A boring Monday for EUR/USD, prices have been staying mostly within 1.3745 – 1.376 band and not doing a lot. Even a stronger than expected German Retail Sales print (1.3% vs -0.5% expected M/M) failed to ignite any significant bullish response, with the resultant bullish reaction even smaller than the initial rally since during the first few hours of market opening.

This lack luster reaction is a strong sign that short-term sentiment is bearish, and we can see glimpse of this bearishness by how prices started lower this morning. However, we should not count the bulls out – prices of EUR/USD climbed higher following the initial setback, led by bullish risk appetite evident via gains in Asian stocks. Hence, even though market sentiment is bearish, the bearish strength is not above the influence of broader market risk trends, and given that European stocks are expected to stay bullish, we should not expect strong declines in EUR/USD in the immediate future.

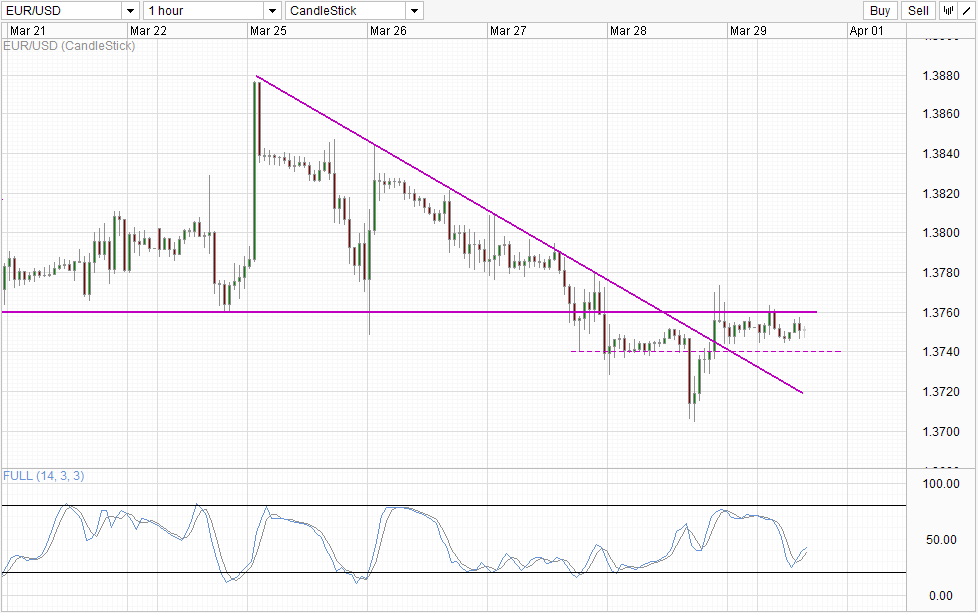

Hourly Chart

Technicals agree, as prices have pushed above the descending trendline, impairing the bearish momentum that has been in play last week. Similarly, Stochastic readings have started to point higher after rebounding off “support zone” between 20 – 30.0 level. Hence, the likelihood of a 1.376 retest cannot be ignored and we could even see further bullish pushes if 1.376 is broken.

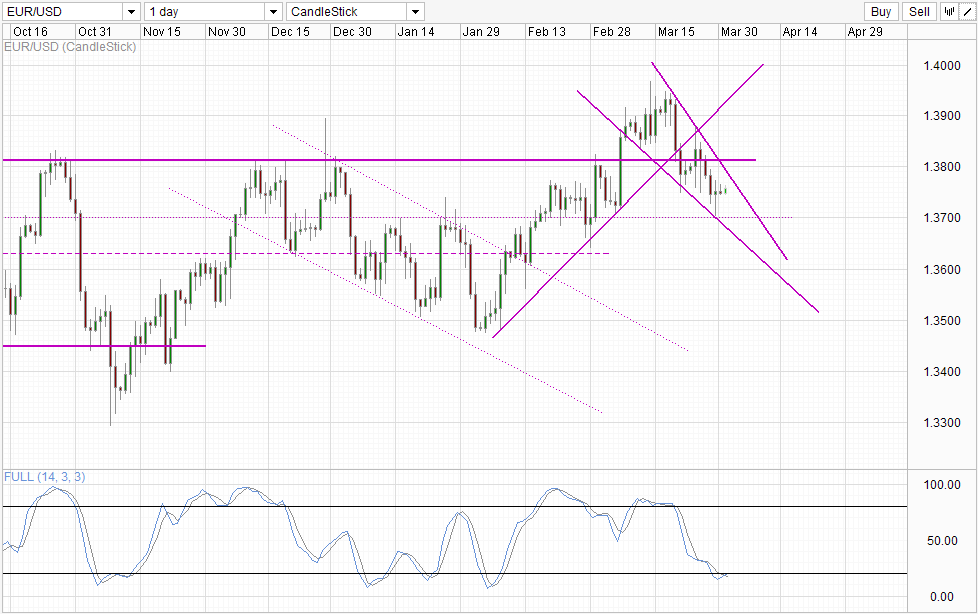

Daily Chart

There is slight bearish bias via the Daily Chart though. Prices may be considered bullish if our perspective starts from early November 2013 or early Feb 2014. However, if we were to look from the highs of March then immediate direction is actually bearish. Considering that we’ve managed to invalidate a bullish breakout scenario, it is clear that bearish momentum is strong and we could see yet another retest of 1.37 and even lower objectives if an Head and Shoulders pattern is formed. Prices may be heading higher in the short-run (as seen on Hourly Chart) but with resistance from descending trendline overhead expected, the likelihood of a bearish rebound increases.

More Links:

USD/JPY Technicals – Testing 103.0 Resistance

AUD/USD Technicals – Bearish Response Seen Ahead Of 0.93 Break, RBA Rate Decision

Week In FX Europe – CB’s, Debt Agencies and Governments Gotta Work Together

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.