The day of the Brexit referendum has finally arrived and investors are understandably cautious ahead of what could be a turbulent end to the week.

European equity markets are expected to open a little lower this morning following a subdued session in Asia overnight and some selling in the afternoon in the US on Wednesday, as investors sought shelter from the wild swings that could lie ahead.

Today’s referendum on the U.K.’s membership of the E.U. is arguably the biggest risk event of the year and with a number of polls suggesting the race is neck and neck, I would expect the markets to be quite volatile at times over the next 24 hours. Moves in the pound in particular could be quite wild once the voting closes this evening and the results start to be released from around 1am (U.K.) onwards.

It’s interesting that, while we are seeing signs of caution in equity markets, the pound has only this morning hit new highs against the dollar for the year.

Source – OANDA fxTrade Platform

Coming on the day of the referendum, this is a very significant move and indicates a strong belief in the markets that the U.K. is going to vote to remain in the E.U.. It will be interesting to see whether the pound can build on these gains as the day progresses. Given that a number of institutions are conducting their own exit polls, it could well be a sign that the voting is indeed going as the betting odds have for some time suggested they would.

That said, with the pound trading at its highest levels this year, the potential downside here in the case of a surprise vote to leave has got even bigger. Even prior to the rally over the last week, a vote to leave would likely have prompted a sharp decline in the pound. With the pound now around eight cents higher against the dollar than it was then, the potential downside has become even more substantial.

A vote to leave could easily trigger a move below this year’s lows by Friday’s close. The upside potential on the other hand may not be that great, although I would expect to see the pound initially spike higher in the event of a vote to remain. The question is whether it would be able to sustain any substantial move to the upside, which I’m not confident it will be able to do.

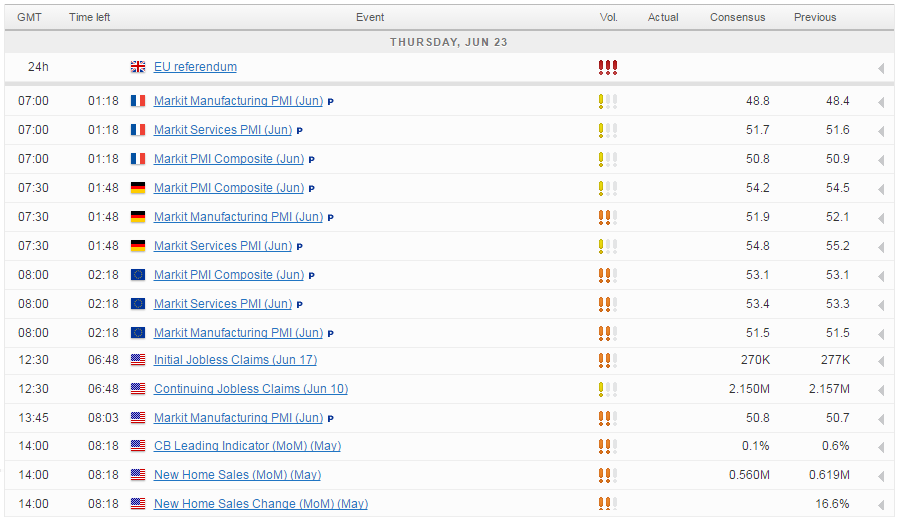

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.