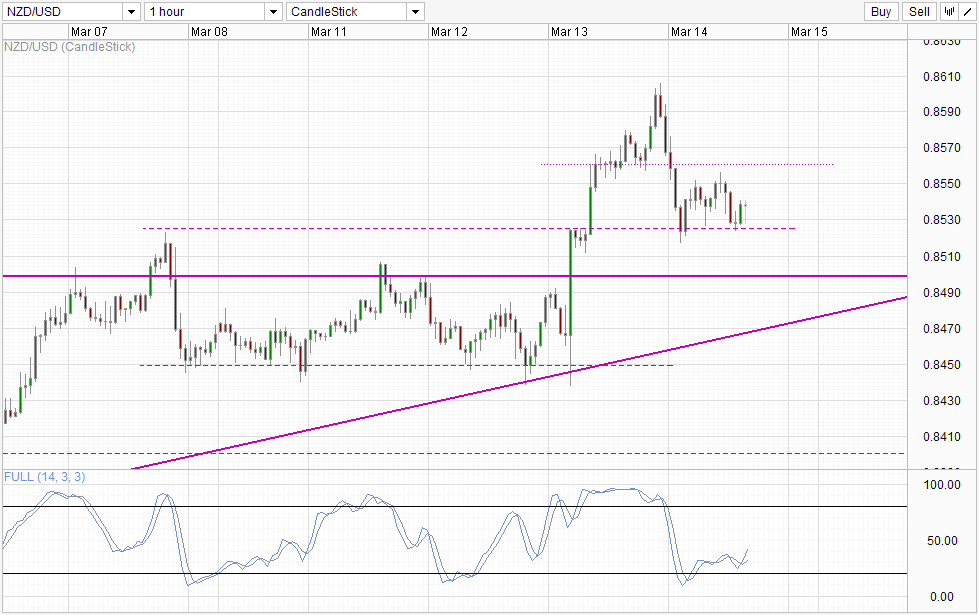

Yesterday’s “risk off” move during US session dragged classic “risk currencies” such as AUD/USD and EUR/USD lower. NZD/USD wasn’t sparred, with prices falling from a high of 0.8605 to a low of 0.85715. That being said, bulls held themselves rather well, limiting NZD/USD losses versus its counterparts where prices are currently trading below Wednesday’s US closing levels.

Prices is currently staying above the 0.8525, the level which prices reached post RBNZ rate hike yesterday. By staying above this key level, the overall bullish pressure remain intact and we could see prices challenging 0.856 resistance once again. Stochastic indicator agrees with Stoch curve currently within a bullish cycle, favoring further upside movement.

Considering that prices are currently pushing higher despite European session similarly showing broad bearish sentiment (Dax -0.64%, FTSE 100 -0.28% and CAC 40 -0.45% at the time of writing), there is good reason to believe that prices will at the very least stay supported even if US session turns out to be bearish once again.

More Links:

GBP/USD – Pound Recovers and Flirts with 1.67

USD/CAD – US Dollar Loses Ground Despite Positive Employment Data

USD/JPY – Yen Up As Japanese Manafacturing Data Impresses

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.