European futures are pointing to a weaker open on Wednesday as investors adopt a little caution ahead of the release of the October FOMC minutes, which may shed further light on the central bank’s intentions in December.

The statement that was released following the meeting in October was far more hawkish than the markets had anticipated and sent a clear warning to the markets that December is when it intends to raise rates, data permitting. In keeping with the rest of the year, the data since the statement hasn’t been perfect but we have had a fantastic jobs report and all things considered, I think that policy makers will be more than satisfied.

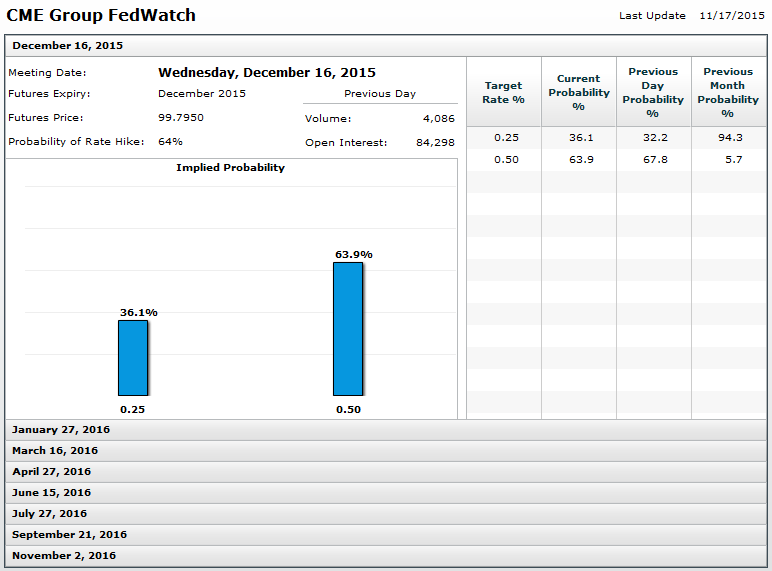

Today’s minutes offer further insight into the Fed’s views on the data and just how strong the rate hike consensus is among policy makers. While the message in the statement was clear, any suggestion in the minutes that policy makers are having doubts could strongly influence what is now, a heavily priced in rate hike in the markets. A December rate hike has gone from 35% priced in before last month’s statement, according to Fed Funds futures, to 64% priced in now.

Source – CME Group FedWatch Tool

It’s taken the markets a while to accept that a rate hike is coming and I wonder how much it would take for it to change its mind again, especially if we get some weak data on top between now and the meeting.

Alternatively, any suggestion in the minutes that the consensus view is strongly in favour of a hike should reinforce rate hike expectations. Given how they have tapered off recently, we could see a rate hike become increasingly priced in again. Although that will again be heavily subject to change between now and the meeting.

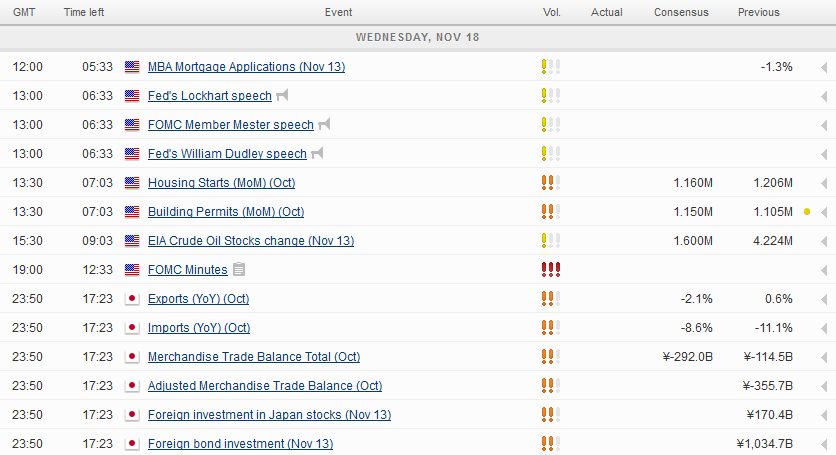

It’s also worth noting that we’ll hear from a number of Fed officials this afternoon which will offer a more updated view on the economy and interest rates. To an extent, the minutes are a little outdated and there’s been a lot of data since then so the views of officials today could arguably be more important. That said, I don’t expect that the stop the market reacting with the usual hysteria to any suggestion that a rate hike is going to happen or, more so, that a U-turn is likely.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.