Palladium prices climbed to its highest level since August 2011, but the reason for the rally is purely supply side rather than due to an increase in demand. Friday saw miners from South Africa going on strike, halting short-term production capability and piling on further bullish pressure on top of the already strained global supply chain due to the Russian/Ukraine crisis which may restrict exports of the precious metal out from Russia. With both South Africa and Russia accounting for more than 80% of the world’s palladium production, it is no wonder that prices are highly elevated currently.

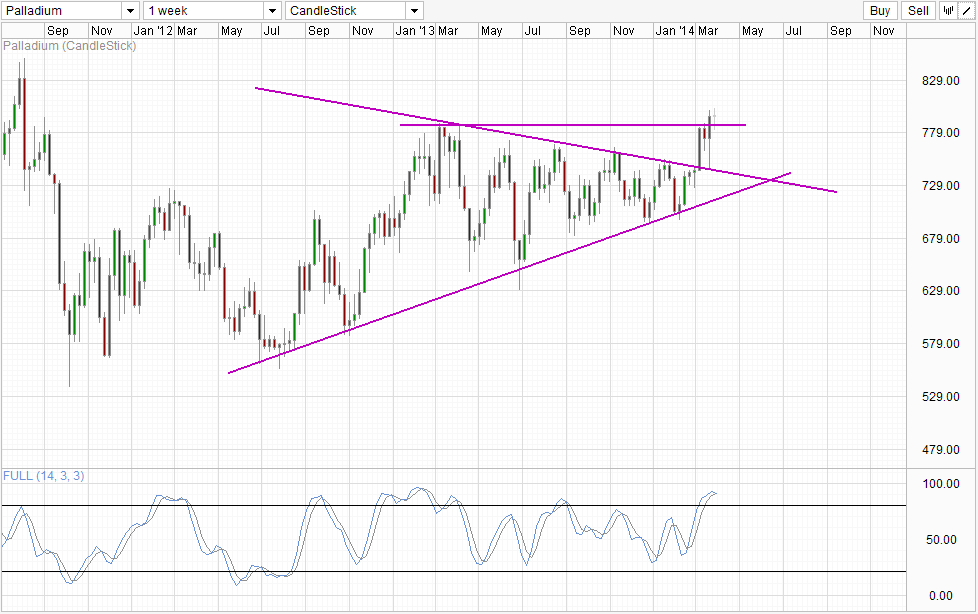

Weekly Chart

However, what does it mean for the future? To be fair, we have not seen any significant sanction made on Russia by the rest of the world, and there hasn’t really been any serious military conflict that has jeopardized mining activities in Russia. On the issue of South African strikes, it should also be noted that these strikes have been going on and off since early Jan 2014 – the onset of current rally, and it is unlikely that bullish follow-through above the resistance can be great based on this flippy floppy strikes that obviously have not really impaired production significantly.

Things are not looking great on the demand front either. Firstly, the need for precious metals has fallen after an earlier rate hike expectation has been instilled in the market following Janet Yellen’s speech last week. Secondly, demand for precious metals for industrial purposes is expected to fall with yesterday’s disappointing Manufacturing PMI numbers from Germany, China and US. As such, outlook for palladium is not bullish even though we are on the verge of a bullish breakout.

From a technical perspective, it should be noted that Stochastic readings are heavily overbought and has already started to push lower, looking likely to cross the Signal line and initiate a bearish cycle signal if the stoch curve continue further lower. The Doji candlestick that is in play right now also suggest that follow-through from the bullish breakout is iffy, and we should not be surprised if prices fail to climb higher but start to reverse again.

More Links:

Gold Technicals – Bearish Below 1,315

S&P 500 – US Traders Seen More Bearish Than Others

GBP/USD – Little Activity Ahead of UK Inflation Numbers

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.