European markets are trading predominantly in negative territory at the start of the week, paring strong gains on Friday that followed a strong hint that the European Central Bank will ease in December and rate cuts from the People’s Bank of China. While people continue to question whether the Fed should be looking to tighten monetary policy with a meagre 25 basis point hike, there are still plenty of central banks out there ensuring that we remain in a highly stimulative environment.

The DAX is the only major European index currently trading in positive territory, having been boosted by the latest business climate survey from Ifo. While companies do appear concerned about the current climate, particularly in manufacturing, they remain optimistic about future conditions. When you consider the number of headwinds currently facing German companies, notably the slowdown in emerging markets and the VW scandal, it’s encouraging to see that businesses are still bullish. Manufacturing is likely to remain an issue for German growth but, as is the case in some other countries in the eurozone, the services sector appears to be doing a good job of picking up the slack.

The full Ifo Business Climate report can be found here.

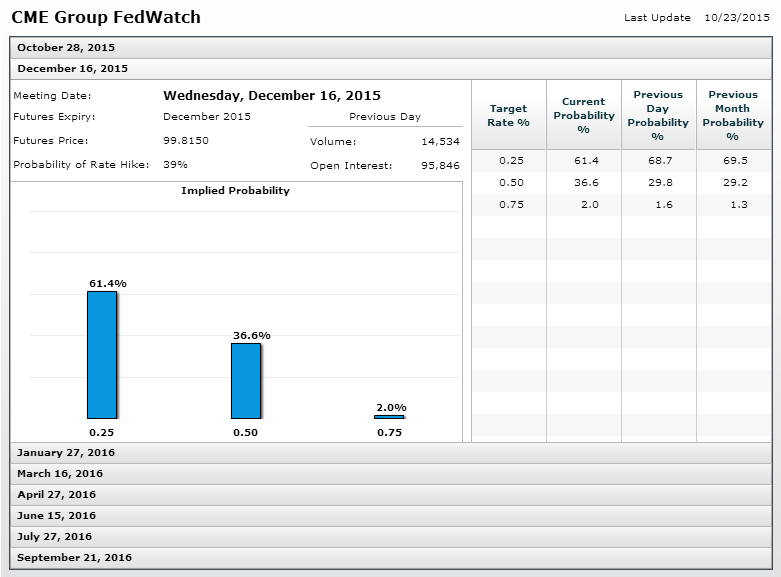

It’s going to be a big week for the U.S. with a large amount of data being released and, most important of all, the Fed announcing its latest monetary policy decision. The decision itself is likely to be a straightforward no change but it’s the statement that’s going to be of interest, in the absence of a press conference. This is the Fed’s last chance to convince the markets that a rate hike is coming this year, therefore December, assuming of course that it still intends to do so. As it stands, the Fed has done quite a dreadful job of convincing the markets. Fed Funds futures are currently pricing in a more than 60% chance that interest rates will not rise this year.

Source – CME Group FedWatch Tool

Today we’ll get the first of the economic releases, with new home sales data being releases just before the U.S. open.

EURUSD

The euro is continuing to look quite heavy against the dollar after suffering two days of heavy selling. The pair is in consolidation today and failed to be lifted by the decent German data which suggests sentiment remains very bearish. As it stands, the pair has found support around 1.10, which has been an important level in the past and is of course, an interesting psychological level. Even so, this still strikes me as a temporary support and I think we could see the pair move back towards 1.08, which proved to be a big support level in May and July.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.