An interesting week lies ahead for financial markets as we get the latest jobs report, retail sales and inflation data from the UK, FOMC minutes and inflation data from the US as well as a host of other data and releases from the eurozone, Australia and Canada.

The data from the UK is likely to attract a lot of attention as it will offer some of the earliest insight into the real impact of Brexit on the economy. If the PMI surveys for July are anything to go by then the UK could be in for a rough ride in the months ahead, something we could start to see in the July data. That said, it’s likely to take some time for the effects of the vote to be felt so I wouldn’t expect any dramatic changes like we saw in the PMIs.

The retail sales number will probably be the most eagerly anticipated given the importance of the consumer to the UK economy. Should consumer sentiment hold up over the next six months, assisted by the bold moves from the Bank of England, then the UK may be able to weather the early part of the storm and possibly avoid recession. Whether this will remain the case as unemployment creeps up, as the BoE forecast it will, is another matter but this will take a little more time to both happen and be reflected in the data.

Week Ahead Fed Minutes to Guide USD After Retail Sales Flop

As far as July is concerned, the consumer is expected to have remained relatively undeterred. The BRC last week reported that the value of retail sales in the stores that it covers rose by 1.1% in July, following a small drop a month earlier. The official report this week is expected to be slightly less optimistic, with growth of only 0.1% expected compared to June, although this still equates to 4.2% on the year so it’s not all doom and gloom.

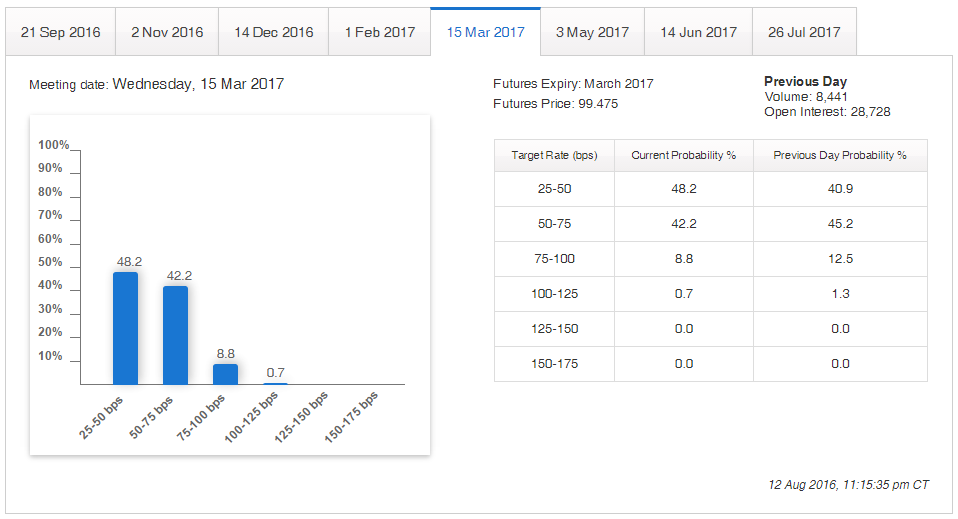

This FOMC minutes will be the other main event this week after the Fed opted to once again leaves rates unchanged last month. The decision was expected following the Brexit vote and increased headwinds that brings, although the statement that accompanied it did appear to both confuse and split people. The inclusion of some quite positive language was largely overlooked by the markets after the release, something the minutes this week will hopefully clear up. As it stands, markets are only now pricing in a hike in March next year, something the Fed will have to change if it still has other plans in mind.

Source – CME Group FedWatch Tool

US Consumer Wallets Remain Closed

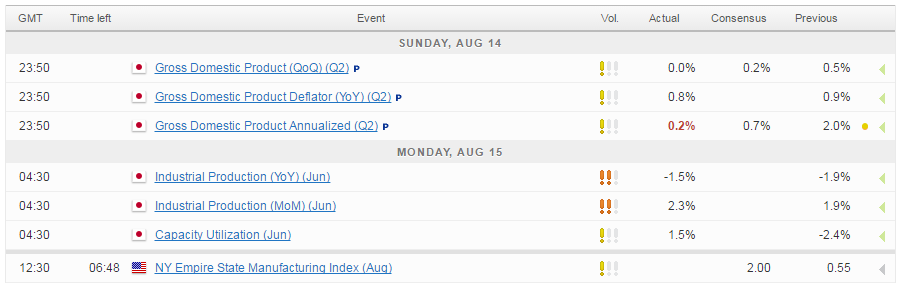

As far as today is concerned, it’s looking a little quiet from an economic data standpoint, with US empire state manufacturing index the only standout release. The broadly positive Asian session overnight looks likely to be shrugged off by European investors, with index futures pointing to a relatively flat open. Japan was one of the only losers overnight after GDP data showed the country stagnated again in the second quarter, falling short of already low expectations. Shinzo Abe faces a tough task to get the economy moving again and investors are not convinced that his latest ¥28 trillion stimulus will do the job.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.