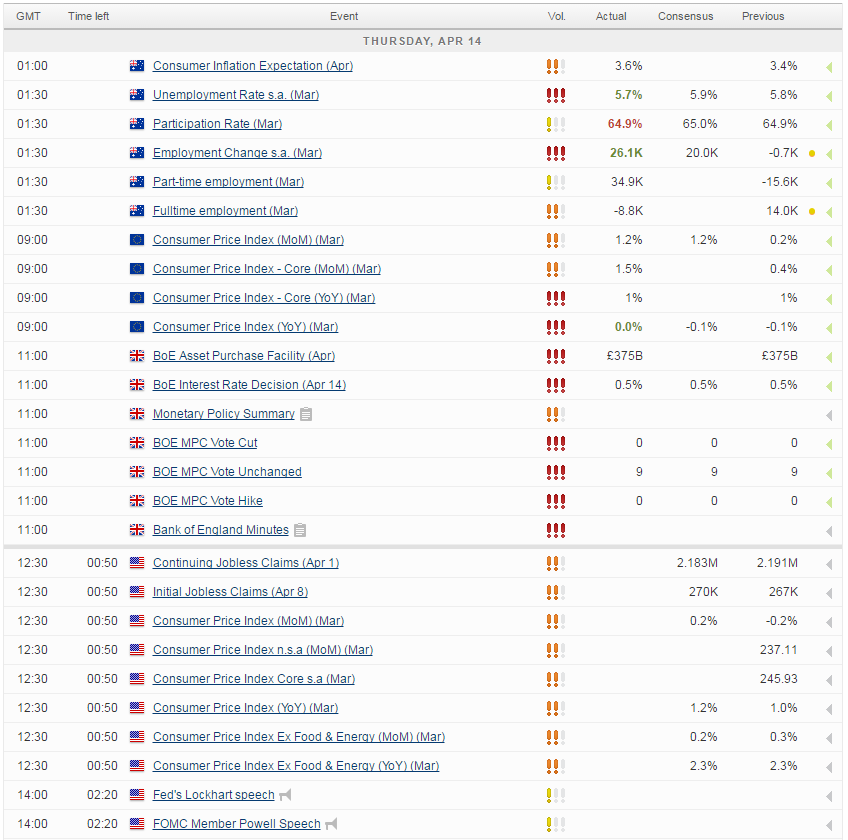

Thursday is shaping up to be a busy day for financial markets, starting with U.S. inflation data for March, followed by more speeches from Federal Reserve officials and topped off with and a batch of earnings reports.

U.S. inflation is expected to have picked up in March, rising to 1.2% from 1% in February, as the sharp drop in oil prices continues to fall out of the year on year comparison, albeit not as quickly as previously expected due to the continued slide up to January this year. The core reading is a better indication of underlying price pressures and that is expected to remain at 2.3%, above the Fed’s 2% target. While this is not the Fed’s preferred measure of inflation – this being the core PCE price index which currently stands at 1.7% – it does provide earlier insight into price pressures, coming two weeks before the core PCE number. Another month of inflation picking up would surely support the argument for another rate hike before the end of the year, which the market is currently pricing in.

This question may be put to two Fed officials who are due to speak shortly after the release. Jerome Powell and Dennis Lockhart and both seen as being among the more centrist members of the policy committee and so any indication from them that they’re leaning towards a hike could be a strong indication that the next rate rise will come much earlier than the markets currently expect. That said, it should be noted that Lockhart is not a voting member of the committee this year but his views could be representative of other members that have previously been on the fence as well.

Corporate earnings are likely to be a key focus for the markets in the coming weeks with the global economy facing major challenges this year and the actions of central banks seeing diminishing returns. There are a number of banks reporting earnings today which will be of particular interest to investors, especially following JP Morgans results on Wednesday which highlighted the challenges ahead for the industry. Rising non-performing loans related to the energy industry, squeezed margins from lower interest rates and disappointing investment banking results are likely to be common themes throughout the sector in the first quarter. It will be interesting to see whether the others can follow in the footsteps of JP Morgan and exceed expectations, with the bar having been set quite low in the lead up to the results.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.