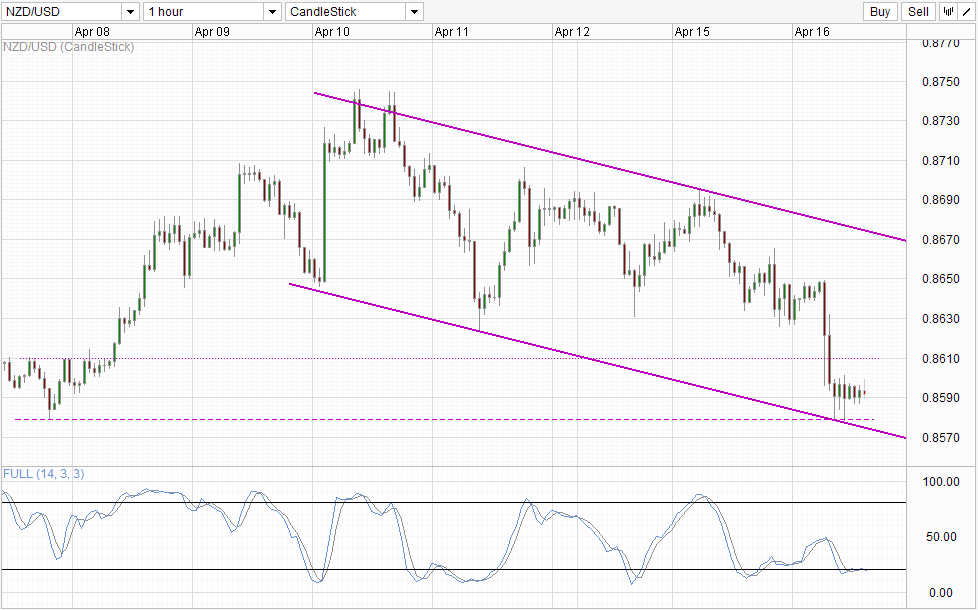

The downtrend that started since last Thursday received a boost today thanks to weaker than expected NZ Consumer Price Index which came in at a surprising 1.5% versus the expected 1.7% and previous 1.6%. This unexpected slowdown in inflation growth reduce the urgency for central bank RBNZ to hike rates, pushing NZD/USD sharply lower.

Hourly Chart

However, even though price managed to clear the 0.86 round figure support, it seems that the latest CPI miss has failed to really ignite a more aggressive bearish sell-off. Pace of decline remains similar to the original downtrend, with prices staying within the descending Channel. In fact, prices remained supported above 0.859 after rebounding off Channel Bottom and confluence with soft support of 0.858, suggesting that a move towards Channel Top is still possible even though fundamentally NZD is weaker than before.

Daily Chart

Daily Chart agrees as well as prices may find support from Channel bottom which opens up a move towards Channel Top. Stochastic indicator is showing a bearish cycle but it is possible that Stoch curve may reverse from here given that numerous turning points occurred around current Stoch levels. Considering that the most recent trough happened just as price was testing Channel bottom, the likelihood of the same happening in the near future should not be ignored.

Furthermore, overall uptrend remains intact, and even if prices does break Channel Bottom, overall bullish bias will remain as long as we stay above 0.85. It is also likely that Stoch levels will be Oversold should we reach close to 0.85, as such it is difficult to envision S/T quick sell-off in NZD/USD in the immediate future.

From a fundamental perspective, it should be noted that even though inflation rates are lower than expected, the rate hike policy of RBNZ is expected to continue as the Central Bank biggest challenge right now is keep Housing Prices lower. Hence, long-term fundamental direction for NZD remains bullish which will keep NZD/USD afloat even in the event of USD strengthening.

More Links:

Gold Technicals – 1,300 Broken As Bearish Momentum In Full Force

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.