Nothing to see here for EUR/USD. Prices have been trading relatively flat since opening today, staying between 1.378 – 1.381. But this hides the fact that EUR/USD is actually mildly bullish, a fact that can be seen from how a weaker than expected Chinese Manufacturing PMI data failed to push EUR/USD lower, and instead allow prices to recover and even trading higher than opening levels currently.

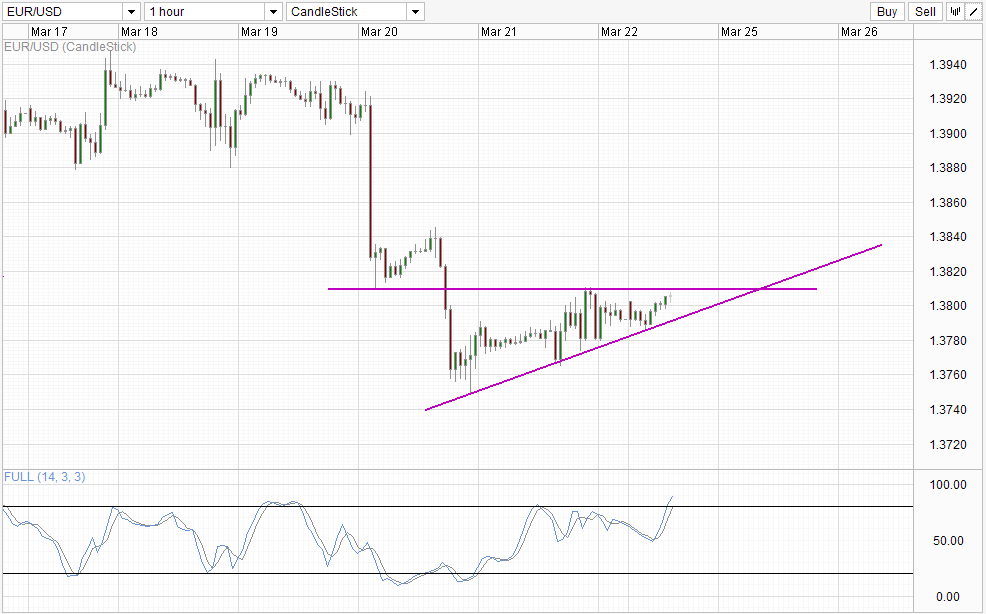

Hourly Chart

Looking at price action in the past 2 trading days, we can see that prices are recovering following a sharp sell-off which sent prices from 1.392 to a low of 1.375. Hence, it is not surprising to see this recovery momentum continuing higher from where we left off on Friday as there wasn’t anything significant development during the weekend.

That being said, this does not mean that prices can continue climbing higher indefinitely as what we’re seeing is merely corrective in nature. Stochastic readings agree with Stoch curve within the Overbought region, favoring a bearish cycle moving forward. Similarly, prices has yet to test the 1.381 resistance, and should prices fail to break the aforementioned resistance, the likelihood of a push towards rising trendline becomes higher, and should the trendline gets broken, we could even see quick bearish acceleration towards 1.375 and open up possibility for further downsides.

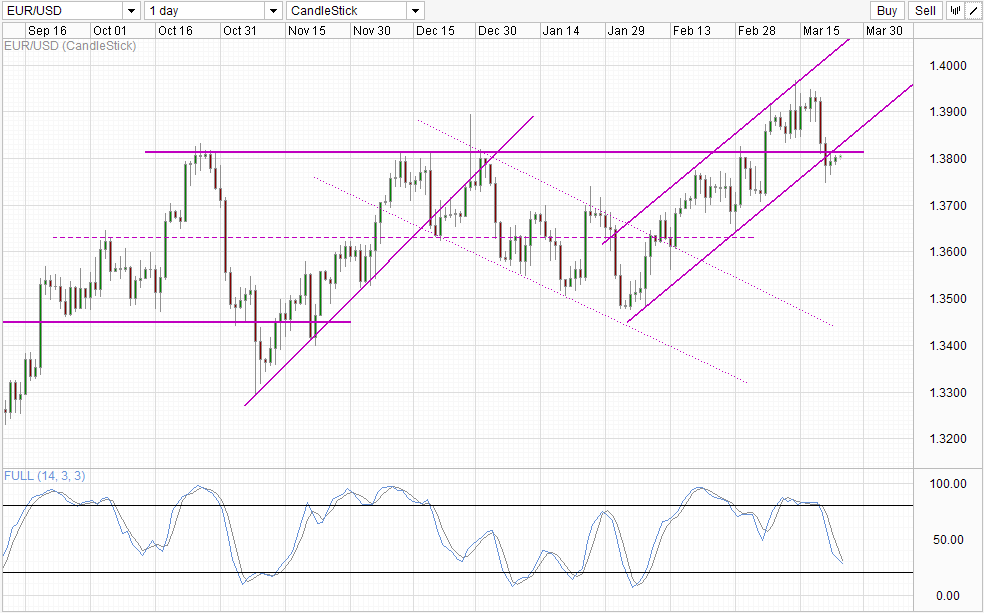

Daily Chart

Daily Chart is also bearish with the failure to breach above 1.3815 resistance affirming the bearish breakout of the rising Channel. However, Stochastic readings is close to the Oversold region already, and as such it is likely that significant support can be expected around 1.37 round figure, reducing the likelihood of a swift return to 1.35.

Fundamentally, the case for continued rallies in EUR/USD is weak as economic growth rates in Euro-Zone remains weak. To be fair, the same could be said about US growth rates where policy makers are more optimistic than the actual numbers. Nonetheless, US policy makers have already started to tighten monetary policy, while ECB is merely less dovish than before. Hence, with USD will be expected to out-muscle EUR in the long run based on the difference in Central Bank policies, but should economic data from Euro-zone outperform that of US, there will be a better chance for EUR/USD to climb further towards 1.40 and potentially beyond.

More Links:

AUD/USD Technicals – Bearish Start Against Broad Bullishness In Asian Market

Gold Technicals – Back Below 1,335 Despite Institutional Speculators Purchases

Week in FX Europe – BoE Shake Up No Match For Yellen’s FOMC

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.