We have an eventful day in store in the markets on Friday following what has been a pretty quiet week until now, with Janet Yellen headlining with her speech at Jackson Hole this afternoon.

Before that though we have a number of pieces of economic data being released throughout the morning and early afternoon which is likely to attract plenty of attention. We kick off this morning with revised second quarter GDP data from the UK and France, with both facing a tough time right now for very different reasons. The first estimate of UK GDP showed the economy was more resilient than was feared in the second quarter, growing at 0.6% and setting the country up for a good second half to the year. That, of course, was before the UK voted to leave the EU on 23 June creating a vast amount of uncertainty and leaving the economy in limbo while we wait to find out what the future will hold.

Jackson Hole APAC Breakfast Edition

In a way, that makes this morning’s release already somewhat outdated. That said, should the number have been revised lower and the threat of Brexit been more of a drag on the economy than appeared last month, it could provide some interesting insight into what we can expect in the coming quarters. France on the other hand stagnated in the last quarter, according to the preliminary release, something the country has become accustomed to in recent years, although prior to the release we had seen some improvement over the last 12 months. The threat of Brexit probably had minimal to no impact on this release but could going forward.

The standout event today is undoubtedly Yellen’s appearance at Jackson Hole and whether this will once again be used as the platform to direct the markets ahead of an upcoming policy announcement. The sounds coming from the Fed camp over the last couple of weeks appear to suggest that another rate hike is imminent and Yellen could use this event today to all but confirm this. I’m sure she will be very careful not to overpromise but we’ve seen in the past that she isn’t entirely averse to dropping clear hints, as she did ahead of the last rate hike eight months ago. The markets are currently pricing in a rate hike in December and I imagine the markets will be very quick to respond to what Yellen has to say. Any indication that Yellen remains unconvinced could quickly see markets push back their expectations to March or beyond, as they have so often in the past.

USD/CAD Canadian Dollar Rises Slightly After USD Stumbles Ahead of Jackson Hole

It will be interesting to see whether Yellen takes into consideration the GDP and inflation data that will be released shortly before her appearance. The second quarter GDP figure is only expected to be revised marginally lower while the GDP deflator – a closely following inflation metric – is expected to remain unchanged at 2.2%. The latter in particular will be a key release and could feature in Yellen’s comments.

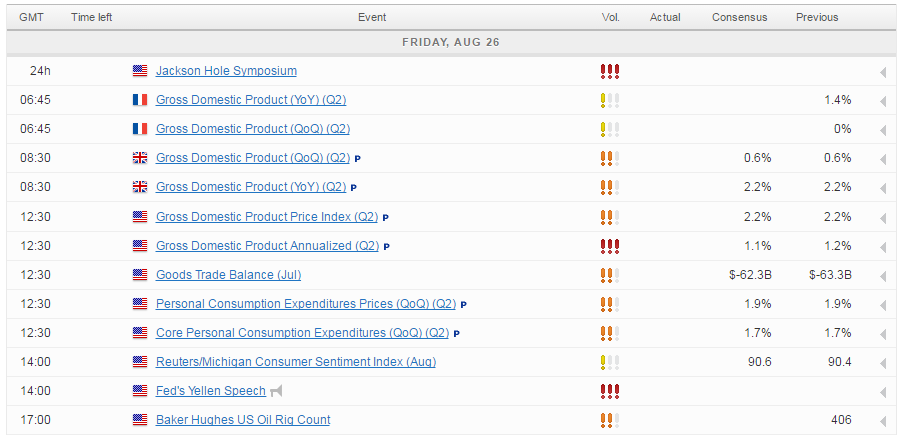

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.