Prices climbed up sharply over the weekend, climbing to a high of 1,328 per ounce during the first couple hours of trading on Monday (Sunday evening New York). This gain can be attributed to heightened tension in Ukraine once again where small arms exchanges were made between pro-Russia supporters and Ukrainian police, leading to fears that Russia may once again step in with military force in the name of keeping native Russians safe. Just like what happened during the Crimea crisis, market participants are afraid this may eventually lead to an all-out war between Russia and Crimea, driving war commodities such as Oil and Gold higher.

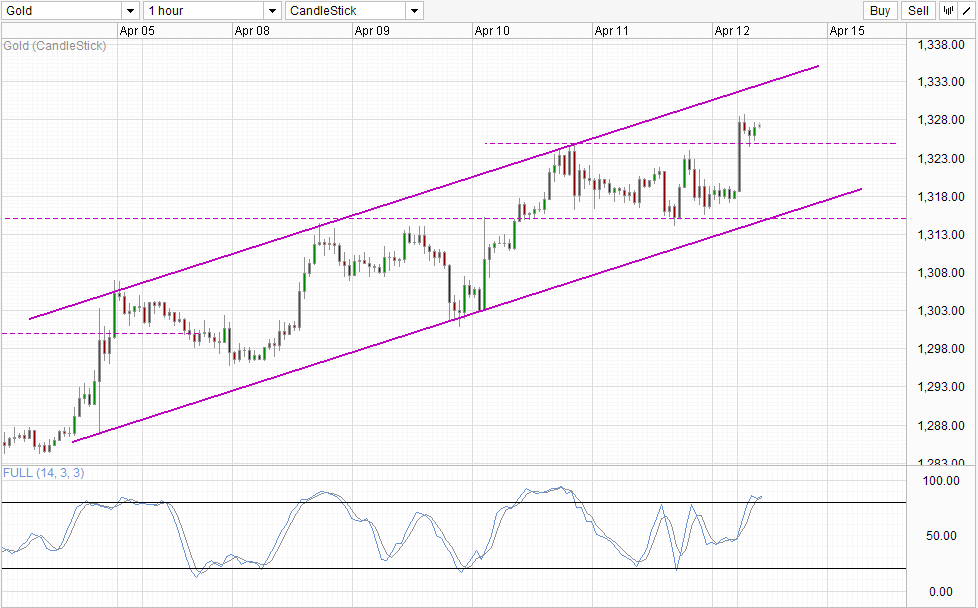

Hourly Chart

Prices have pulled back slightly following the opening gap, but we remained above Thursday’s swing high, suggesting that bullish momentum isn’t over and further gains are possible, opening up Channel Top as viable short-term bullish target. Stochastic indicator suggest that momentum is Overbought, but it should be noted that Stoch curve and Signal line both are pointing higher – as such we could see Stoch curve heading further into the Overbought region especially since a bearish signal has just been averted with the rebound off last Thursday’s high.

Daily Chart

Daily Chart is less bullish though. Prices are heading directly into the 1,330 resistance while Stochastic indicator is also deeply Overbought, favoring bearish reversal in the near term. That being said, there is no evidence that bullish momentum is stalling right now, hence traders should not automatically place sell orders at 1,330 resistance, as prices may still do the surprising thing and push all the way towards 1,350+ before reversing lower.

This is not entirely impossible looking at the current state in Ukraine. Compared to the Crimean crisis, the uprising in the eastern cities are much more violent, and already the death toll is higher than what has been suffered in Crimea despite continuing for less than 2 weeks. Furthermore, unlike in Crimea, Russia does not have any agreement to station troops in any of the eastern cities, and should Putin want to send troops in the name of protecting Russian sympathizers this can be construed as an act of war, increasing the likelihood of all-out military retaliation from Ukraine and its allies.

That being said, if the crisis actually deescalates, we could see prices reversing lower as well as there is little other bullish impetus left. Asian stock markets are performing much better than the US counterparts, suggesting that the stock sell-off contagion may not be as serious as we think. Hence, likelihood of a global stock meltdown becomes lower and we should see safe haven demand of Gold fall too. Latest Commitment of Traders report is also showing yet another week of decreasing net-long positions, reflecting the lower institutional speculator demand in Gold and suggest that further declines in Gold in the future is possible.

More Links:

Week In FX Europe – BoE To Judge Slack Before Hike

Week In FX Americas – A Tough Few Sessions Being A Dollar Bull

Week in FX Asia – Yen Appreciates Further After FOMC Minutes Released

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.