A stronger USD has seen Asia Equities diverge today in Asia. Meanwhile wheat, along with other commodities continues to look more like chaff than wheat.

The strengthening USD has not been a boon for already weak commodities this week. With the USD rallying and most commodities priced in dollars, they are becoming more expensive in real terms at a time of weak demand and chronic oversupply.

Unsurprisingly oil continues to fall; copper sits at three-month lows, iron ore sits at monthly lows. Gold is hovering above 1300.

Extraneous factors such as OPEC’s will they won’t they on production cuts aside, post-Jackson Hole the street seems to be more and more convinced that the Fed will soon hike. I’m personally not so convinced, but the constant emphasis on “data” means that a decent Non-Farm print Friday will see a September hike well and truly in play according to the market.

The USD is unsurprisingly the primary beneficiary, although I note US Bond yields are mostly unmoved. Rallying against all of its G-10 counterparts. Most notably Yen where further easing comments and intervention comments from Japan today saw USD/JPY trade above 103.20, shrugging off yet more poor Japanese data this morning.

Australian 200

None of this is good news for the resource-heavy Australian Stock Exchange (ASX). The ASX 200 was off 1% this morning with large mining companies leading the way.

The weekly chart below highlights some key levels we are testing on the downside. We are flirting with support here at the 5430 level with weekly trendline support at 5265 not so far away.

Interim support (not shown) is at 5415, the 100-day moving average.

Expect a high print on Friday’s Non-Farm’s to cause more commodity pain with the ASX squarely in a resource based firing line if it is.

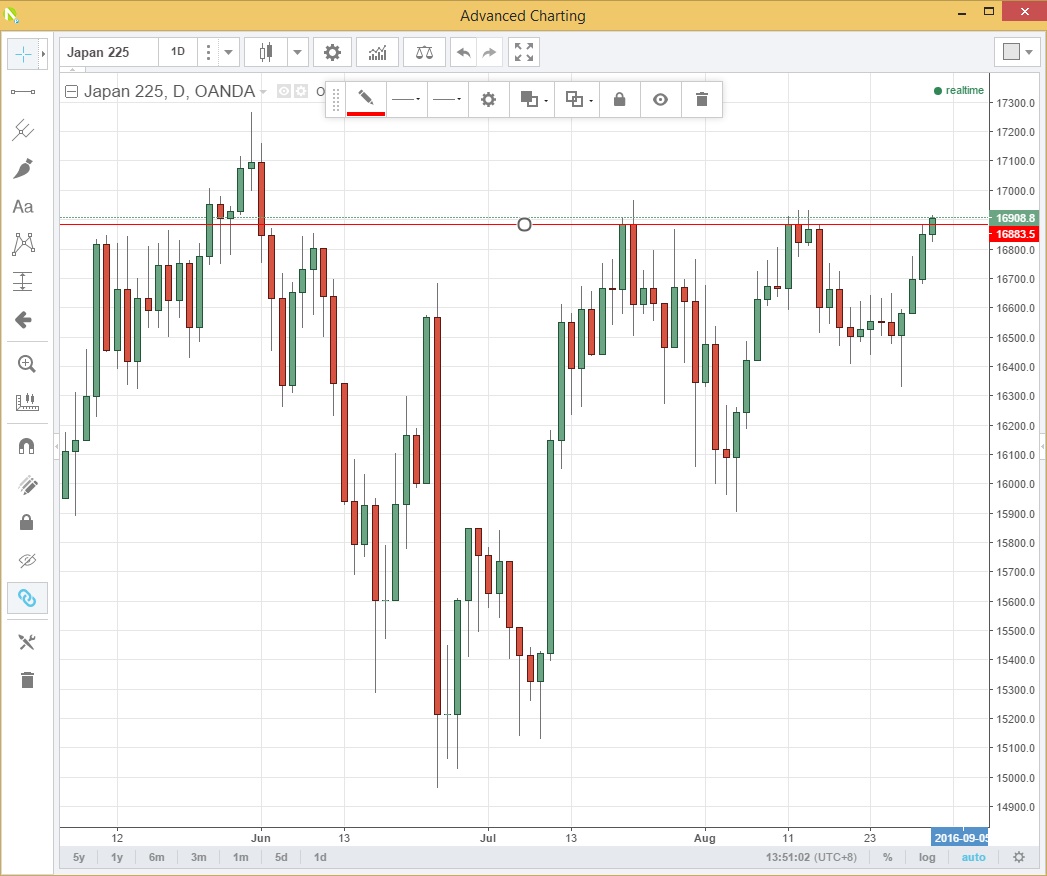

Nikkei

Conversely, the stronger USD has been a boon for Nikkei. The 225 Index in the green as USD/JPY trades well above 103.00 on month-end fixing demand and today’s quota of “intervention,” easing,” “watching markets closely” comments from Japanese Government officials.

Where goes the USD/JPY goes the Nikkei and today this is up. Japan’s exporter-heavy index is seeing the weaker Yen providing a fillip to future corporate performance. The Nikkei is pushing through weekly resistance at the 16883 level. This was a multiple weekly high going back to mid-July.

A strong NFP Friday could see the USD/JPY push higher with the equivalent follow through when the Nikkei opens Monday. A weekly close above 16883 opening up the 17100 area on a technical basis.

Singapore 30 Index

It is not all a straight line milk and honey correlation, though. The Singapore Straits Times 30 has broken daily support in the 312.70 area with no real support on the daily until the Brexit lows around 298.50.

One suspects Singapore 30 is being traded as an emerging market proxy to an impending stronger USD.

Wheat

The bear market in commodities is not confined to the “hard’ stuff. Softs have suffered as well, few more so than wheat. Enormous harvests from Russia and the Ukraine have offset less than the ideal weather in France and the USA.

This weighed upon prices globally. To the extent that it is cheaper for Indonesian millers of wheat to buy from Russia than to buy from Australia its next door neighbour! Indonesia is Australia’s largest wheat export customer and this news no doubts bodes ill for listed “soft commodity” companies of the Ausralia200 as well.

The weekly chart below paints a grim story. Wheat has broken out of the bottom of its recent trading range at $3.800 a bushel. The long term trend line comes in at 4.6650 with previous support at 4.5000 now resistance also.

The saying goes “sorting the wheat from the chaff.” Looking at the weekly chart the saying is more likely to be “sorting the chaff from the wheat…”

Summary

The market is getting bulled-up for a big Non-Farm print this Friday and then a September Fed hike coming into play. Whether this occurs is a story for another day. The USD is the primary beneficiary as the expectation of higher rates weighs on commodities and emerging markets, favouring export driven, valued added heavy indices, like the Nikkei.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.