AUD/USD remains lifted today, keeping most of the gains of yesterday. To be fair it is not difficult for prices to hold onto Monday gains as market sentiment is broadly bullish as seen from rallies in Stocks globally yesterday. Asian session today remains bullish as well, fuelled by better than expected US economic numbers yesterday, and that helped bulls to maintain pressure, holding prices above the 0.908 soft support which is also the ceiling of consolidation zone found on 13th March.

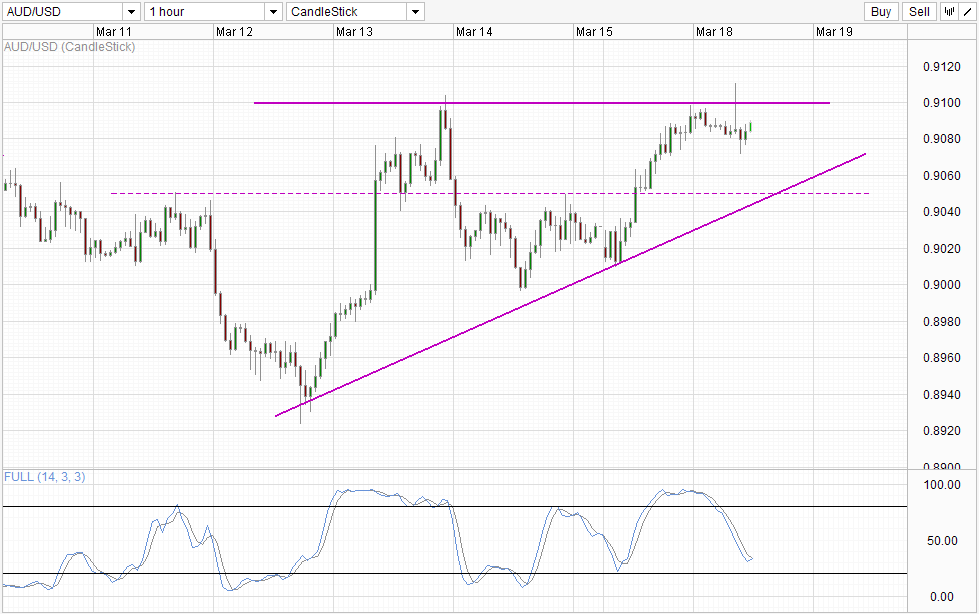

Hourly Chart

However, it should also be noted that bearish pressure remains as well. 0.91 round figure remain a bridge too far for bulls to cross, and the latest rally this morning spurred by the release of RBA minutes failed to overcome the key level which undermines the case for further bullish endeavour. Nonetheless, we shouldn’t be too harsh on bulls as RBA minutes wasn’t really the hawkish to begin with. The central bank did mention that they would like to hold rates steady moving forward, implying that there would not be any rate cuts forthcoming in the near future, but this stance was already revealed during the actual policy statement earlier on and should not have constituted a reason for bullishness in AUD/USD. Hence, blame should not be placed on bulls for the failure to climb above 0.91, and instead we should continue to focus on 0.908 support holding which suggest that a proper test of 0.91 may be possible moving forward.

Stochastic indicator is also bullish as Stoch curve has reversed and is currently pointing higher with Stoch curve likely to cross the Signal line soon. Even though this is happening above the Oversold region, the latest trough was also formed around the same level, increasing the reliability of this bullish signal that is forming.

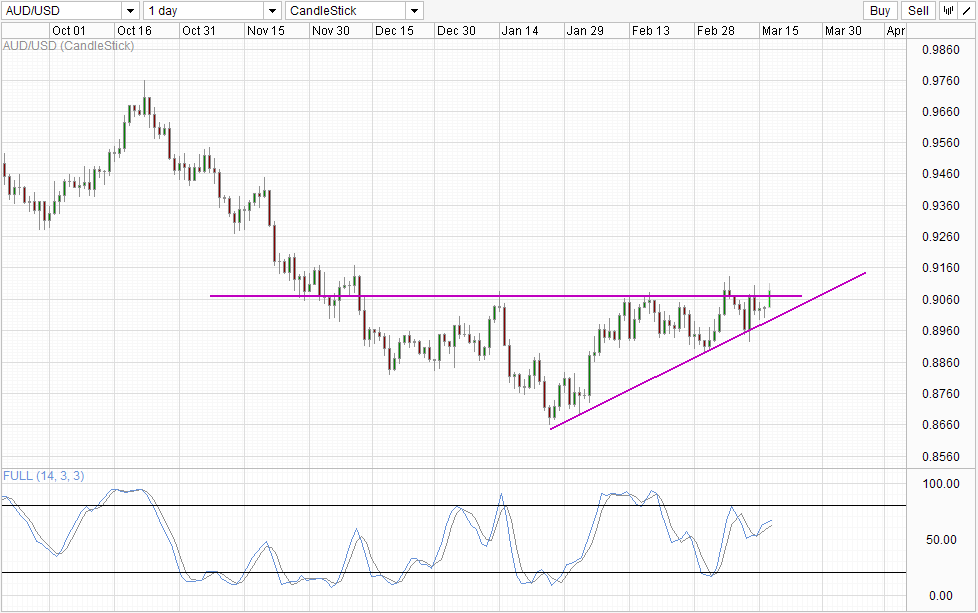

Daily Chart

Daily Chart is also bullish but prices will preferably need to climb above 0.915 and ideally above 0.916 in order to demonstrate stronger bullish conviction. This is necessary because broad direction in AUD is bearish and hence it is not unreasonable to seek strong confirmation. Furthermore, we are on edge of a bullish breakout, and if it is really confirmed we could see strong bullish follow-through which will more than compensate for the opportunity cost of buying above the 0.907 resistance.

Fundamentally, it seems that Australia’s economy may be turning the corner. Latest employment numbers was much better than expected, while inflation numbers are healthy as well. Hence, the risk of deflation is low and given that RBA is no longer slashing rates lower the potential for AUD/USD to climb is higher. However, China’s economic numbers continue to be worrying and Australia may still be dragged down by its largest trade partner at no fault of her own. Also, with USD continuing to look strong, it is highly unlikely that AUD/USD will be able to climb all the way back up to parity easily, and traders who want to play a resurging AUD narrative may wish to pair it with other currency that is weaker rather than USD that is strengthening as well.

More Links:

S&P 500 – Trading Above 1,850 But Short-Term Bearish Pressure Remain

GBP/USD – Pound Shows Little Movement in Cautious Trading

USD/CAD – Little Movement As Ukraine Crisis In Spotlight

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.