European equity markets are expected to open marginally higher on Wednesday following mixed sessions in the U.S. and Asia overnight, as investors await the latest interest rate decision from the Federal Reserve, as well as a number of economic data and earnings releases.

It’s been a relatively slow start to the week but things should certainly pick up from here. We kick things off this morning with the preliminary release of second quarter GDP from the U.K. which is expected to show the economy grew by 0.5% last quarter, or 2.1% on the year. This is a decent rate of growth in this environment but with the country having voted for Brexit at the end of the quarter, it’s also a little irrelevant. How the economy performs going forward will depend on how the negotiations go and what Teresa May’s new government does in the meantime to protect itself and a recession now looks likely in the next 12 months.

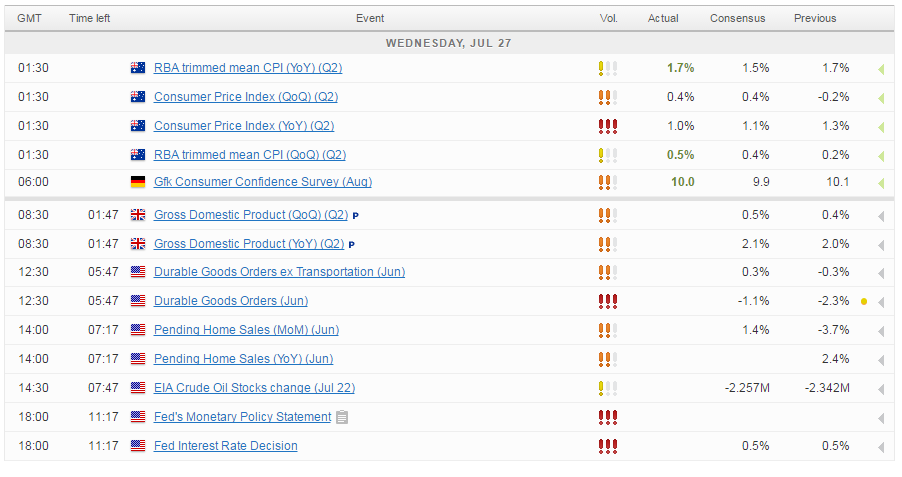

There’s also plenty of data to come from the U.S. this afternoon including durable goods orders and pending home sales, as well as EIA crude inventories. That said, as will be the case throughout the day, attention will very much be on this evenings FOMC decision and, more importantly, the statement that will accompany it. The Fed is extremely unlikely to raise rates at the end of today’s meeting, regardless of the limited impact that Brexit has currently had on the economy as there is simply not enough data to support this, not to mention that the markets have almost entirely priced it out. The Fed will not want to rock the boat.

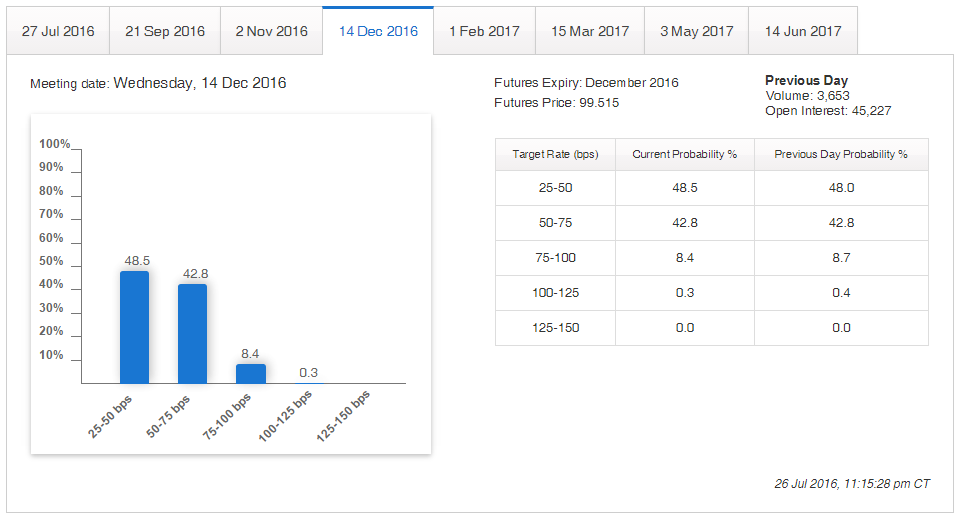

This evening’s announcement is therefore all about the statement and whether it will be used to build expectations of a hike in the second half of the year or deliver a more dovish message highlighting the heightened risks, including Brexit. As it stands, the markets have once again come around to the idea that there will be another hike this year, pricing in a 51% chance of it happening by December. This could change drastically tonight though, especially if we get a dovish message littered with warnings of risks to the economy.

Source – CME Group FedWatch Tool

While the Fed remains on a tightening path, the Bank of Japan looks likely to announce further stimulus measures this week to go with a fiscal stimulus package that Prime Minister Shinzo Abe claimed will be more than ¥28 trillion in size and announced in detail next week. This is larger than what had been reported and much larger that reports yesterday that it would be less than a quarter of this, which has seen the yen and Nikkei reverse yesterday’s moves and could lift expectations ahead of the BoJ decision.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.