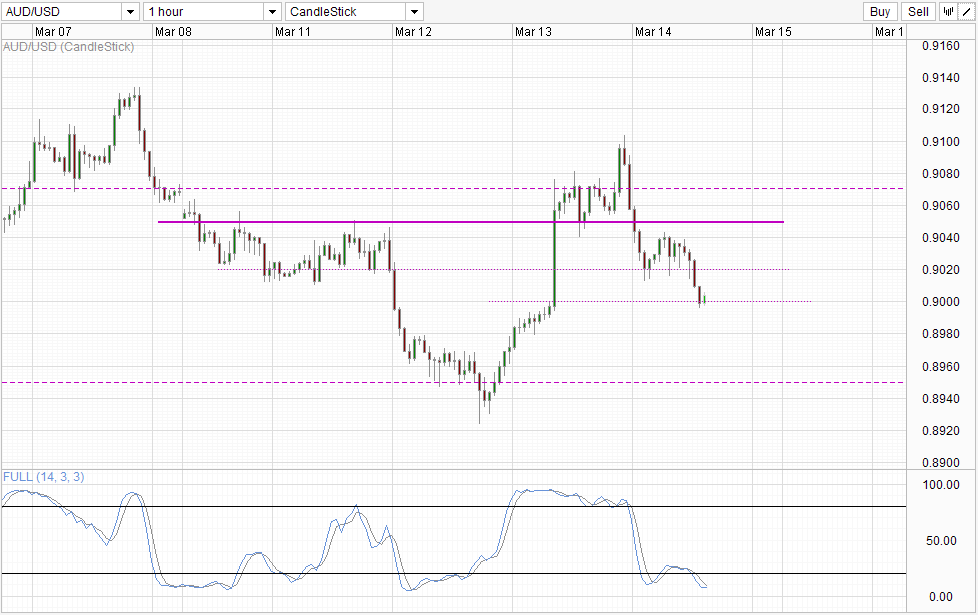

Hourly Chart

Prices enjoyed some temporary reprieve when the sell-off rebounded off 0.902 support level, but with risk off pressure extending into the Asian markets today, 0.902 was ultimately broken. Currently price is testing 0.90 round figure which is also close to the levels prior to the release of Employment Change numbers. Should 0.90 is broken, the bullish “feel good”sentiment of yesterday can be regarded as fully invalidated and we could see further bearish acceleration towards this week’s swing low.

From a technical perspective, Stochastic indicator favours a rebound from 0.90 to 0.902 in the short-run with Stoch curve tapering flat and may start to reverse higher, crossing Signal line in the process. However, long-term bullishness is still suspect as we’ve just only seen a failed bullish cycle signal accompanying the 0.902 rebound. Nonetheless, it’s not all doom and gloom, as the bullish sentiment of yesterday is indeed strong. Prices managed to brake 0.907 resistance during US opening hours when stocks were actually bullish initially. This shows that there is still hope and should broad risk sentiment recovers, we should not be surprised if AUD/USD recovers strongly.

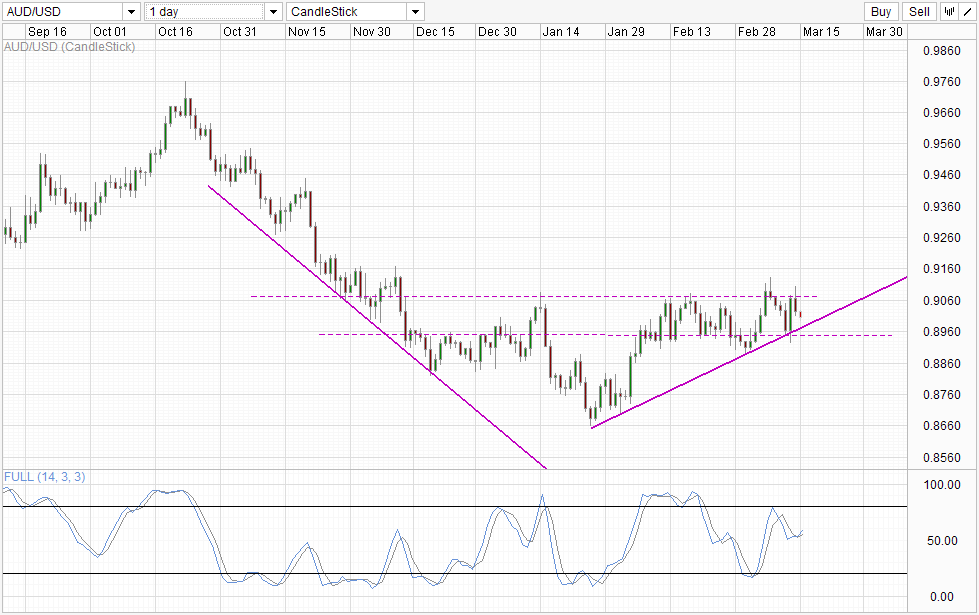

Daily Chart

Looking at Daily Chart, bulls should feel more assured as rising trendline is expected to provide support should price fall further, and 0.895 will be called upon to do the job in the event that the rising trendline fails. Hence, the likelihood of sharp sell-offs from here is low, and should prices continue to stay afloat in the next few days, the bullish rally that started from late Jan will remain intact and provide a good launchpad for price to rally higher when risk appetite returns. That being said, price will need to clear 0.907 convincingly to invalidate the long-term bearish trend, and the longer price stay within current consolidation zone, the greater the downside risk will become.

More Links:

USD/JPY – Yen Up As Japanese Manafacturing Data Impresses

GBP/USD – Pound Recovers and Flirts with 1.67

EUR/USD Technicals – S/T Bullish Narrative Hinges On 1.385 Support

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.