The dollar extended gains against the pound on Tuesday following a batch of encouraging US economic data and hawkish comments on Friday from Fed Chair Janet Yellen.

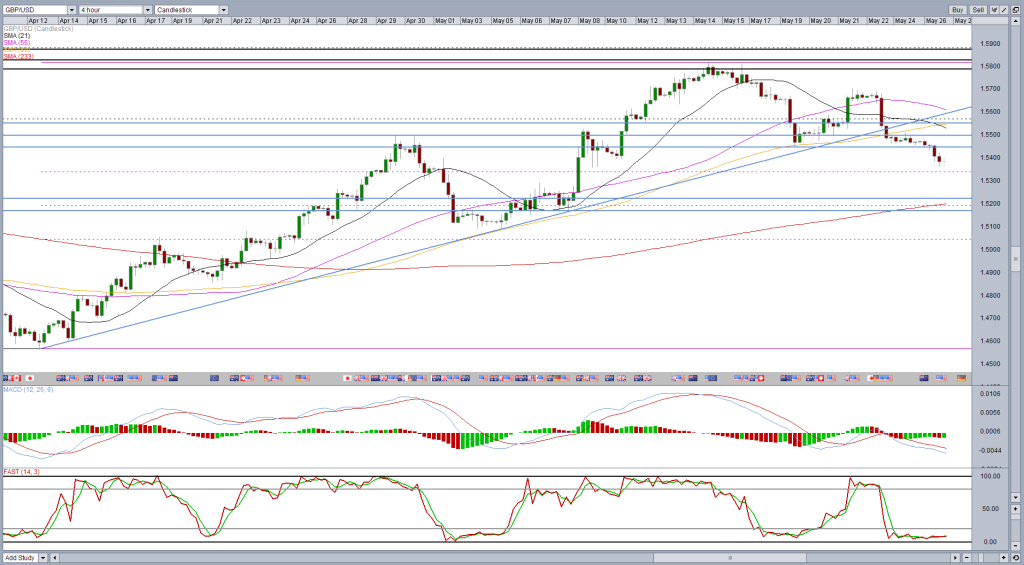

The rally in cable already appeared to be over prior to this having run into a brick wall around 1.58 (previous support and resistance, 50 fib level – 15 July highs to 13 April lows – and 233-day SMA). Following this we’ve seen potential support levels being taken out (and the ascending trend line broken) and the pair make new lower highs and lows, a sign that the recent uptrend has indeed reversed.

With so much disagreement among investors on when the Fed will hike interest rates, I think what we’ll see now is the pair find a new trading range with the 233-DMA providing the top end of the range. The bottom end could be determined in the coming week or two but I think the 1.5170-1.5220 region could be interesting.

Aside from being a key level of support and resistance on numerous occasions in the past, it also marks the 50% retracement of the move from 13 April lows to 14 May highs. The 89-DMA, which has been reliable support and resistance level in the past, may also provide additional support here.

An early sign of this may come if divergences appear between the oscillators and price action on the 4-hour chart as we near that key area.

To find these trading tools and others, visit OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.