Bullish pressure on Oil subsided after the Ukraine Government failed to follow-through with the ultimatum which would have brought the eastern European nation closer to war with Russia. With the likelihood of outright war lower right now, it is not surprising to see Oil prices failing to breach 104.0 resistance.

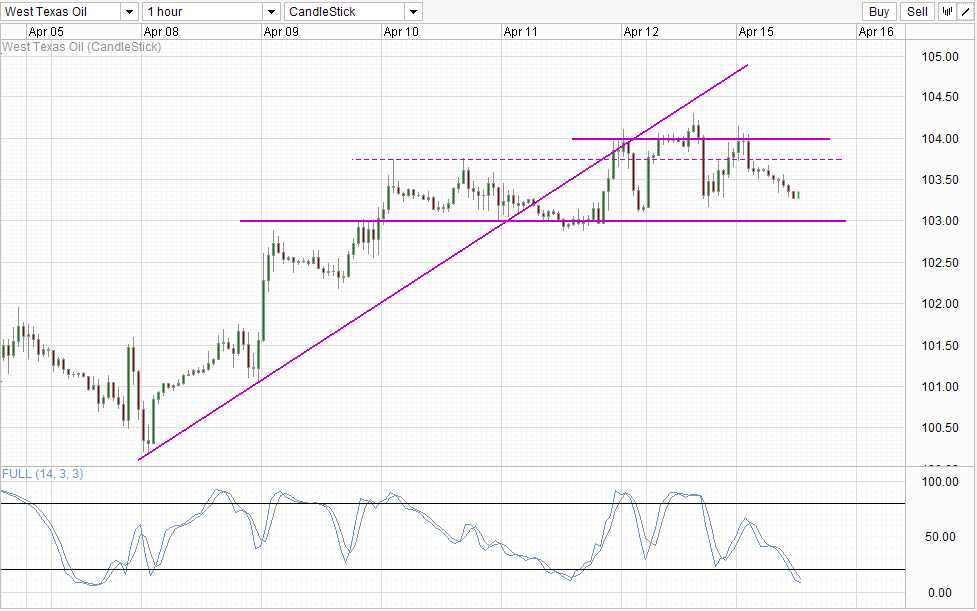

Hourly Chart

However, prices remained broadly supported. 103.0 round figure support wasn’t even tested, with prices currently finding support around yesterday’s swing low of 103.15 – 103.25. Stochastic readings are also deeply Oversold with Stoch curve tapering flatter, suggesting that a bullish cycle signal is not too far away. This is also not too surprising considering that market is less bearish than before with US stocks and not Asian equities reclaiming back previous losses. This bullish risk-trend helped to keep prices afloat, and may even propel a retest of 104.0 round figure if the recovery is able to affirm the long-term bull-trend in stocks which will likely inspire even stronger bullish response and by proxy higher prices in Oil which are positively risk correlated.

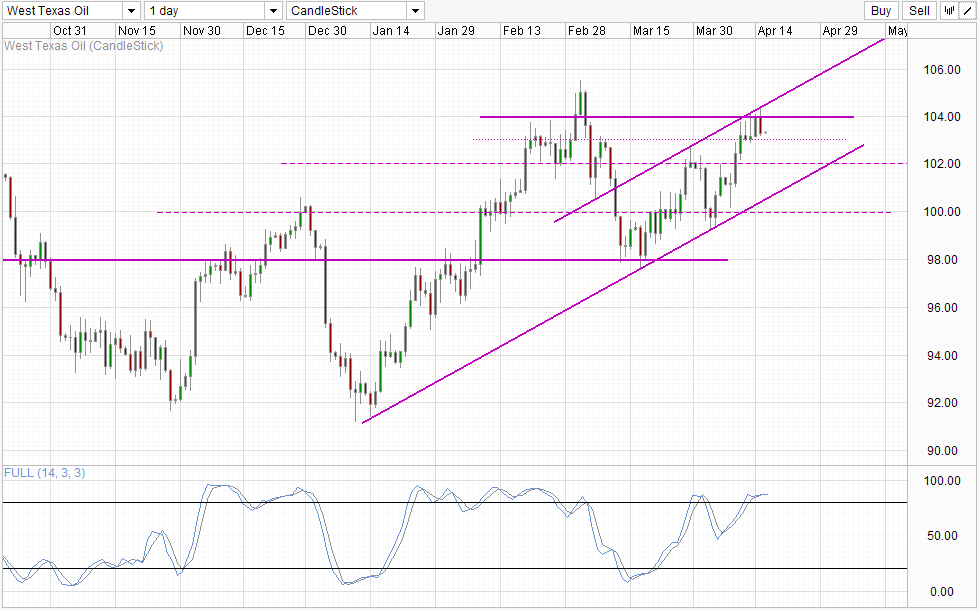

Daily Chart

However, Daily Chart puts a wet blanket on the bullish cheers. Even if prices manage to climb above 104.0, prices will still need to content with the rising Channel Top and also overcome the earlier 2014 high in order to reestablish the uptrend fully. Failure to do so and it is likely that bears will push prices sharply lower once again. This is because long-term fundamentals for WTI Crude remains weak with lower than expected manufacturing activities and overall economic growth. Hence, all the premium given to WTI during early 2014 needs to be discounted back from a fundamental perspective as the economic recovery narrative is definitely not as strong as we thought it would be. 103.0 remains a key level for bears to breach in order to confirm the top of 104.0 and conservative traders may wish to seek confirmation as S/T momentum remains bullish for now.

More Links:

Gold Technicals – Bulls Failing The 1,330 Test

S&P 500 – Bearish Momentum Intact Below 1,830

US10Y – Yields Falling But Long Term Demand Expected To Fall

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.